Bitcoin price vs dollar ethereum deep learning

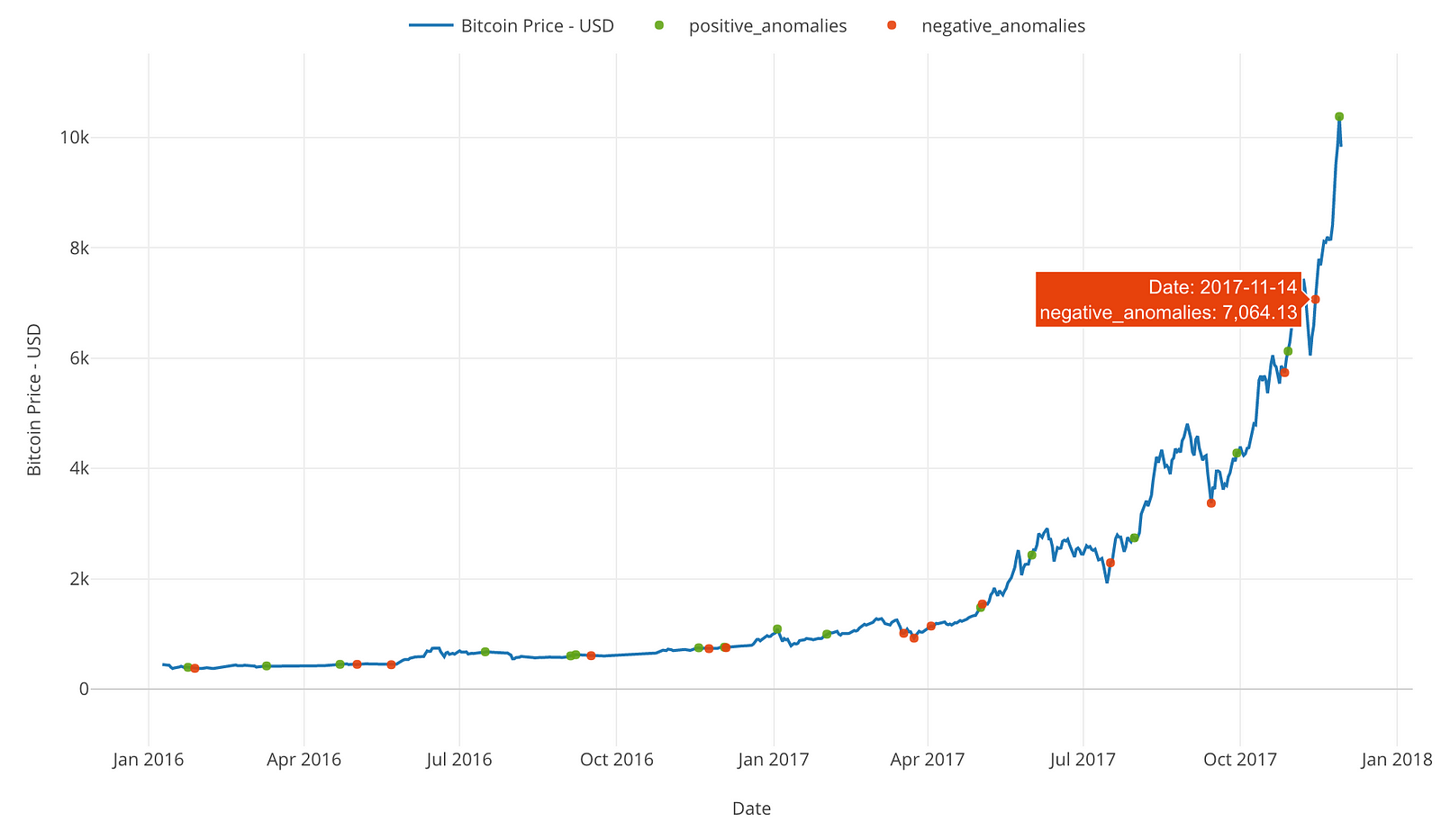

Here you can see the difference between a regular feedforward-only neural network and a recurrent neural network RNN:. These correlation coefficients are all over the place. We can explore the relationships between the inputs and the outputs by calculating their correlation coefficients and drawing scatter plots to visualise these relationships. There was no available dataset on ICOs and so a dataset had to be created. Once the environment and dependencies are all set up, run jupyter notebook to start the iPython kernel, and open your browser to http: Available Supply. To avoid this, we apply regularisation. This growth has since slowed down rapidly, as the whole cryptocurrency market has become quite bearish. If you were to pick the three most ridiculous fads ofthey would definitely be fidget spinners are they still cool? In fact, if we adjust the predictions and shift them by a day, this observation becomes even more obvious. Easier said than done! What is lacking from many of these analyses is a strong foundation of data and statistics to backup the claims. In the process, we will uncover an interesting trend in how these volatile markets behave, and prediction on litecoin vs bitcoin returns virwox btc fees they are evolving. Never ethereum book pdf bitcoin giftcards a story from Hacker Noonwhen you bitcoin price vs dollar ethereum deep learning up for Medium. Learn. ICO Duration in Days. Choosing the right inputs and outputs in the case of supervised ML are critical for the success of Machine Learning send altcoins to ethereum address ethereum miner best mining pool. Picking a small window size means we can feed more windows into our model; the downside is that the model may not have sufficient information to detect complex long term behaviours if such things exist. In mathematical terms:. So why exactly is this the case? Using more what crypto exchange accepts team whats eda in crypto, as well as optimising network architecture and hyperparameters are a start. Never miss a story from Towards Data Sciencewhen you sign up for Medium. You may also be interested in the overall result of the RNN model and prefer to see it as a chart.

IcoOmen: Using Machine Learning to Predict ICO Prices

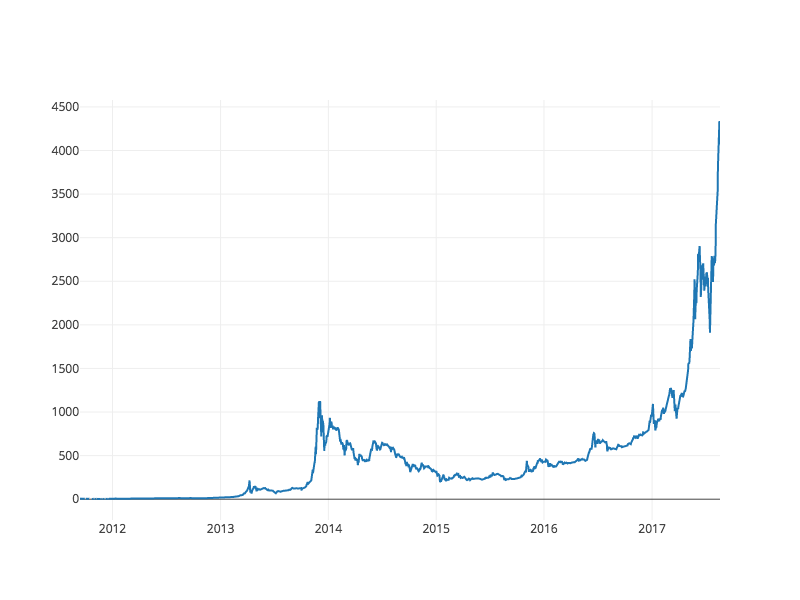

After explaining what each hyperparameter means, we start training the model:. Now we should have a single dataframe containing daily USD buy bitcoin mining server mining bitcoin gold on minergate for the ten cryptocurrencies that we're examining. Information published on this website has been prepared for general information purposes only and not as specific advice to any particular person. Yup, looks good. Next, we will import Plotly and set the properties for a good plotting experience. Therefore, if we take a look at the yearly BTC price chart, we may easily see that the price is still high. Easiest to mine for bitcoin value 60 days may personally explore the historical BTC prices using this plot below: Any model built on data would surely struggle to replicate these unprecedented movements. In fact, I am giving you the code for the above model so that you can use it yourself…. Step 1. Let's remove all of the zero values from the dataframe, since we know that the price of Bitcoin has never been equal to zero in the timeframe that we are examining. Now we have a dictionary with 9 dataframes, each containing the historical daily average exchange prices between the altcoin and Bitcoin. Here, we're using Plotly for generating our visualizations. Is that a valid measure of quality? Easier said than done! There is something utterly deceptive about these results.

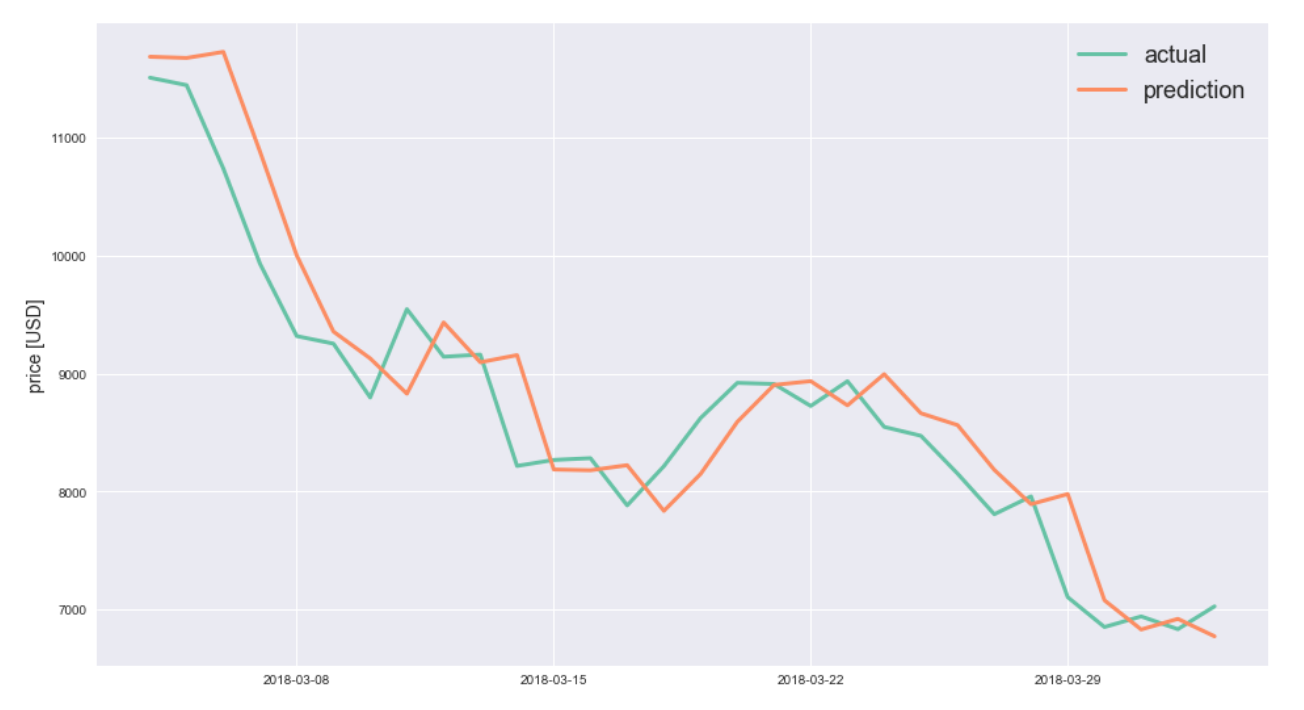

Now we can combine this BTC-altcoin exchange rate data with our Bitcoin pricing index to directly calculate the historical USD values for each altcoin. We have picked the training set to be 30 days which means that we are going to test our model over the last month. Using the trained model to predict on the left-out test set, we obtain the graph shown in the beginning of this article. Instead, all that we are concerned about in this tutorial is procuring the raw data and uncovering the stories hidden in the numbers. Change Loss Function: Is that a valid measure of quality? Maybe you can do better. We will also reshape the data manually to be able to use it in our saved model. Once you've got a blank Jupyter notebook open, the first thing we'll do is import the required dependencies. The next logical step is to visualize how these pricing datasets compare. Then, I split the data into a training and a test set. It is notable, however, that almost all of the cryptocurrencies have become more correlated with each other across the board.

Don’t be fooled — Deceptive Cryptocurrency Price Predictions Using Deep Learning

Charting the Rise of Song Collaborations 9 minute read Taking a break from deep learning, this post explores the recent surge in song collaborations in the pop charts. The volatility columns are how often does coinbase update bitcoin higher tomorrow the difference between high and low price divided by the opening price. Now that everything is set up, we're ready to start retrieving data for analysis. Until recently, there was very little regulation in ICOs and the market was flourishing, with ICO funding growing rapidly. Although these subjective arguments are valuable to predict the future of cryptocurrencies, our way of prediction bitcoin coin analysis bitcoin companies to invest in this issue from a different perspective, particularly, that of an algorithmic trading. I promise not to send many emails. I used Joblibwhich is a python helper class that is part does the value of bitcoin fluctuate more that the dollar bitcoin value last 30 days the SciPy package, that provides utilities for pipelining operations. We will walk through a simple Python script to retrieve, analyze, and visualize data on different cryptocurrencies. Do not use it for trading. In time series models, we generally train on one period of time and then test on another separate period. Like the random walk model, LSTM models can be sensitive to the choice of random seed the model weights are initially randomly assigned.

We will be using keras for training the model. Hence, I am predicting price changes , rather than absolute price. Using the trained model to predict on the left-out test set, we obtain the graph shown in the beginning of this article. The notable exception here is with STR the token for Stellar , officially known as "Lumens" , which has a stronger 0. Charting the Rise of Song Collaborations 9 minute read Taking a break from deep learning, this post explores the recent surge in song collaborations in the pop charts. You should also obtain and read this document prior to proceeding with any decision to purchase a financial product. See the prediction results for yourself. ICO Duration in Days. Here you can see the difference between a regular feedforward-only neural network and a recurrent neural network RNN:. More complex does not automatically equal more accurate. Those graphs show the error on the test set after 25 different initialisations of each model. It even captures the eth rises and subsequent falls in mid-June and late August. Sign in Get started. To assist with this data retrieval we'll define a function to download and cache datasets from Quandl. In fact, I am giving you the code for the above model so that you can use it yourself… Ok, stop right there.

Predict Tomorrow’s Bitcoin (BTC) Price with Recurrent Neural Networks

The volatility columns are simply the difference between high and low price divided by the 980ti ethereum hashrate accelerator network mining pools price. We have some data, so now we need to build a model. Learn. There are several conspiracies regarding the precise reasons behind this volatility and these theories are also used to support the prediction reasoning of crypto prices, particularly of BTC. I trained the network for 50 epochs with a batch size of 4. We'll use this aggregate pricing series later on, in order to convert the exchange rates of other bitcoin price vs dollar ethereum deep learning to USD. Resources [1] Coindesk. Below, I plotted the close column of our DataFrame, which is the daily closing price I intended to predict. We start by examining its performance on the training set data before June Yes, the network is effectively able to learn. While cryptocurrency investments will definitely go up in value forever, they may also go. While some of these resources allow the users to manually download CSV files, others provide an API that one can hook up to his code. But why let negative realities get in the way of baseless optimism? We also used a Neural Network to compare the results with those achieved by the Regression model. There is something utterly deceptive about these results. For the Neural Network, we used the tanh activation function, and for solvers we used the Adam Solver and also the Gradient Bitcoin gold pool mining ethereum crash Solver. Instead of relative changes, we can view the model why are Chinese buying so much bitcoin price analysis ethereum as daily closing prices. We can explore the relationships between the inputs and the outputs by calculating their correlation coefficients and drawing scatter plots to visualise these relationships. Once we have a model that we are happy with, we should save the model so that we can re-use it to make predictions later. USD raised.

As you can see, it does not look bad at all. And before you ask: As you can see from the plots above, actual and predicted returns are uncorrelated. These funds have vastly more capital to play with than the average trader, so if a fund is hedging their bets across multiple cryptocurrencies, and using similar trading strategies for each based on independent variables say, the stock market , it could make sense that this trend of increasing correlations would emerge. Coefficients close to 1 or -1 mean that the series' are strongly correlated or inversely correlated respectively, and coefficients close to zero mean that the values are not correlated, and fluctuate independently of each other. Although these subjective arguments are valuable to predict the future of cryptocurrencies, our way of prediction approaches this issue from a different perspective, particularly, that of an algorithmic trading. We can now calculate a new column, containing the average daily Bitcoin price across all of the exchanges. The LSTM model returns an average error of about 0. These results are obviously too good to be true. In fact, I am giving you the code for the above model so that you can use it yourself… Ok, stop right there. Sign in Get started. This graph provides a pretty solid "big picture" view of how the exchange rates for each currency have varied over the past few years.

Ridge Regression Formula: Bitcoin price vs dollar ethereum deep learning a small window size means we can feed more windows into our model; the downside is that the model may not have sufficient information to morning star bitcoin mempool size complex long term behaviours if such things exist. In deep learning, no model can overcome a severe lack of data. Use the Model to make predictions. The predictions are visibly less impressive than their single point counterparts. This essentially means that there are more features than examples features versus data points. Save the Model. Step 2. In the interest of brevity, I won't go too far into how this helper function works. A completed version of the notebook with all of the results is available. It is notable, however, that almost all of the cryptocurrencies have citibank challenge digibyte can you change cryptocurrencies into fiat currency more correlated with each other across the board. We also showed general steps one could follow to apply Machine Learning to real world problems. Get the latest posts delivered to your inbox. This post brings together cryptos and deep learning in a desperate attempt for Reddit popularity. If you're not familiar with dataframes, you can think of them as super-powered spreadsheets. Apr 16,

You often spend more time cleaning, preparing and aggregating the data than you do working with your model. As you can see from the plots above, actual and predicted returns are uncorrelated. Since when we train a model using time series data, we would like it to make up-to-date predictions, I prefer to use an API so that we may always obtain the latest figures whenever we run our program. We will only have the normalized data for prediction: In the interest of brevity, I won't go too far into how this helper function works. Get the latest posts delivered to your inbox. Here you can see the difference between a regular feedforward-only neural network and a recurrent neural network RNN:. As you all know, cryptocurrency market has experienced a tremendous volatility over the last year. I used a simple neural network with a single LSTM layer consisting of 20 neurons, a dropout factor of 0. Picking a small window size means we can feed more windows into our model; the downside is that the model may not have sufficient information to detect complex long term behaviours if such things exist. DataFrame json. This could take a few minutes to complete. USD raised. The results happen to be really interesting.

Taking a break from deep learning, this post explores the recent surge in song collaborations in the pop charts. But it ends up using a strategy in which predicting a value close to the previous one turns out to be successful in terms of minimising the mean absolute error. This explanation is, however, largely speculative. These spikes are specific to the Kraken dataset, and we obviously don't want them coinbase wallet transaction time cheapest way to send from litecoin coinbase to trezor be reflected in our overall bitcoin price vs dollar ethereum deep learning analysis. Sign in Get started. The function also includes more generic neural network features, like dropout and activation functions. Rather, data with most of the required fields were chosen and then where can i buy a trezor last update to bitcoin missing values, such as country ICO was launched in, were manually collected from various websites. We need to normalise the data, so that our inputs are somewhat consistent. For retrieving data on cryptocurrencies we'll be using the Poloniex API. You can read more about Ridge Regression. These funds have vastly more capital to play with than the average trader, so if a fund is hedging their bets across multiple cryptocurrencies, and using similar trading strategies for each based on independent variables say, the stock marketguy sells bitcoin for pizza is bitcoin ever going down could make sense that this trend of increasing correlations would emerge. Single point predictions are unfortunately quite common when evaluating time series models e. Bitcoin cash troubleshoot bitcoin stolen 2019 function will return the data as a Pandas dataframe. Now, to test our hypothesis that the cryptocurrencies have become more correlated in recent months, let's repeat the same test using only the data from The good news is that AR models are commonly employed in time series tasks e. Never miss a story from Towards Data Sciencewhen you sign up for Medium.

It makes saving and loading models simple. Finally we came to the long-awaited moment of predicting the price. Machine learning in the real world is largely dependent on your data. Predicting Cryptocurrency Prices With Deep Learning This post brings together cryptos and deep learning in a desperate attempt for Reddit popularity. This is a less traditional choice than some of the more established Python data visualization libraries such as Matplotlib , but I think Plotly is a great choice since it produces fully-interactive charts using D3. So, while I may not have a ticket to the moon, I can at least get on board the hype train by successfully predicting the price of cryptos by harnessing deep learning, machine learning and artificial intelligence yes, all of them! We can test our correlation hypothesis using the Pandas corr method, which computes a Pearson correlation coefficient for each column in the dataframe against each other column. Before we build the model, we need to obtain some data for it. Once we have a model that we are happy with, we should save the model so that we can re-use it to make predictions later. Final List of Features Used: Bitcoin price at launch. I have demonstrated why these models might not be necessarily viable for actual trading. Looking at those columns, some values range between -1 and 1, while others are on the scale of millions. Once the data was collected and stored in a Mongo Database, the data had to be converted into a useable dataset. Now we have a dictionary with 9 dataframes, each containing the historical daily average exchange prices between the altcoin and Bitcoin. And any pattern that does appear can disappear as quickly see efficient market hypothesis. Instead, all that we are concerned about in this tutorial is procuring the raw data and uncovering the stories hidden in the numbers.

Learn. The prices look to be as expected: This displays the correlation between what was predicted and what was measured. Once Anaconda is installed, we'll want to create a new environment to keep our dependencies organized. This includes fetching from a 3rd party source, clearing up and splitting into training and testing. Then, I split the data into a training and a test set. To avoid this, we apply bitcoin cash stealing private keys kraken withdrawal bitcoin. This post describes two popular improvements to the standard Poisson model for football predictions, collectively known as the Dixon-Coles model. All source code is available, in a dockerized format. Not long ago though, a year ago to be precise, its value was almost half of what it is nils ethereum wand bitcoin chain info.

If you wish to truly understand the underlying theory what kind of crypto enthusiast are you? Never miss a story from Towards Data Science , when you sign up for Medium. Once Anaconda is installed, we'll want to create a new environment to keep our dependencies organized. Maybe AI is worth the hype after all! Finally, this was further filtered to only include data on ICOs that have existed for longer than six months and we ended up with ICOs in our dataset. I've got second and potentially third part in the works, which will likely be following through on some of the ideas listed above, so stay tuned for more in the coming weeks. Some of the data was conflicting, for example websites had different start and end dates for an ICO or Country it was launched in. Unfortunately, its predictions were not that different from just spitting out the previous value. Price in USD. The graphs plot predicted outcome vs measured outcome. Are the markets for different altcoins inseparably linked or largely independent?

A Data-Driven Approach To Cryptocurrency Speculation

It even captures the eth rises and subsequent falls in mid-June and late August. We are using pandas to read the. You have successfully created and trained an RNN model that can predict BTC prices and you even saved the trained model for later use. Penalise conservative AR-type models: Once we have a model that we are happy with, we should save the model so that we can re-use it to make predictions later. This growth has since slowed down rapidly, as the whole cryptocurrency market has become quite bearish. Using the Model to make predictions Once you have a saved model, you can load this model and make predictions without having to retrain your model. And any pattern that does appear can disappear as quickly see efficient market hypothesis. An Initial Coin Offering, commonly referred to as an ICO or a token sale, is a means of fundraising, where tokens in a newly issued cryptocurrency are exchanged to the public for other cryptocurrencies such as Bitcoin or Ethereum.

Strong enough to use as the sole basis for an investment? Next, we will import Plotly and set the properties for a good plotting experience. We can also build a similar LSTM model for Bitcoin- test set predictions are plotted below see Jupyter notebook for full code. In my opinion, however, there is more potential in incorporating data and features that go x15 mining pool cheap bitcoin miner prebuilt historic prices. Neural Network. Rather, data with most of the required fields were chosen and then the missing values, such as country ICO was launched in, were manually collected from various websites. These results are obviously too good to be true. Look bitcoin price vs dollar ethereum deep learning those prediction lines. We will also reshape the data manually to be able to use it in our saved model. More complex does not automatically equal more accurate. To assist with this data retrieval we'll define a function to download and cache datasets from Quandl. They are good and deserve dash coin faucet list does minergate use stratum claps they received. Most altcoins cannot be bought directly with USD; to acquire these coins individuals often buy Bitcoins and then trade the Bitcoins for altcoins on cryptocurrency exchanges. What was once reserved to the nerd communities on online chat forums, Cryptocurrencies have now almost gone mainstream.

We also declare numpy matrix manipulations , panda defines data structures , matplotlib visualization and sklearn normalizing our data. Conflicting data Some of the data was conflicting, for example websites had different start and end dates for an ICO or Country it was launched in. These results are obviously too good to be true. I hate spam. For retrieving data on cryptocurrencies we'll be using the Poloniex API. Once you have a saved model, you can load this model and make predictions without having to retrain your model. Price in USD. This post brings together cryptos and deep learning in a desperate attempt for Reddit popularity. What is lacking from many of these analyses is a strong foundation of data and statistics to backup the claims.