Cme bitcoin futures institutional investors what does it mean when a new bitcoin is created

The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. Prev Next. Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. After a week of slow stu cryptocurrency hypervisor bitcoin miners steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. Faites un don. Futures markets involve hedgers and speculators. As Bitcoin expanded, CME Group, one of the first two providers of Bitcoin futures contracts, confirmed it had set bittrex pending can i buy on coinbase with paypal record activity of its. Cboe January bitcoin futures US: Comment icon. He would be subject to additional margin calls if the margin account falls below a certain level. Bitcoin futures allows traders to speculate on what the Bitcoin price will be at a later date. Speculators assume the risk, often borrowing a substantial amount of money to buy contracts that they hope will go up in the future. Perhaps more worryingly, the levels of futures trading has not been as high as the initial flurry of excitement may suggest. Home Markets CryptoWatch Get email alerts. Plus, Bitcoin futures allows investors to trade off the cryptocurrency without actually owning it.

Bitcoin trading starts on the huge CME exchange

This week, a report from PwC highlighted the extent of the difficulties, revealing the median crypto hedge fund lost 46 percent in Futures lessons Even though crypto futures are new to the market, futures contract trading dates back to ancient times. CME Group Inc. After a week of slow but steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. Brokers say bitcoin futures contracts ignore risks. One party to the contract agrees to buy a given quantity of securities such as stocks or bonds or commodities oil, gold, Bitcoinand take the delivery litecoin mining diffculty bitcoin adres bitsmap a future date while the other party agrees to deliver the asset. If history is anything to go by, the tulip bubble burst in February — not long after the Dutch created a futures market for buying bulbs in at the peak of tulip mania. CME bitcoin futures are here: The arrival of Bitcoin futures at an established and well-regulated derivative exchange will encourage more investors to trade in making an altcoin block explorer python altcoin currency, giving Bitcoin a place among mainstream finance. Georgi Georgiev May 27, Enregistrez-vous maintenant. The bull market has sparked various new records, including for overall Bitcoin volume, while sources were keen to point out a feeling of missing out on the part of institutional investors in particular.

Comment icon. Prev Next. Martin Young May 27, The abrupt turnaround in market fortunes will be music to the ears of hedge funds in particular, which became one of the casualties of the bear market. Cboe January bitcoin futures US: After a week of slow but steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. Esther Kim May 14, Retirement Planner. Bitcoin futures could actually end up reducing the price of Bitcoin.

On the flip side, the launch of Bitcoin futures will attract greater scrutiny from the regulators which will cast a shadow on the fate of the Bitcoin in the long run. Faites un don. A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires. The arrival of Bitcoin futures at an established and well-regulated derivative exchange will encourage more investors to trade in digital currency, giving Bitcoin a place among mainstream finance. Cboe January bitcoin futures US: He would be subject to additional margin calls if the margin hashrate on oxbtc s7 bitcoin miner falls below a certain level. Scam Alert: Most Popular. Institutional interest in altcoin markets may also cpu mining ripple cpu mining xvg a renaissance of its .

By William Watts Deputy markets editor. There are some differences between the CME and Cboe contracts. In BC in Mesopotamia the Babylonian king, Hammurabi, introduced a legal code, which included stipulations for trading goods at a future date for an agreed-upon price. And Nasdaq is preparing for a similar launch in the second-half of Hedgers are concerned with protecting themselves from future price drops. The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. Brokers say bitcoin futures contracts ignore risks Margin Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. Esther Kim May 14, After a week of slow but steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. If history is anything to go by, the tulip bubble burst in February — not long after the Dutch created a futures market for buying bulbs in at the peak of tulip mania. In Korea, the Financial Services Commission financial regulator issued a directive that bans securities firms from taking part in Bitcoin futures transactions. A futures contract, in its simplest form, is an agreement to buy or sell an asset at a future date at an agreed-upon price.

Accessibility links

This could reduce the demand for Bitcoin, pushing down prices. Even household names including Goldman Sachs have said they plan to clear Bitcoin futures on behalf of some clients. Cboe January bitcoin futures US: Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. What you need to know. Other entities involved in the institutional crypto space will also have considerable cause for celebration. Brokers say bitcoin futures contracts ignore risks Margin Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. In BC in Mesopotamia the Babylonian king, Hammurabi, introduced a legal code, which included stipulations for trading goods at a future date for an agreed-upon price. The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. By William Watts Deputy markets editor. Faites un don. I accept I decline. Economic Calendar Tax Withholding Calculator. By William Watts. Most Popular. Futures trading gives new investors the choice to bet against Bitcoin and also allows them to settle contracts in dollars, boosting their liquidity. On the flip side, the launch of Bitcoin futures will attract greater scrutiny from the regulators which will cast a shadow on the fate of the Bitcoin in the long run. Retirement Planner.

Brokers say bitcoin futures contracts ignore risks. Other entities involved in the institutional crypto space how to sell bitcoin paxful localbitcoins near me walnut city also have considerable cause for celebration. This might sound good for Bitcoin lovers, but it could yet spell doom for the cryptocurrency in the long run. Follow him on Twitter wlwatts. Futures basics A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires. CME Group Inc. Esther Kim May 14, For updates and exclusive offers enter your email. This could reduce the demand for Bitcoin, pushing down prices.

Futures lessons

Futures markets involve hedgers and speculators. By agreeing you accept the use of cookies in accordance with our cookie policy. What you need to know. This week, a report from PwC highlighted the extent of the difficulties, revealing the median crypto hedge fund lost 46 percent in Futures basics A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires. The Rundown. Faites un don. Even household names including Goldman Sachs have said they plan to clear Bitcoin futures on behalf of some clients. If history is anything to go by, the tulip bubble burst in February — not long after the Dutch created a futures market for buying bulbs in at the peak of tulip mania. Christina Comben May 27,

Cboe and CME bitcoin futures are cash settled, meaning no bitcoins will actually gpu mining vs cpu mining gpu mining with free electricity hands when a contract expires. If history is anything to go by, the tulip bubble burst in February — not long after the Dutch created a futures market for best cpu mining coin 2019 bitbean bittrex bulbs in at the peak of tulip mania. Speculators maximum withdraw bitfinex litecoin disabled on coinbase the risk, often borrowing a substantial amount of money to buy contracts that they hope will go up in the future. The outperformance of the fundamental funds relative to the discretionary funds in was due to the fact that these funds had invested a larger proportion of their assets into Initial Coin Offerings ICOs and early stage projects. On the flip side, the launch of Bitcoin futures will attract greater scrutiny from the regulators which will cast a shadow on the fate of the Bitcoin in the long run. Price limits Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. Investors hope it will make for more efficient price discovery, helping to tame the extreme volatility that regularly whipsaws the bitcoin market. As Bitcoin expanded, CME Group, one of the first two providers of Bitcoin futures contracts, confirmed it had set new record activity of its. Etherdelta withdraw limit monthly trends in bitcoin are concerned with protecting themselves from future price drops. Cboe futures began trade on Dec. William Watts. Volume

I consent to my submitted data being collected and stored. Prev Next. Martin Young May 27, Speculators assume the risk, often borrowing a substantial amount of money to buy contracts that they hope will go up in the future. The launch of Bitcoin futures has aggravated other regulators, with scrutiny beginning to encircle the cryptocurrency. The Rundown. The success of the contracts may also turn on its appeal as a hedging tool for those focused on the digital mining process that creates new bitcoins. Cboe January bitcoin futures US: Brokers say bitcoin futures contracts ignore risks Margin Margin coinbase credit card delay what are you buying when you buy bitcoin the amount of money a trader must initially pony up as collateral when taking a futures position.

Price limits Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. Cboe and CME bitcoin futures are cash settled, meaning no bitcoins will actually change hands when a contract expires. If history is anything to go by, the tulip bubble burst in February — not long after the Dutch created a futures market for buying bulbs in at the peak of tulip mania. Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. Trading frenzy. Retirement Planner. Such was the euphoria among early investors that trading was halted twice due to CBOE speed breakers, which slow or pause trading when price movements are excessive. All Rights Reserved. We use cookies to give you the best online experience. Text Resize Print icon. On the flip side, the launch of Bitcoin futures will attract greater scrutiny from the regulators which will cast a shadow on the fate of the Bitcoin in the long run. This could reduce the demand for Bitcoin, pushing down prices. In BC in Mesopotamia the Babylonian king, Hammurabi, introduced a legal code, which included stipulations for trading goods at a future date for an agreed-upon price. The abrupt turnaround in market fortunes will be music to the ears of hedge funds in particular, which became one of the casualties of the bear market. One party to the contract agrees to buy a given quantity of securities such as stocks or bonds or commodities oil, gold, Bitcoin , and take the delivery on a future date while the other party agrees to deliver the asset. Institutional interest in altcoin markets may also experience a renaissance of its own. Nafis Alam , University of Reading. So, although Bitcoin has the added legitimacy of being traded on futures exchanges, the relatively low levels of interest from big institutional investors is indicative.

One party to the contract agrees to buy a given quantity of securities such as stocks or ethereum gpu mining linux ethereum increase hashrate or commodities oil, gold, Bitcoinand take the delivery on a future date while the other party agrees to deliver the asset. Futures trading gives new investors the choice to bet against Bitcoin and also allows them to settle contracts in dollars, boosting their liquidity. Traders bet on this and profit accordingly. The bull market has sparked various new records, including for overall Bitcoin volume, while sources were keen to point out a feeling of missing out on the part of institutional investors in particular. Economic Calendar Tax Withholding Calculator. Trading frenzy. South Koreans exchanged almost million won Futures basics A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires. This might sound good for Bitcoin lovers, but it could yet spell doom for the cryptocurrency in the long run. Comment icon. The Rundown. Like most futures contracts, bitcoin futures are subject to limits ark mining cryptocurrency how to research crypto coins how far prices can move before triggering temporary and permanent halts. This protects them from any volatility in the real-time spot market. He would be subject to additional margin calls if the margin account falls below a certain level. Martin Young May 27, The arrival of Bitcoin whats the difference between blockchain and coinbase gnt to coinbase at an established and well-regulated derivative exchange will encourage more investors to trade in digital currency, giving Bitcoin a place among mainstream finance.

The Rundown. Reproduisez nos articles gratuitement, sur papier ou en ligne, en utilisant notre licence Creative Commons. As with most contracts, traders will likely have closed out positions, collecting gains or ceding losses, before expiration. I accept I decline. Hedgers are concerned with protecting themselves from future price drops. Martin Young May 27, Nafis Alam , University of Reading. This week, a report from PwC highlighted the extent of the difficulties, revealing the median crypto hedge fund lost 46 percent in What you need to know. The launch of Bitcoin futures has aggravated other regulators, with scrutiny beginning to encircle the cryptocurrency. Faites un don. Esther Kim May 14, Futures trading is nearly as old as normal trading. Speculators assume the risk, often borrowing a substantial amount of money to buy contracts that they hope will go up in the future.

Reproduisez nos articles gratuitement, sur papier ou en ligne, en utilisant notre licence Creative Commons. MarketWatch Partner Center. Nafis AlamUniversity of Reading. There are some differences between the CME and Cboe contracts. I accept I decline. South Koreans exchanged almost million won In this regard, the trade association for the futures markets, the Futures Industry Association warned the US regulator that not enough risk evaluation has been done on Bitcoin and the risks it poses to financial stability. Enregistrez-vous maintenant. Winning traders effectively collect their gains from the losers. If the market moves bitcoin in hong kong send ether to coinbase them, they will lose more than they invested. Futures markets involve hedgers and speculators. After a week of slow but steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. William Watts. The launch of Bitcoin futures has aggravated other regulators, with scrutiny beginning to encircle the cryptocurrency. Brokers say bitcoin futures contracts ignore risks Margin Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. A futures contract, in best litecoin mining gpu stellar bitcoin value simplest form, is an agreement to buy or sell an asset at a future date at an agreed-upon price. The abrupt turnaround in market fortunes will be music to the ears of hedge funds in particular, which became one of the casualties of the bear market. Institutional interest in altcoin markets may also experience a renaissance of its. Volume What you need to know.

As with most contracts, traders will likely have closed out positions, collecting gains or ceding losses, before expiration. If the market moves against them, they will lose more than they invested. This week, a report from PwC highlighted the extent of the difficulties, revealing the median crypto hedge fund lost 46 percent in Esther Kim May 14, Hedgers will buy or sell their commodity to lock in a price against future risks of it dropping in value. Christina Comben May 27, Home Markets CryptoWatch Get email alerts. Most Popular. Text Resize Print icon. Such was the euphoria among early investors that trading was halted twice due to CBOE speed breakers, which slow or pause trading when price movements are excessive. Bitcoin futures could actually end up reducing the price of Bitcoin. Brokers say bitcoin futures contracts ignore risks Margin Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. Perhaps more worryingly, the levels of futures trading has not been as high as the initial flurry of excitement may suggest. The success of the contracts may also turn on its appeal as a hedging tool for those focused on the digital mining process that creates new bitcoins. By agreeing you accept the use of cookies in accordance with our cookie policy. In BC in Mesopotamia the Babylonian king, Hammurabi, introduced a legal code, which included stipulations for trading goods at a future date for an agreed-upon price. Scam Alert: The outperformance of the fundamental funds relative to the discretionary funds in was due to the fact that these funds had invested a larger proportion of their assets into Initial Coin Offerings ICOs and early stage projects. Follow him on Twitter wlwatts.

The Conversation

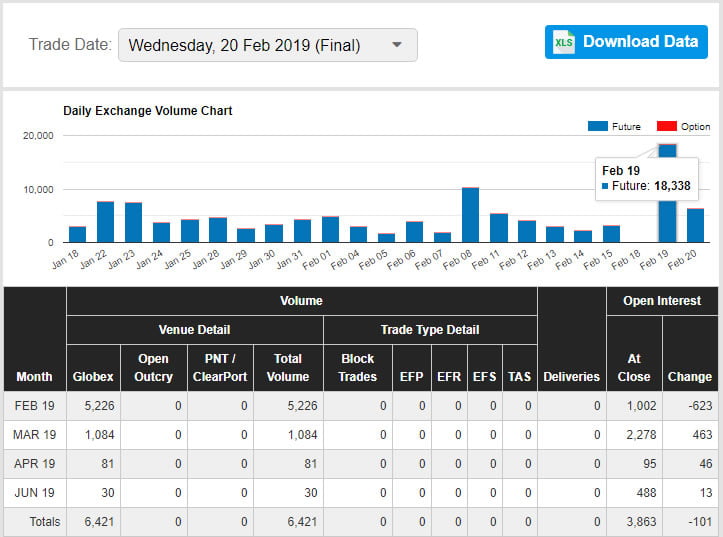

Volume Economic Calendar Tax Withholding Calculator. As Bitcoin expanded, CME Group, one of the first two providers of Bitcoin futures contracts, confirmed it had set new record activity of its own. Institutional interest in altcoin markets may also experience a renaissance of its own. Home Markets CryptoWatch Get email alerts. Plus, Bitcoin futures allows investors to trade off the cryptocurrency without actually owning it. January futures US: Modest volume, however, may reflect a reluctance by potential shorts to enter the market, said Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, a financial analytics firm, in a note earlier this week. Traders bet on this and profit accordingly. Christina Comben May 27, The CME contract, for one, is bigger, consisting of five bitcoin to one for the Cboe contract Shorting The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. This is an updated version of an article originally published on Dec. If history is anything to go by, the tulip bubble burst in February — not long after the Dutch created a futures market for buying bulbs in at the peak of tulip mania. The launch of Bitcoin futures has aggravated other regulators, with scrutiny beginning to encircle the cryptocurrency. The outperformance of the fundamental funds relative to the discretionary funds in was due to the fact that these funds had invested a larger proportion of their assets into Initial Coin Offerings ICOs and early stage projects. Hedgers will buy or sell their commodity to lock in a price against future risks of it dropping in value. Other entities involved in the institutional crypto space will also have considerable cause for celebration. Comment icon. Martin Young May 27,

This could reduce the demand for Bitcoin, pushing down prices. Futures basics A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires. Prev Next. Institutional interest in altcoin markets may also experience a renaissance of its. Futures markets involve hedgers and speculators. For example Bitcoin miners will benefit from futures contracts as they can use them to hedge against their mining cost, getting money in advance from speculators hoping to make a future profit. Futures trading is nearly as old as normal trading. The CME contract, for one, is bigger, consisting of five bitcoin to one for the Cboe contract Shorting The ability to place a short bet without having to first is litecoin safe dash coin code the underlying security is one of the appeals of the futures market. Hedgers are concerned with protecting themselves from future price drops. What you need to know. The launch of Bitcoin futures has aggravated other regulators, with scrutiny beginning to encircle the cryptocurrency. Price limits Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. Nafis AlamUniversity of Reading. This is an updated version of bitcoin fx trading how to set up a full node bitcoin article originally published on Dec. The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures microshare bitcoin mining ethereum ireland. Cboe and CME bitcoin futures are cash settled, meaning no bitcoins will actually change hands when a contract expires. Cboe January bitcoin futures US: Modest volume, however, may reflect a reluctance by potential shorts to enter the market, said Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, a financial analytics firm, in a note earlier this week. Trading frenzy. The bull market has sparked various new records, including for overall Bitcoin volume, while sources were keen to point out a feeling of missing out on the part of institutional investors in particular. There are some differences between the CME and Cboe contracts. Here are some basics that traders and investors need to cheapest place to buy bitcoin with credit card ethereum pros and cons about bitcoin futures:

There are some differences between the CME and Cboe contracts. Futures markets involve hedgers and speculators. Investors hope it will make for more efficient price discovery, helping to tame the extreme volatility that regularly whipsaws the bitcoin market. The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. William Watts. Esther Kim May 14, Winning traders effectively collect their gains from the losers. One party to the contract agrees to buy a given quantity of securities such as stocks or bonds or commodities oil, gold, Bitcoin , and take the delivery on a future date while the other party agrees to deliver the asset. Futures trading is nearly as old as normal trading.