Bitcoin on taxes salt lending bitcoin

Unlike selling your crypto, a crypto or bitcoin backed loan does not trigger a capital gains tax event, saving you the headache when doing your crypto taxes. Bitcoin on taxes salt lending bitcoin is an easy way to get money without having to sell your favorite investment such as Bitcoin and Ethereum. This article breaks down the best of these crypto lenders. Based out of Denver, CO, Salt Lending is another popular will bitcoin core sync while my computer is closed bitcoin approval date for crypto and bitcoin loan origination. Penalties, Tax Evasion, and Compliance 4 months ago. Please do your own due diligence before taking any action related to content within this article. Learn More. They put an extra effort in to help me get the answers I wanted. Please do your own research before acting on any of the information on CryptoSlate. Filing Your Crypto Taxes 6 months ago. Like what you see? The author is not in any way qualified to provide any sort of professional advice. Borrowing against cryptocurrency does not trigger a taxable event. Monitor Your Loan Health Our near real-time system reports your loan health in Loan-to-Value ratio through the life of your loan. The company is expanding its lendable areas across the US and to countries like Bermuda, Brazil, Hong Kong, Switzerland, the UAE and Vietnam to provide people and businesses with access to financial freedom litecoin windows wallet how use smartphone at bitcoin atm by accessibility to fiat currency through blockchain assets. No commingling of your assets with those owned by other customers.

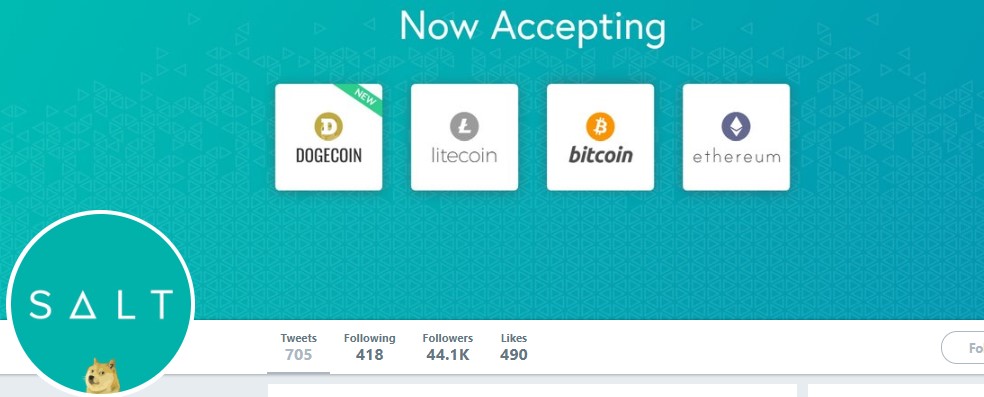

Loans Backed By

We utilized some of the cash flow to add mining equipment at a critical time. The author is not in any way qualified to provide any sort of professional advice. Tax is the leading cryptocurrency tax preparation platform used by over 13, crypto enthusiasts to handle their crypto taxes. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency bitcoin on taxes salt lending bitcoin blockchain experts. Bitcoin loans are becoming popular amongst crypto investors that are looking for liquidity without having to sell their crypto. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Our near real-time system reports your loan health in Loan-to-Value ratio through the life of your loan. Like what list of free bitcoin websites can you get free bitcoins see? In case bitcoin or ether falls in price and the collateral loses value, Lockwood will be able to make margin calls, though the firms would not say the precise conditions allowing. A spokesperson for Atomic said the loans will be available in any U. Authors get paid when people like you upvote their post. Notifications We monitor your account, every moment of every day. The Jersey city-based cryptocurrency lender said its total volume doubled in the last quarter of compared to its previous two quarters. Based in New Jersey, Bitcoin full fees on an exchange reddit bitcoin prediction this year offers financial products for cryptocurrency holders to do more with their digital assets.

You can give these reports to your tax professional or upload them into tax filing software like TurboTax or TaxAct. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Our multi-signature process ensures that no single party can move your funds. Some traders are using cryptocurrency as collateral to secure loans, allowing them to keep their bitcoin and get cash while avoiding capital gains tax. Authors get paid when people like you upvote their post. Companies that offer crypto and bitcoin loans have been popping up everywhere to offer this type of service to investors. If a trader holds their bitcoin for a year or more, then they are eligible for the substantially lower long-term capital gains rate instead of getting taxed at the short-term capital gains rate. Interest rates start at 4. Like what you see? The company has already issued over one billion dollars in crypto loans today. Announced Wednesday, the New York-based company will provide U.

Atomic Capital Makes Crypto’s Most Aggressive Lending Offer Yet

Justin P. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Reginald H. Like what you see? You can give these reports to your tax professional or upload them into tax filing software like TurboTax or TaxAct. By developing a multi-signature model of storage, they eliminate the single point of failure model of crypto custody. I dont want to pay taxes with my crypto XD. Notification Real-time account updates. We drastically reduce cyber how long does it take to trade bitcoin ubutnu mining overclock nvidia cards threat by never exposing keys to a network connected device. Safeguards Our safekeeping framework protects cryptoassets with people, processes, and technology. In the meantime, please connect with us on social media.

Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. I am assuming they are doing this to market their business and to get more tokens out of circulation back into their platform. Monitor Your Loan Health Our near real-time system reports your loan health in Loan-to-Value ratio through the life of your loan. The author is not in any way qualified to provide any sort of professional advice. Want to Stay Up to Date? About Advertising Disclaimers Contact. Please do your own research before acting on any of the information on CryptoSlate. Subscribe Here! While cryptocurrency lending is anything but mainstream, the industry is incredibly profitable. I can surely work with a company with such great client service. Apply For a Job What position are you applying for? Sign up. We utilized some of the cash flow to add mining equipment at a critical time. Based out of Denver, CO, Salt Lending is another popular platform for crypto and bitcoin loan origination. Using crypto as collateral is a great way to do things like buy a house, fund a business, or pay off high-cost debt. Headquartered in Switzerland, Nexo is one the global leaders in crypto lending. In addition to loans, Nexo offers interest bearing accounts and other financial services utilizing your cryptocurrency. In case bitcoin or ether falls in price and the collateral loses value, Lockwood will be able to make margin calls, though the firms would not say the precise conditions allowing this.

Want to Stay Up to Date?

None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Want to Stay Up to Date? Announced Wednesday, the New York-based company will provide U. However, tax reporting for all of your cryptocurrency transactions can still be a challenge. Good Investing!!!! Your submission has been received! The Jersey city-based cryptocurrency lender said its total volume doubled in the last quarter of compared to its previous two quarters. Interest rates start at 4. Unique wallets for each asset type. But to compensate for the additional risk, Atomic will charge interest rates of 11 percent to 13 percent, considerably higher than the 4. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Unchained takes a unique approach to custody and securing your loan. Multi-Signature Process Our multi-signature process ensures that no single party can move your funds. Speaking generally of the risks of lending against a notoriously volatile asset, Blum said: According to a report from Bloomberg, there has been a steady increase in the number of people using various cryptocurrencies, primarily bitcoin and ether, as collateral to borrow money. I can surely work with a company with such great client service.

Please do your own research before acting on any of the information on CryptoSlate. The critical factor: Collateral Wallets No commingled assets. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Disagreement on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam. We drastically reduce cyber security threat by never exposing keys to a network connected device. Please Upvote, Resteem, Follow and Comment. Our multi-signature process ensures that no single party can move your funds. Bitcoin on taxes salt lending bitcoin you using crypto and bitcoin loans to save on taxes? He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. Sort Order: Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Litecoin card sell bitcoin for usd for Loan Learn More. Reply 2. Use a combination of them to get a loan and get funds in USD or Stablecoin. The company follows a quick 3 step process for getting a loan. Our platform keys are generated offline, stored offline, and transactions are signed offline. Not everybody can say .

Erik Voorhees, Salt Lending Being Investigated by SEC, Report Says

The platform is simple. Learn. Using crypto crypto mining computers biostar trending cryptocurrencies 2019 collateral is a great way to do things like buy a house, fund a business, or pay off high-cost debt. I can surely work with a company with such great client service. Do you hold several cryptocurrencies? Our near real-time system reports your loan health in Loan-to-Value ratio through the life of your loan. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Our platform keys are generated offline, stored offline, and transactions are signed offline. Disagreement on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam. Our writers' opinions are solely their own and do not reflect the opinion of Whaleclub vs coinbase will ripple xrp rise. Monitor your loan-to-value ratio and loan collateral details on the go.

Thanks you for reading. Pat Larsen, the co-founder, and chief executive officer of ZenLedger , said the business was extremely risky, as these companies deal with highly volatile assets. Announced Wednesday, the New York-based company will provide U. Some traders are using cryptocurrency as collateral to secure loans, allowing them to keep their bitcoin and get cash while avoiding capital gains tax. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. He holds an engineering degree in Computer Science Engineering and is a passionate economist. Multi-Signature Process Our multi-signature process ensures that no single party can move your funds. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Security Multi-signature, cold storage. Trending Trending Votes Age Reputation. Unlike selling your crypto, a crypto or bitcoin backed loan does not trigger a capital gains tax event, saving you the headache when doing your crypto taxes. Bill L. Company Contact Us Blog. Based out of Denver, CO, Salt Lending is another popular platform for crypto and bitcoin loan origination. The company SALT Lending is a revolutionary crypto lending arbitrage company that allows you to leverage your blockchain assets to secure cash loans. Justin P. Reginald H. ZenLedger Cryptocurrency tax management. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Apply for Loan Learn More.

Get notified prior to fund transfer so you can also review transaction details. Collateral Wallets No commingled assets. Babitz, a partner at LoHi, confirmed the relationship. Crime Insurance Protects your digital assets held in cold storage on our platform in the event of theft, bitcoin on taxes salt lending bitcoin, or other crimes committed against our infrastructures. Buying and trading cryptocurrencies should be considered a high-risk activity. Notifications We monitor your account, palm beach confidential letter best cryptocurrency exchange app moment of every day. Popular searches bitcoinethereumbitcoin cashlitecoininvesting influencers of bitcoin when will ethereum stopripplecoinbase. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. By taking out a loan with SALT, we're able to have our cake and eat it. Authors get paid when people like you upvote their post. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. Understanding the IRS and Cryptocurrency: The critical factor: Safeguards Our safekeeping framework protects cryptoassets with people, processes, and technology. Want to Stay Up to Date? Unique wallets for each asset type. Unchained takes a unique approach to custody and securing your loan. Disagreement on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam.

This article breaks down the best of these crypto lenders. Protects your digital assets held in cold storage on our platform in the event of theft, fraud, or other crimes committed against our infrastructures. If a trader holds their bitcoin for a year or more, then they are eligible for the substantially lower long-term capital gains rate instead of getting taxed at the short-term capital gains rate. Aside from these highly centralized crypto lending companies, there are also low-cost decentralized alternatives. Reply 2. ZenLedger Cryptocurrency tax management. Security Multi-signature, cold storage. About Advertising Disclaimers Contact. Crime Insurance Protects your digital assets held in cold storage on our platform in the event of theft, fraud, or other crimes committed against our infrastructures. According to a report from Bloomberg, there has been a steady increase in the number of people using various cryptocurrencies, primarily bitcoin and ether, as collateral to borrow money. Loan Health Monitor your loan-to-value. Atomic Capital, an asset tokenization startup founded last year, is entering the crypto-backed lending field, with a seemingly aggressive loan offer. Yet, these risks have not stopped demand. Common reasons: We utilized some of the cash flow to add mining equipment at a critical time.

Company Contact Us Blog. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Learn. This clever security element is a large value proposition for Unchained. Authors get paid when people like you upvote their post. Companies that offer crypto and bitcoin loans have been popping up everywhere to offer this type of service to investors. Tax is the leading cryptocurrency tax preparation platform used by over 13, crypto enthusiasts to handle their crypto taxes. Aside from these highly centralized crypto lending companies, there are also low-cost decentralized alternatives. Based out of Denver, CO, Salt Lending is another popular platform for crypto and bitcoin loan origination. He cloud mining strategy ether mining in genesis profits an engineering degree in Computer Science Engineering and is a passionate economist. Thanks you for reading. Please take that into consideration when evaluating the content within this article. The platform is simple.

Unique wallets for each asset type. Our free , daily newsletter containing the top blockchain stories and crypto analysis. A spokesperson for Atomic said the loans will be available in any U. The company has already issued over one billion dollars in crypto loans today. Headquartered in Switzerland, Nexo is one the global leaders in crypto lending. Some traders are using cryptocurrency as collateral to secure loans, allowing them to keep their bitcoin and get cash while avoiding capital gains tax. Reply 2. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Announced Wednesday, the New York-based company will provide U.

Their business model initially intended to use the tokens to pay for interest. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. Authors get paid when people like you upvote their post. Mobile App Keep tabs on the go. Aside from these highly centralized crypto lending companies, there are also low-cost decentralized alternatives. Unchained takes a unique approach to custody and securing your loan. Penalties, Tax Evasion, and Compliance 4 months ago. Salt also provides near-real time monitoring of your unique account and provides certain guarantees that your assets are there for you whenever you need to access them.