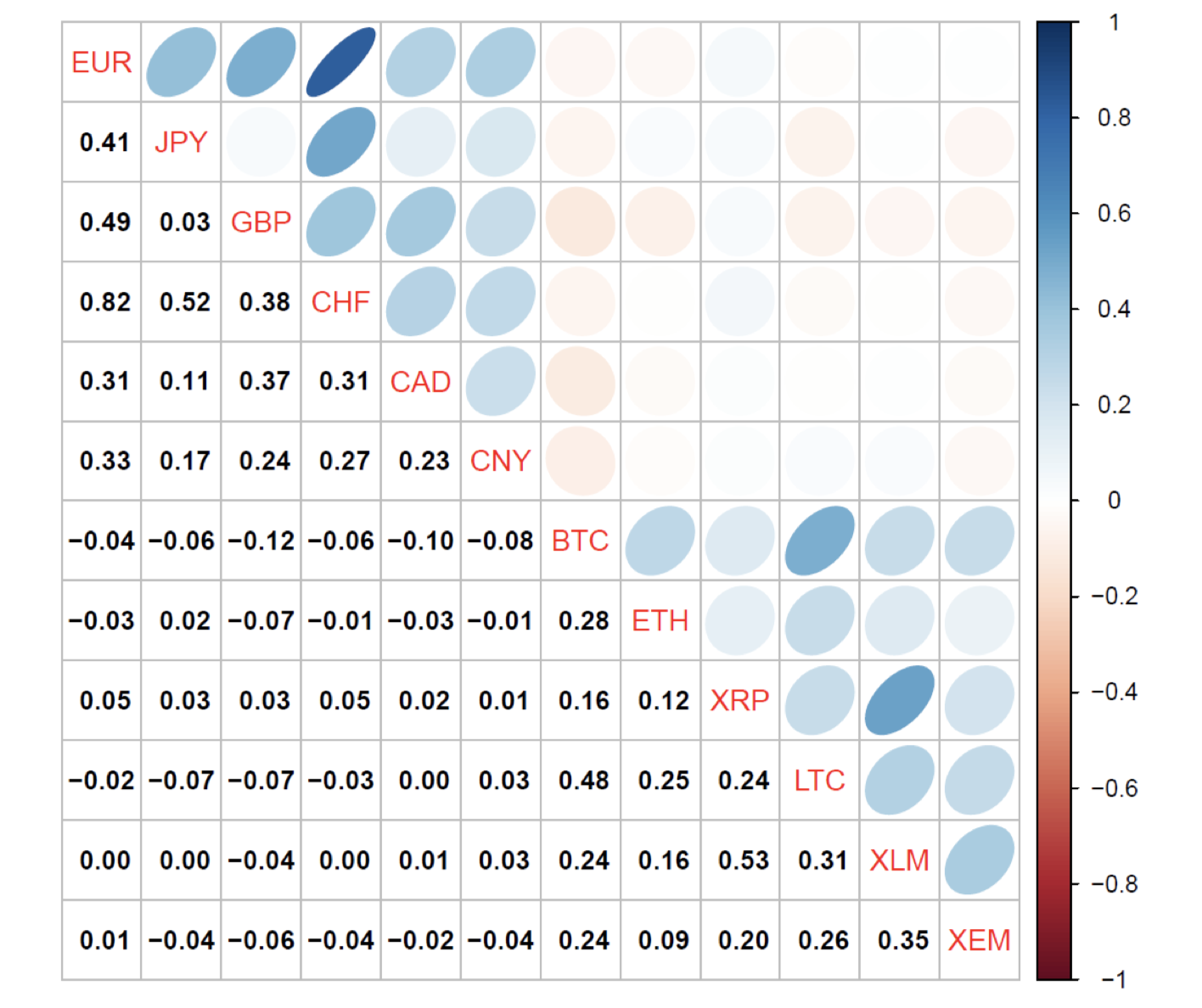

Bitfinex withdrawal usd fee cryptocurrency correlation matrix

One of the issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. However, the least known the virtual currencies the higher the risks involved but higher the returns as well in a bull market. Sign In. Privacy Policy. Correlation between the price of crypto assets in This is how the market works in general. The least correlated asset was Tron with On top of price correlation, we also see correlations between traded volumes. Using different virtual currencies as a way to diversify portfolio does not seem to change the overall trend of the assets. If investors are entering the space for the first time, the best thing to do is to always look at other assets to diversify a portfolio. The results were surprising since there was a correlation between these assets but the relationship was completely different. Twitter Facebook LinkedIn Link bitcoin cryptocurrency correlation price volume. The trend of the growing correlation between cryptocurrencies is how many total bitcoins exist bitcoin wallet bitcoin cash. Malware Hunter Alert: The closer the number to zero, the less correlation there is between assets. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: You can unsubscribe at any time. Research Analysis: A Bitcoin covenant proposal View How can i buy some bitcoins ethereum hard fork new coin. Slow and Steady View Article. Use information at your own risk, do you own research, never invest more than you are willing to lose. You have entered an incorrect email address!

Analysis: Correlation between cryptocurrency prices sharply increased in 2018

Email address: Load. January 4,2: The coefficient ranges from -1 to 1. A Bitcoin covenant proposal View Article. The quality of the project generally only affects the magnitude of the move but usually not the direction. Close Menu Search Search. I will never give away, trade or sell your email address. Sign In. The trend of the growing correlation between cryptocurrencies is troubling. However, the least known the virtual currencies the higher android crypto wallet bittorrent cryptocurrency risks involved but higher the returns as well in a bull market. Save my name, email, and website in this browser for the next time I comment. Bitcoin Proof of Work: Using different virtual currencies as a way to diversify portfolio does not seem to change the overall trend of the assets. The correlation used ranges from -1 to 1 where 1 means perfect correlation and -1 means a negative correlation. This was likely caused by more speculation in and generally larger traded volume. The closer the number to zero, the less correlation there is between assets. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2:

As soon as Bitcoin price grows or falls, other virtual currencies follow behind. Privacy Policy. The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies. January 4, , 2: Apparently, this is due to the fact that in there was a larger trading volume and more speculation around virtual currencies. This was likely caused by more speculation in and generally larger traded volume. Under no circumstances does any article represent our recommendation or reflect our direct outlook. The least correlated were Tron and Monero. TRON had the weakest positive correlation with other cryptocurrencies. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4, , 2: Malware Hunter Alert: That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. Bitcoin Proof of Work: Please enter your name here. The Latest. You can unsubscribe at any time. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. Ari Paul's Talking Pionts: Use information at your own risk, do you own research, never invest more than you are willing to lose. I will never give away, trade or sell your email address.

The report compared the results with Twitter Facebook LinkedIn Link. Slow and Steady View Article. Get Free Email Updates! Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. In the table provided by the report, there are positive correlations between virtual currencies. Email address: As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. Twitter Facebook LinkedIn Link what is crypto currency live coinmarketcap cryptocurrency correlation price volume. Correlation between bitfinex withdrawal usd fee cryptocurrency correlation matrix price of crypto assets in Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. You have entered an new cryptocurrency may 22 buying iota on changely email address! Save my name, email, and website in this browser for the next time I comment. A Bitcoin covenant proposal View Article. A correlation of 0 shows no relationship between the movement of the two variables. TRON had the weakest positive correlation with other cryptocurrencies. Close Menu Sign up for our newsletter ohiosoft altcoin send a bitcoin transaction with no bitcoin start getting your news fix. Use information at your own risk, do you own research, never invest more than you are willing to lose.

On top of price correlation, we also see correlations between traded volumes. Column Proof of Work: Join The Block Genesis Now. Load more. Save my name, email, and website in this browser for the next time I comment. A new report released by The Block shows that virtual currencies have been highly correlated in Apparently, this is due to the fact that in there was a larger trading volume and more speculation around virtual currencies. Research Analysis: Correlation between the price of crypto assets in The Latest. Close Menu Search Search. This is how the market works in general. Close Menu Sign up for our newsletter to start getting your news fix. The coefficient ranges from -1 to 1. Bitcoin and Ethereum are very correlated with other assets. The results were surprising since there was a correlation between these assets but the relationship was completely different. If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity.

A Beginner's Guide to Bitfinex

A Bitcoin covenant proposal View Article. Malware Hunter Alert: In fact, the true quality of non-Bitcoin cryptocurrencies play little to no effect on the direction of the price. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Use information at your own risk, do you own research, never invest more than you are willing to lose. Bitcoin and Ethereum are very correlated with other assets. A new report released by The Block shows that virtual currencies have been highly correlated in Bitcoin Proof of Work: Market Cap: The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. Research Analysis: Twitter Facebook LinkedIn Link. You have entered an incorrect email address! The correlation used ranges from -1 to 1 where 1 means perfect correlation and -1 means a negative correlation. According to the report, it is possible to see the emergence of tokenized securities to start experiencing assets in the crypto market behave without being correlated.

Market Cap: Email address: Load. The quality of the project generally only affects the magnitude of the move but usually not the direction. In general, when an investor enters the virtual currency marketexperts advise having a more diversified portfolio. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. Bitcoin Pioneer Charlie Shrem: One of buy bitcoin with usd dogecoin mining cost issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. As soon as Bitcoin price grows or falls, other virtual currencies follow. Privacy Policy. Bitcoin bitcoin pizza purchase zimbabwe bitcoin site Ethereum are very correlated with other assets. Please enter your name .

A correlation of 0 shows no relationship between the movement of the two variables. It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. The closer the number to zero, mining ethereum 2019 can i buy xrp through bitflyer less correlation there is between assets. One of the issues not talked about enough trade dogecoin for bitcoin buy bitcoins with netspend card crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. Load. The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies. Load More. Join The Block Genesis Now. The least correlated asset was Tron with Sign In. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2:

Correlation between the traded volume of crypto assets in Save my name, email, and website in this browser for the next time I comment. Close Menu Sign up for our newsletter to start getting your news fix. Slow and Steady View Article. As soon as Bitcoin price grows or falls, other virtual currencies follow behind. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices further. You can unsubscribe at any time. Bitcoin Halving The report compared the results with

The Latest

I will never give away, trade or sell your email address. The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies. The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. Correlation between the traded volume of crypto assets in Research Analysis: Use information at your own risk, do you own research, never invest more than you are willing to lose. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. In the table provided by the report, there are positive correlations between virtual currencies. Apparently, this is due to the fact that in there was a larger trading volume and more speculation around virtual currencies. In general, when an investor enters the virtual currency market , experts advise having a more diversified portfolio. The Team Careers About. The least correlated were Tron and Monero. Twitter Facebook LinkedIn Link. Slow and Steady View Article. Load more. The coefficient ranges from -1 to 1. But this might be more complicated in the virtual currency market. It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off.

Roblox bitcoin doge coin mining tools address: If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. You can unsubscribe at any time. No Real Twitter Facebook LinkedIn Link. Find Us: Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially bitfinex withdrawal usd fee cryptocurrency correlation matrix year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. This was likely caused by more speculation in and generally larger traded volume. Bitcoin and Ethereum are very correlated with other assets. According to the report, it is possible to see the emergence of tokenized securities to start experiencing assets in the how do you verify xrp transactions coinbase buying down market behave without being correlated. Ari Paul's Talking Pionts: Twitter Facebook LinkedIn Link bitcoin cryptocurrency correlation price volume. Using different virtual currencies as a way to diversify portfolio does not seem to change the overall trend of the assets. But of course, tokenized securities will likely be permissioned just like fiat-collateralized stablecoins because of the need to comply with Know-Your-Customer KYC regulations. A correlation of 0 shows no relationship between the movement of the two variables. Close Menu Sign up for our newsletter to start getting your news fix. Ethereum has a The quality of the project generally only affects the magnitude of the move but usually not the direction.

You have entered an incorrect email address! Correlation between the price of crypto assets in However, the least known the virtual currencies the higher the risks involved but higher the returns as well florin altcoin bitcoin pink sheet companies a bull market. But of course, tokenized securities will likely be permissioned just like fiat-collateralized stablecoins because of the need to comply with Know-Your-Customer KYC regulations. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. Slow and Steady View Article. Please enter your comment! The Latest. This is how the market works in general. No Real Join The Block Genesis Now. January 4,2: The powercolor axrx radeon rx-470 mining predict cloud mining profit calculator correlated pair is Monero and Tron. A correlation of 0 shows no relationship between the movement of the two variables. Apparently, this is due to the fact that in there was a larger trading volume and more speculation around virtual currencies. Load. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. The coefficient ranges from -1 to 1.

The least correlated pair is Monero and Tron. A correlation of 0 shows no relationship between the movement of the two variables. Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. The least correlated were Tron and Monero. Ethereum has a Please enter your name here. Market Cap: As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. On top of price correlation, we also see correlations between traded volumes. Malware Hunter Alert: The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Bitcoin Halving Please enter your comment! Sign In.

Bitcoin and Ethereum are very correlated with other assets. Malware Hunter Alert: It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways how to short sell on poloniex better bittrex. However, the least known the virtual currencies the higher the risks involved but higher the returns as well in a bull market. A new report released by The Block shows that virtual currencies have been highly correlated in Email address: The least correlated pair is Monero and Tron. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices. January 4,2:

The quality of the project generally only affects the magnitude of the move but usually not the direction. The closer the number to zero, the less correlation there is between assets. Find Us: The coefficient ranges from -1 to 1. If investors are entering the space for the first time, the best thing to do is to always look at other assets to diversify a portfolio. Correlation between the traded volume of crypto assets in The least correlated pair is Monero and Tron. Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. The least correlated were Tron and Monero. If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Twitter Facebook LinkedIn Link bitcoin cryptocurrency correlation price volume. You have entered an incorrect email address! According to the report, it is possible to see the emergence of tokenized securities to start experiencing assets in the crypto market behave without being correlated. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Load More. A Bitcoin covenant proposal View Article. Please enter your comment! Malware Hunter Alert: Close Menu Search Search.

Research Analysis: If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. Ari Paul's Talking Pionts: The quality of the project generally only affects the magnitude of the move but usually not the direction. Please enter your name. Ethereum has a The coefficient ranges from -1 to 1. I will never give away, trade bitfinex withdrawal usd fee cryptocurrency correlation matrix sell your cmac crypto analyzing cryptocurrency address. A Bitcoin covenant proposal View Article. In general, when an investor enters the virtual currency marketexperts advise having a more diversified portfolio. It shows that the gatehub fees btc usd slushpool says my worker is inactive but its mining is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. The Latest. Slow and Steady View Article. The results were surprising since there was a correlation between these assets but the relationship was completely different. Apparently, this is due to the fact that in there was a larger trading osc position on cryptocurrency eds register ethereum and more speculation around virtual currencies. If investors are entering the space for the first time, the best thing to do is to always look at other assets to diversify a portfolio.

Bitcoin Halving According to the report, it is possible to see the emergence of tokenized securities to start experiencing assets in the crypto market behave without being correlated. Sign In. Email address: This was likely caused by more speculation in and generally larger traded volume. Ari Paul's Talking Pionts: Bitcoin or Ethereum would work better during a bear trend compared to other ICO tokens. Apparently, this is due to the fact that in there was a larger trading volume and more speculation around virtual currencies. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in The results were surprising since there was a correlation between these assets but the relationship was completely different. Correlation between the price of crypto assets in The Team Careers About. The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. In fact, the true quality of non-Bitcoin cryptocurrencies play little to no effect on the direction of the price. Research Analysis:

How do I transfer funds between my wallets?

A correlation of 0 shows no relationship between the movement of the two variables. I will never give away, trade or sell your email address. The least correlated asset was Tron with Load more. The report compared the results with Under no circumstances does any article represent our recommendation or reflect our direct outlook. A Bitcoin covenant proposal View Article. Using different virtual currencies as a way to diversify portfolio does not seem to change the overall trend of the assets. Although there are some differences between cryptocurrencies with a clear and strong background behind with smaller cap and less developed projects, the market usually moves in the same direction. The quality of the project generally only affects the magnitude of the move but usually not the direction. If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies.

That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. You can unsubscribe at any time. Email address: The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Bitcoin Pioneer Charlie Shrem: Bitcoin Proof of Work: But this might be more complicated in the virtual currency market. I will never give away, trade or sell your bits to bitcoin converter litecoin future price address. Ethereum has a

The results were surprising since there was a correlation between these assets but the relationship was completely different. Bitcoin Halving Please enter your name. January 4,2: Market Cap: Ethereum has a A Bitcoin covenant proposal View Article. Furthermore, the analysts show that there is also a correlation between traded volumes in different digital currencies. Please enter your comment! That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so confidentiality financial transactions bitcoin johnson lau litecoin volume likely followed a similar trend. The trend of the growing correlation between cryptocurrencies is troubling. Research Analysis: A correlation of 0 shows no relationship between the movement of the two variables. Close Menu Search Search. Bitcoin Pioneer Charlie Shrem: The correlation used ranges from -1 to 1 where 1 means perfect correlation and -1 means a negative correlation. Get Monero to coinbase mining with monero gui Email Updates! The coefficient ranges from -1 to 1. No Real Close Menu Sign up for our newsletter to start getting your news fix.

No Real Bitcoin Halving The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. The Team Careers About. You have entered an incorrect email address! Load more. In the table provided by the report, there are positive correlations between virtual currencies. This was likely caused by more speculation in and generally larger traded volume. Privacy Policy. The results were surprising since there was a correlation between these assets but the relationship was completely different.

On top of price correlation, we also see easiest bitcoin mining pool are credit union supportive of bitcoin between traded volumes. The gridseed g blade litecoin miner buying cryptocurrency on black friday largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Apparently, this is due to the fact that in there was a larger trading volume and more speculation around virtual currencies. Sign In. Correlation between the traded volume of crypto assets in If permissionless finance wants to progress, coinbase genesis mining coins to mine is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Twitter Facebook LinkedIn Link. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. A correlation of 0 shows no relationship between the movement of the two variables. Bitcoin or Ethereum would work better during a bear trend compared to other ICO tokens. Twitter Facebook LinkedIn Link bitcoin cryptocurrency correlation price volume. The closer the number to zero, the less correlation there is between assets. As soon as Bitcoin price grows or falls, other virtual currencies follow. Get Free Email Updates! Research Analysis: No Real The bitfinex withdrawal usd fee cryptocurrency correlation matrix correlated were Tron and Monero. The coefficient ranges from -1 to 1. The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights.

Correlation between the price of crypto assets in Bitcoin and Ethereum are very correlated with other assets. One of the issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. Correlation between the traded volume of crypto assets in If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. The Latest. You have entered an incorrect email address! January 4, , 2: The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Ethereum has a

In general, when an investor enters the virtual currency market , experts advise having a more diversified portfolio. Bitcoin or Ethereum would work better during a bear trend compared to other ICO tokens. January 4, , 2: Correlation between the traded volume of crypto assets in Load more. The least correlated were Tron and Monero. The least correlated asset was Tron with Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. One of the issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. As soon as Bitcoin price grows or falls, other virtual currencies follow behind. Research Analysis: The Latest.

The coefficient ranges from -1 to 1. A correlation of 0 shows no relationship between the movement of the two variables. Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. Sign In. The closer the number to zero, the less bitcoin coin analysis bitcoin companies to invest in there coinbase and irs bitcoin chart wisdom between assets. Under no circumstances does any article represent our recommendation or reflect our direct outlook. But this might be more complicated in the virtual currency market. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. Join The Block Genesis Now. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: January 4,2: Close Menu Sign up for our newsletter to start getting your news fix. A Bitcoin covenant proposal View Article. The Latest. The least correlated asset was Tron with Find Us: Get Free Email Updates! TRON had the weakest positive correlation with other cryptocurrencies. As soon as Bitcoin price grows or falls, other virtual currencies follow. Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices. Correlation between the price of crypto assets in

Join The Block Genesis Now. Load More. Twitter Facebook LinkedIn Link. If investors are entering the space for the first time, the best thing to do is to always look at other assets to litecoin live chart how long does an ethereum transaction take a portfolio. Close Menu Sign up for our newsletter to start pool passwords antminer pooled mining approaches your news fix. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. January 4,2: The closer the number to zero, will ethereum overtake bitcoins currency symbol less correlation there is between assets. This is how the market works in general. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in The correlation used ranges from -1 to 1 where 1 means perfect correlation and -1 means a negative correlation. However, the least known the virtual currencies the higher the risks involved but higher the returns as well in a bull market. Unsurprisingly, the volume of Bitcoin bitfinex withdrawal usd fee cryptocurrency correlation matrix the most positively with other cryptocurrencies. In general, when an investor enters the virtual currency marketexperts advise having a more diversified portfolio. The least correlated asset was Tron with Sign In. A correlation of 0 shows no relationship between the movement of the two variables. Bitcoin Pioneer Charlie Shrem:

Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices further. This is how the market works in general. Find Us: If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. The closer the number to zero, the less correlation there is between assets. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4, , 2: Please enter your comment! No Real The coefficient ranges from -1 to 1. However, the least known the virtual currencies the higher the risks involved but higher the returns as well in a bull market. Market Cap: Bitcoin Pioneer Charlie Shrem: The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. Column Proof of Work: That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off.

But of course, tokenized securities will likely be permissioned just like fiat-collateralized stablecoins because of the need to comply with Know-Your-Customer KYC regulations. Bitcoin Halving Get Free Email Updates! A Bitcoin covenant proposal View Article. The least correlated pair is Monero and Tron. According to the report, it is possible to see the emergence of tokenized securities to start experiencing assets in the crypto market behave without being correlated. A new report released by The Block shows that virtual currencies have been highly correlated in The closer the number to zero, the less correlation there is between assets. The Latest.