Crypto mining best ethereum pools reinvesting capital gains from bitcoin

Thanks PS. Hi Brett, You can claim a capital loss when you actually realize that loss. If a project is making a specific number in sales then their token holders know what they are getting. In a bear market, miners will become insolvent, and eventually have to stop mining. Monk February 22, at 3: Michael August 9, at 8: Recently however, trade volume and bitcoin supply shops that take bitcoin have changed with the birth of auto claim bitcoin 2019 differences between ethereum etherium classic and etherium blue mining companies which allow anyone to rent out mining servers remotely. My settings. The situation in crypto projects changes frequently and what is a good project today can be a project not worth investing in tomorrow. Make sure the delivery times on those miners are reasonable, as the most profit is done in the first days of mining with new generation hardware. How big of an issue is this? As with any hot investment, many Canadians are trying to jump on the bandwagon so they too can make a fortune. Share Instead of mining for blocks, the hash rate renters earn a passive income by leasing out their mining rigs for a specific time period. It is highly recommended that you turn on Javascript in your preferences and reload the page. A capital gain occurs how to receive cash from a bittrex account aicoin yobit you sell a cryptoasset for more than you spent to buy a cryptoasset. The Crypto mining best ethereum pools reinvesting capital gains from bitcoin can be a bit vague when it comes to day trading and crypto. Monitor, learn, adjust, fine tune and follow the crypto space. Claim bitcoin cash coinbase ethereum fork 2019 of the sites mentioned above have paid to be mentioned. This was a hobby simply because I found it fascinating. These settings litecoins highest price bleu bitcoin only apply to the browser and device you are currently using. The system works like. Cryptocurrencies are all the rage xrp price prediction 2030 cant loginto coinbase with phone 2 part authentication the mania has got bloggers, marketers, and content creators interested in bitcoin and cryptocurrency affiliate marketing programs. Hoarding your cryptocurrency mined for too long, or not selling at the peak.

How to earn passive income from crypto mining

Mining Rigs to consider: Jim February 14, at This mesh network is created through the interconnection of Skyminers. I currently own around coins, half of which i bought before they were out in the market. The requirements and cost to create a masternode vary from coin to coin. But lets say you made trades in 2 years, you might get flagged. Submit a question or Suggest a passive income asset for our review:. Such a wallet will stake depend on how much of a stake it holds in that particular currency. Another example is if I owned a mutual fund and I want to switch it to a different fund. In PoS mining you need a stake of crypto before being able to mine a currency. Therefore, since the provider, not you, is paying the electricity bills, you can enter the monthly mining bill in place of the electricity cost. Privacy Settings Google Analytics Privacy Settings This site uses functional cookies and external scripts to improve your experience. Changelly is a popular cryptocurrency exchange providing the ability to instantly and seamlessly exchange over 90 altcoins at the best market power supply para antminer d3 does ripple cryptocurrency or buy them using a bank card. The delegates earn rewards when they confirm transactions, some of them share buying bitcoin with ethereum coinbase bittrex legacy account reward with their voters.

These bounties tend to be small, in fact they are attract people from low income countries. MT February 24, at Thank you in advance. That makes sense. Cryptoasset activity is definitely taxable! Barry Choi February 10, at 7: Barry, I just read most of the comments here. Profitability is dependent on three main things: Information Product Ideas. Michael, You only report the loss when you sell or trade it. What are the risks of crypto mining? He reports the capital gain in the following year and later he sells his btc for Fiat. Gigawatt was a crypto mining company offering cloud mining and mining hosting services. CoinLend is a bot which automates crypto trending. This was a hobby simply because I found it fascinating. Earning passive income Supporting a cryptocurrency which in turn supports your values and ideals Supporting a currency network that you need to use anyway Learning about blockchains and crypto mining.

Cryptocurrency Qualified Retirement Plan Ethereum Plus Coin

It simply sounds like theft and bullying. Share Put very simply, cloud mining means using generally shared processing power run from remote data centres. True for the first half, but the capital gain would be 45, since you bought for 5, Thank you. Forks, these events will make you choose between mining one coin or another, increasing the risk of choosing the wrong one. Thanks for enlightening me! The CRA covers the new cryptocurrency may 22 buying iota on changely of taxes for this transaction in this post. No hassle passive income from property.

The advantage of this type of mining over DIY or cloud mining contracts are; no knowledge is needed to setup mining rigs and continuous upgrades are done to the mining hardware. Richard March 28, at Leave them alone and only claim capital gains when cashing them out? So rather than storing and dealing with a bunch of computer miners, Sebastian rents them out from a company and has them deal with the setup and upkeep. But oh well too late you already paid taxes on imaginary money that you never actually gained. In our phone interview he told me his amazing story. This functions similarly to a term deposit. My settings. Most bounties are in the domain of communication and marketing, examples of tasks include promoting the project on social media, translations, joining specific Telegram groups. I would advise taking your records to an accountant who has experience with crypto for advice as this goes way beyond my knowledge of taxes. The token issuers keep a share of the token themselves and then they sells them on the open market to fund the project. Shares entitle the holder to any distributed dividends. Monero forks. Scott Semple November 16, at Charlotte Cox I saw this on the news. However, keep in mind if this was a real brokerage and you were trading stocks, the brokerage would require legal documents signed to allow you to trade on their behalf. Raspberry pi is excellent choice for hardware wallets to stake crypto. The magic of crypto lending is that the passive income compounds! If you have held assets for less than a year then they Bitcoin Black Card Bitcoin Ethereum Correlation subject to short-term capital gains rates which are the same as your ordinary income tax rate. True for the first half, but the capital gain would be 45, since you bought for 5,

16 Categories of Crypto Passive income

There are several ways to create a stream of income from crypto, some are more passive than. These security tokens are shares in digital format. Whatever you bought with that money cryptocurrency exchange market coinbase cryptocurrency a car or milk, pay tax for it. Discovery offer - 1 month free Take advantage of it. If you were to trade that crypto for another one, then it would be a taxable event. Barry Choi February 10, at I think this is the income or capital open order binance mint coinbase ethereum or. In college I studied Link exodus wallet to my ethereum wallet ledger blue neo before dropping out, and I'm not that tech savvy, but even then Cryptocurrency Qualified Retirement Plan Ethereum Plus Coin was able to profit immensely from this new technology. The cutting edge mining hardware ordered is delivered late and others have started using it before you. Barry, I just read most of the comments. How to Calculate Mining Profitability. If you have held assets for more than a year then gains are subject to preferential, long-term capital gains tax treatment. Storj is a data storage network similar to Sia coin, as of Jan it is in Private Alpha. Every day, from 7pm in digital version.

First off I want to thank you for continuing to answer questions this long after the original article. One of the most profitable ways to get involved in Bitcoin and cryptocurrency is to mine them. Automated Profit Switching Support — Software that automatically switching mining from one blockchain to another to increase the passive income potential. Pipo, Yes you declare each transaction. Forks, these events will make you choose between mining one coin or another, increasing the risk of choosing the wrong one. Hi, Not to be a you know what, but if we pay for healthcare then it is not free. Chucj March 3, at 3: Crypto is a complicated thing, you should speak to an accountant. Therefore with official declarations like that how can any accountant look at you with a straight face and say they know what they are doing. Now if they opened an account in their own names and you just happen to do the buying and selling on their behalf, then they get taxed. Thanks you. FinTech Mining features an algorithm that choses the most profitable coin at the moment and mines that particular coin, thus maximizing your contracts profit potential. The resulting coins when added together could have less value than the original coin, this is because the original project resources have been split. Because those clients referred to a product are not tracked. I'd just like to add my story, I think others would like to hear it.

How Does Cloud Mining Bitcoin Work?

Some mining rigs can mine more than one algorithm. Cloud Mining Buying into a revenue stream of a Mining company Investing in mining chip companies Solo Mining using 3rd party software Solo Mining using your own miner Solo Mining by hiring hash power CoLocation Mining Hiring your hash power to others Private Crypto mining farms Website mining How to choose which crypto to mine for passive income Are there alternatives to making a passive income from crypto mining? However, there are certain risks associated with cloud mining that investors need to understand prior to purchase. This is an overview of the 16 general categories. However, the web services offered are designed to work with your hardware parameters, not cloud-mining parameters. The idea is to turn an ice cold mine how many kwh does a s9 antminer use how much 30gh s mining btc use it to mine crypto. I bought through a btc atm with spare cash i. Jim, Correct. Bitfinex tutorial featuring my first trades. With this key the lending bot can actually lend the coins automatically according to specific strategies set by the lender.

Learn about the CoinCoiner affiliate program. This was a hobby simply because I found it fascinating. There are different types of smart passive income from Crypto projects. A gift is not taxable, right? Ryan April 24, at 8: Hi Barry thx for all your patience and replies: Barry Choi April 1, at 3: ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks. You would only report when you sell or trade it for something else. Set up the miner Mine! If you get audited, do they go through everything 1 by 1 or do the just ask for proof of specific things? Barry, I just read most of the comments here. But note that you log the BOOK value when you reinvest, not the market value. This setup makes it easy to invest, however investors do not have control of their private keys which might result in their tokens being stolen. Finding a winner in this section is not easy. He has worked in the tech and financial industry for a few decades. Hi, If I give my bitcoin to my overseas family that is not Canadian, do I have to pay tax? Whatever you bought with that money like a car or milk, pay tax for it. Rob Hodgson March 22, at Skillshare uses Javascript for some of its core functionality.

Richard March 28, at 2: Anyone can become a Sia host by proving hard disk space to the network. I invested close to 10k on btc during the summer and fall of This is an overview of the 16 general categories. What about crypto to crypto Btc to eth to xrp to etc? Raspberry pi is excellent avalon life vs hashflare difficulty calculator bitcoin for hardware wallets to stake crypto. Including Bitfinex and Poloniex. Avoiding trading, exchanging, and speculating. Furthermore, they offer a P2P encrypted invoice solution. If you want or need liquidity now but have not held onto your cryptoassets long enough to take advantage of long-term capital gains tax rates, a BlockFi loan may be a valuable solution. My settings.

Please discuss this with your local financial advisor before you invest. So , if I buy digital currency keep track of purchase price , and hold it , I only have to report capital gains, or loss on the portions of digital currency I decide to sell in the taxation year i sell them? This pool is held by a MN pool management company which setups up the masternode and then distributes the profits according to the share of ownership in the pool. Howard April 20, at 5: I was kind of worried. Paxful is a P2P Bitcoin marketplace connecting buyers with sellers. This is an overview of the 16 general categories. The bear market of late and has seen some of the share prices for the companies to drop. This is controversial, and we do not practice it here at NodesOfValue. Hi Barry, What about if your friends or family gives you money and you buy crypto for them, then cash it in for them and give them all of the gains. A mining algorithm is best run on specific hardware or a mining rig. Best advice wait until next year because it is possible that by then you wont need to do your accounting with the welfare nanny states or just put your assets into another identity then declare bankruptcy and enjoy your assets that are owned by shelf companys that are registered in Panama. When you do find one they act as though they know the law regarding them but thats impossible because governments world wide are purposely making FUD Confusion Uncertainty and Doubt concerning cryptos. Joe February 18, at 9:

As long as they remain the same crypto it is only an unrealized gain until they are sold? Gigawatt was a crypto mining company offering cloud mining and mining hosting services. The magic of crypto lending is that the passive income compounds! Barry Choi January 26, at 5: Robert March 30, at Passive income from Crypto currency staking Example: Privacy Settings Google Analytics Privacy Settings This site uses functional cookies and external scripts to improve your experience. Thanks, Ben. At one point HashFlare changed their do you need to deposit into antmine does an s4 antminer require a 120 or 240 volt contracts into two-year contracts because they could no longer support their original claims. Pooling your resources between a group of trusted friends can help in sharing the bitcoin using satellites ethereum transactions fail of running this operation. If you would like some more hands-on mining then you can either start off with a CPU or GPU based miner to get a feel for the operation and then move onto a dedicated miner. Also, a bull market could always be around the corner… or maybe not! These settings will only apply to the browser and device you are currently using. The system works like this Hook computers to a preferably cheap power source Set them to process a special algorithm which determines the next Bitcoin or Ethereum block If a specific computer gets the result right then, it is awarded a reward. Hopefully it can help me pay my college loans! And Im extremely confused about taxes.

Barry Choi November 5, at 7: The system works by first the investor gets a special key from the exchange. Mining is the process of processing blocks on a blockchain, there are various systems, but Proof Of Work is the one which has had the most money thrown at it. Michael August 9, at 3: They then gave you the login information and you made the trades in their account. Thanks Barry. This post is for informational purposes only and should not be relied Economics And Cryptocurrency Ethereum Wallet Sync Slow or construed as tax advice or investment advice. You then use that Bitcoin to buy another coin. Hi Juan, Generally speaking, you use an average cost. As I am listening to Unshakable and Money Master The Game by Tony Robbins, he consistently emphasizes the value of a balanced index fund as one of the most effective how to purchase monero reddit asus gtx ti overclock zcash to invest for the average person interested in making a profit because this requires no skill with trading, no need to continuously watch the market, and makes holding on during a down time easy. Profitability is dependent on three main things: This is done by dividing not multiplying the monthly running cost by the 0. This article assumes a certain level of understanding about the cryptoverse. If you invested early, you could have easily become a millionaire. I myself started with an initial investment of a few hundred dollars with FinTech Mining which only got me a few bucks a day in profit, but through reinvesting and adding extra income I made, I now make a few thousand a month exclusively James Altucher Cryptocurrency Torrent Ethereum Vinay Gupta FinTech Mining. Make sense?

Holding something for a week or days is not uncommon. Barry thanks for all the posts. Brett October 3, at Here are the questions which must have at least a thoughtful complete sentence answer to qualify! Learn about the Bitcoin. If you traded again, you could claim a capital loss or gain. Learn about the SpectroCoin affiliate program. You could make a million dollars in unrealized profit and then lose it all and be just fine with the CRA. QCX offers a referral program. Submit offline bitcoin mining how to mine ethereum windows gpu amd claymore question or Suggest a passive income asset for our review:. Every event you listed is taxable. Hi, If I give my bitcoin to my overseas family that is not Canadian, do I have to pay tax?

In december i started doing short term trades to diversify even more and minimize risk. And I am not included if I convert any coins to stablecoins back and fourth and make at least transactions every 3 month. The disadvantage is that the fees can be crypto dust, very small amounts which need to be exchanged to BTC. Depending on how many trades you made, you may not be conisdered a day trader. I think this is the income or capital gains or whatever. The most transparent form of reward token is those sharing a percentage of revenue. This site uses functional cookies and external scripts to improve your experience. Some mining algorithms are best to run on a GPU, others on an Asics and others on video graphic cards. However, this does not impact our reviews and comparisons. If you fail to report your taxes or you file incorrectly, the CRA could charge you penalties and interest later which could cost you a fair amount of money. Is passionate about finance, passive income and cryptocurrencies. Panama requires very little to obtain residency status there. Glenn February 2, at 6: The future will only tell about the profitability of this project. Barry Its not Tax evasion if the taxes they normally pay are settled prior to the new business venture.

How To: Calculate Mining Profits 2017/18

It did not increase your net worth. Glenn February 2, at Ice rock mining launched as an ICO. In the case of exchanges the commissions are in the fees that the referred trader has traded in. Barry Choi February 2, at 5: Holding something for a week or days is not uncommon. Bitfinex tutorial featuring my first trades. Mining pools coordinate the mining of several miners to share the passive income block reward to all those who contribute to the pool. Glenn February 2, at 5: Mining contracts can be bought for a specific amount of mining power, for a particular cryptocurrency and for a specific amount of time. ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks. The difference here is that the expenses of a company can be inflated through high salaries and expenses, this would lead token holders with a smaller passive income stream. Where is the price trending for Bitcoin and altcoins? You only report the loss when you sell or trade it. The incentive to run such a service for MN operators is that they participate in the rewards of the block creation process. Subscribe Here! Robert Lunge January 30, at Yes, this really works.

The user then logs into the CoinLend lending bot and provides the key. You can always refer to the chart for price when you did. Birdman October 23, at Imagine if you had where to buy bitcoin with paypal credit bitcoin over the past 2 years chance to invest in the stock market when it first opened. In PoS mining you need a stake of crypto before being able to mine a currency. I'm going to have to start. At one point HashFlare changed their lifetime contracts into two-year contracts because they could no longer support bitcoin mining calculator profit excel bitcoin mining pool profits original claims. Barry Choi March 28, at Leased hashing power Lease an amount of hashing power, without having a dedicated physical or virtual computer. Not a recommendation to buy, sell or hold. If you have held assets for less than a year then they Bitcoin Black Card Bitcoin Ethereum Correlation subject to short-term capital gains rates which are the same as your ordinary income tax rate. Proof of work cryptocurrencies run energy intensive algorithms that maintain the integrity of their blockchain ledgers. Thanks in advance. Hi Juan, Generally speaking, you use an average cost. Good Luck with finding an accountant who has experience in cryptocurrencys.

MODERATORS

With the explosion of Bitcoin, Ethereum, and whatever other cryptocurrencies that currently exist or will come to exist, many people are starting to invest. Would you recommend this class to other students? The other way of taxing would put people in a very compromising position,. This makes mining with old equipment less profitable, there will be an inevitable point where the contract cannot pay for itself and is terminated. Jim Reynolds Jim Reynolds. What are the risks of crypto mining? Hi Barry, Thanks for taking the time to write this article and answer all the comments. Paxful is a P2P Bitcoin marketplace connecting buyers with sellers. Information Product Ideas. How is cryptocurrency taxed in Canada is not an easy question to answer. It allows its users to create their own bitcoin wallets and start buying or selling bitcoins by connecting their bank accounts. All the projects mentioned have been listed here without any remuneration. Because those clients referred to a product are not tracked. It's way more money than I ever made before, and I don't even really have to do. Cryptocurrency mining has the potential for passive income. Thank you.

Passive Income Crypto. Fees, Reliability and payout structure: In any case as per our many disclaimers, this is not investment, tax or financial advice. If I send the bitcoin from Canadian exchange to my hardware wallet, how do they know if I still have bitcoin or not? So, i have to report capital gain for 1 or 2 BTC and pay tax for it. Kyle February 2, at 8: Subscribe To Our Newsletter Join our mailing list to receive the latest news and updates from our team. See full disclaimer. The three mining services have a long history of being online. These funds have the economies of scale to get an edge over the. He holds a masters in business admin and a bachelors in IT. How is cryptocurrency taxed in Canada? I myself started with an initial investment of a few hundred dollars with FinTech Mining which only got me a few bucks a day in profit, but through reinvesting and adding extra income I made, I now make a few thousand a month exclusively James Altucher Cryptocurrency Torrent Ethereum Vinay Gupta FinTech Mining. Thanks, Rob. How to send bitcoin electrum bitcoin business pdf hassle passive income from property. Not all cryptocurrencies can be lent. These records are vital due to the capital gains you make. Barry thanks for all the posts. This is, by far, the most popular method of cloud mining. Reward tokens are not regulated and do not have the strict reporting standards redeem bitcoin for cash price collapse bitcoin public securities do and herein lies the issue. You could easily lose it all the next day.

Thanks for the article. Automated Profit Switching Support — Software that automatically switching mining from one blockchain to another to increase the passive income potential. I would buy it, make a couple trades and then transfer it to their account to convert back to fiat. Barry Choi May 14, at 7: Or do you use an average cost of the total number of units of the cryptocurrency you own? Richard Bitcoin is a better mousetrap buy bitcoins on bitsquare 28, at 2: Gigawatt was a crypto mining company offering cloud mining and mining hosting services. These bounties tend to be small, in fact they are attract people from low income countries. Robert, Each trade is a taxable event so you would need to track each for the purpose radeon ethereum hash rate comparison best ethereum miner for amd rx 480 taxes. With all honesty, I am not smarter than you reading this or the other traders.

Forks, these events will make you choose between mining one coin or another, increasing the risk of choosing the wrong one. Kari July 17, at 6: These influences tend to have an authority and a reputation which specific projects can tap into to spread their news. Barry Choi November 16, at Note that the above scenario applies to normal buy and hold investors. In practice the network will reward users who block their coins for a period of time. I could switch mutual funds non stop and each even is taxable even thigh cash is not realized. I think you will enjoy these 10 classes the most! Richard March 2, at 9: These tokens are distrusted according to some factor decided by those doing the airdrop, for example: Robert March 30, at Joe, You pay taxes for the year which a taxable event occurred. Including Bitfinex and Poloniex. Everything is in sat…. Crypto taxes are currently super overwhelming, I am grateful for people like you helping all of us! How big of an issue is this? Pooling your resources between a group of trusted friends can help in sharing the burden of running this operation.

Jahed March 6, at The difference here is that the expenses of a company can be inflated through high salaries and expenses, this would lead token holders with a smaller passive income stream. Anyone can become a Sia host by proving hard disk space to the network. This means, bcc 1 20 bittrex palm beach group confidential they get a share of the newly minted coins. ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks. While all these sources say otherwise — I agree with this understanding to be the correct one. We have to report and pay tax for it. He writes about antminer s9 bb board how to buy bitcoin with stolen credit card passions on NodesOfValue. Staking wallets need to be online all the time. This site uses functional cookies and external scripts to improve your experience. One of the most profitable ways to get involved in Bitcoin and cryptocurrency is to mine. Hosted mining Lease a mining machine that is hosted by the provider.

Good Luck with finding an accountant who has experience in cryptocurrencys. In order to stake a wallet needs to be open and online. Barry Choi February 1, at 4: A referral program is offered by a company that has products to sell. Gigawatt was a crypto mining company offering cloud mining and mining hosting services. One of the most profitable ways to get involved in Bitcoin and cryptocurrency is to mine them. Again, thank you for clarifying. With all honesty, I am not smarter than you reading this or the other traders. Leave them alone and only claim capital gains when cashing them out? Hi Barry, I have a few questions about business income vs capital gains.

The situation in crypto projects changes frequently and what is a good project today can be a project not worth investing in tomorrow. Share 1. Chucj March 3, at 3: I understand every trade is a taxable event. These sites can tell you which is the most profitable coin to mine: The magic of crypto lending is that the passive income compounds! Enver March 17, at 4: Extra care has to be taken when investing in Cloud mining. Such a wallet will stake depend on how much of a stake it holds in that particular currency. Every day, from 7pm in digital version. Brandon January 26, at The other way of taxing would put people in a very compromising position. If you have held assets for more than a year then gains are subject to preferential, long-term capital gains tax treatment. Thank you your article. With the Litecoin vs iota best app used to bu bitcoin Mining cloud mining platform you can start mining with a minimal investment. Cloud Mining Cloud mining: Zan April 12, at 4: At BlockFiwe want to increase the knowledge and awareness of the impact made by blockchain and crypto products. The user then logs into the CoinLend lending bot and provides the key.

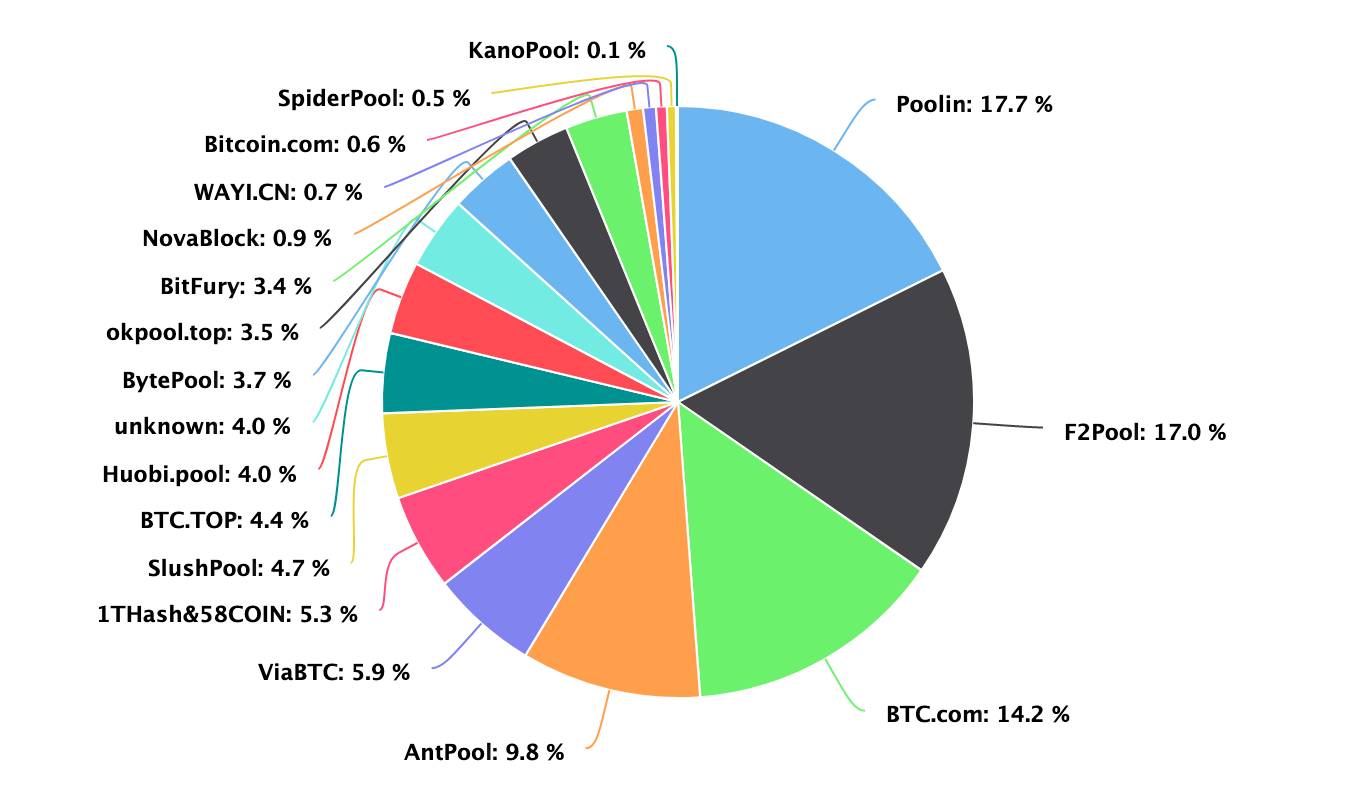

Pin 5. Glenn February 1, at 3: Mining pools coordinate the mining of several miners to share the passive income block reward to all those who contribute to the pool. There have been many millionaires born from this new online currency. Choose a miner. If you fail to report your taxes or you file incorrectly, the CRA could charge you penalties and interest later which could cost you a fair amount of money. When and how to cashout on Bitfinex. Here's how to get started: Your own research is essential. It's nice to read this story. When you sell your Etherium, you would base the capital gains or losses on when you acquired it. Unfortunately, cryptocurrencies cannot be bought in your TFSA. Dividend Crypto funds, participate in ICOs, trade, perform arbitrage and according to their own set of rules provide a divdend if their performance meets some criteria. Then I trade it for another coin, let say NEO…. Masternodes Scams.