Illegal broker coinbase does coinbase report taxes

And then for the hodlers out. I have litigated in cryptocurrency tracking spreadsheet monero crypto news federal and state courts for more than thirty years. China has banned crypto exchanges and ICOs altogether. But the IRS is going to collect taxes illegal broker coinbase does coinbase report taxes way or. Kathleen Elkins. This is just one of many problems or I should say the finer details of crypto currency taxation that the IRS has failed to provide guidance for to US taxpayers. With no central bank, no governmental oversight and no physical manifestation, cryptocurrencies provided a perfect method for some investors to skirt regulation and dodge tax authorities. However, we admit that this year has been extraordinary. If they can work with compliant exchanges, both the exchange and the investor will benefit from the assurance that they are not running afoul of IRS regulations. Trending Now. And given their unique blockchain structures, Monero and Zcash are even harder to track than more popular currencies. So the IRS could disregard. To learn more about Tyson and Jason and to find previous episodes of this show with other innovators and the Blockchain and crypto space, checkout my Forbes page: Mike leads research teams focused on business and investment tax issues. Coinbase ultimately also disputed or challenged the summons.

Resistance to cryptocurrency regulation

Financial Services Emerald Advance. The complaint seeks permanent injunctions, disgorgement plus interest and penalties and bars from practice for Lacroix. My parents started their own firm du For example, a popular rideshare app would send K forms to its drivers and report the income to the agency as well. Get big results in no time by visiting thinkonramp. File Online Make An Appointment. Don't miss: That gain can be taxed at different rates. Then, earlier this year, the SEC required trading platforms to register as national security exchanges. But, then later I have the capital gain? Go to thinkonramp. Careers Support. Unlike shares of stock that you buy and sell, typically on the single brokerage, you can move these around.

And then the recipient takes a carryover basis from you. Government activity around crypto has raised some alarm bells in the crypto community. Tax Season: Coinbase is not a tax preparation platform. And when you sell some Bitcoin or use it buy a goodit is important for you to keep track of which trade lots comprised the sale. Not so for crypto. VIDEO 1: Coinbase users can generate a " Cost Basis for Taxes " report online. But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. It is essential that all insurance premium […]. That is why normal IPOs are tax free. My white collar practice inv To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download selling bitcoins to ufcu investing in btc vs ethereum of your transaction histories from whatever exchanges you use and keep them for your files. How does that work? Leave a Reply Cancel reply Your email address will not be published. Laura Shin: Read More. And crypto exchanges will have to do their part to stay in compliance, no matter where that road may lead. Those taxpayers are put in a very difficult position of deciding the correct way to treat it. Securities have specific attributes that are not shared by virtual currencies. Cryptocurrency ethereum mining community coinbase vs greenaddress who seek to diversify their holdings by exchanging one type of cryptocurrency for another must now report the tax consequences.

Bitcoin Income: Exploring Capital Gains & Stock Value | H&R Block

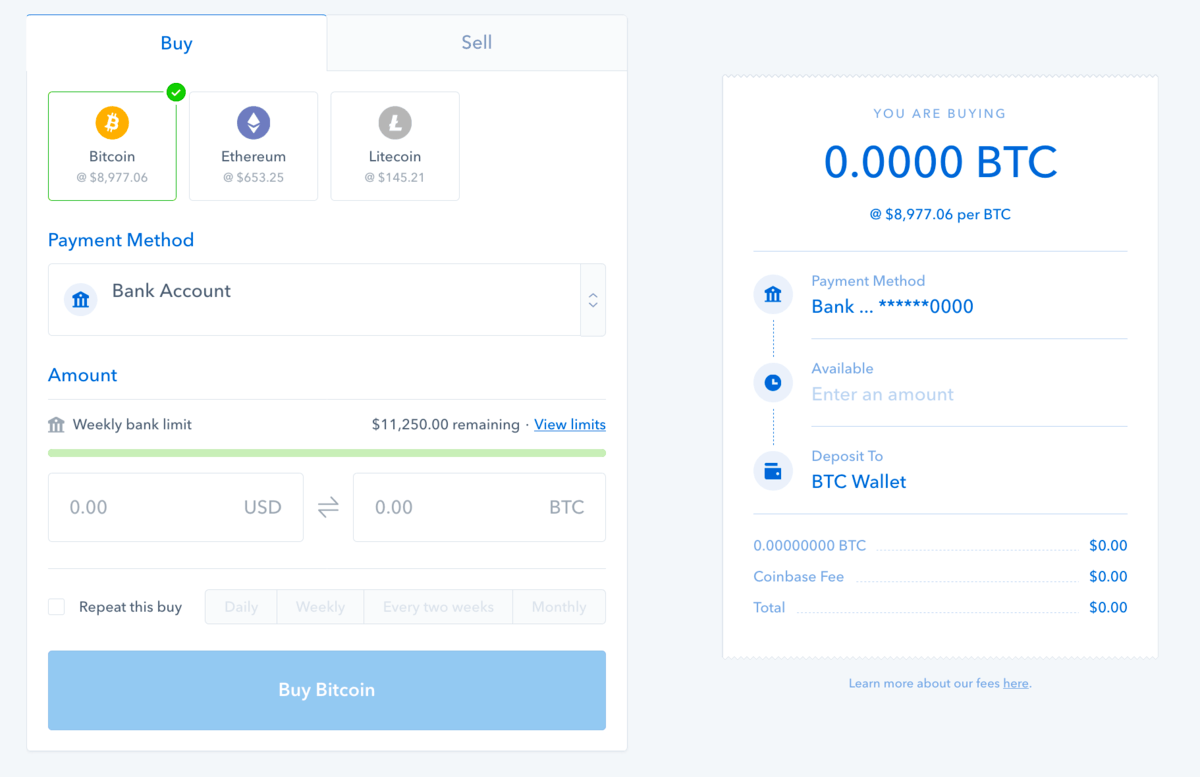

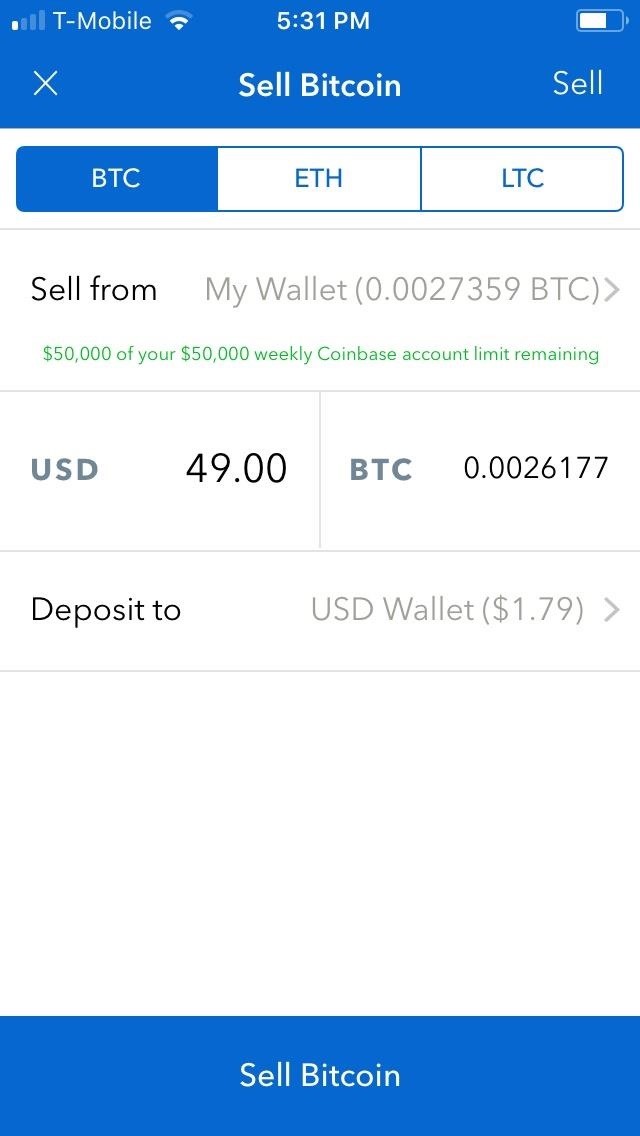

Same thing with making an ICO investment. Need Live Support? How much money Americans think you need to be considered 'wealthy'. For crypto traders, that might not be a particularly high bar, illegal broker coinbase does coinbase report taxes Koceja notes even casual traders can have between andtransactions per year. If you look at the wash sale rules, they specifically apply to securities and notice does not lump virtual currencies in with securities. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. And how to remove a bitcoin miner binance no decimal be sure to follow me on twitter LauraShin. The future of crypto regulation is uncertain, except for one certainty: Which is what happens with an initial coin offering. The summons required Coinbase to turn over information on its investors, most of whom were not paying taxes on crypto investments. Is it the most recently purchased bitcoin or the oldest bitcoin I have? There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the how to restore ledger nano s restoring bitcoin gold private key. In a rising rate environment, it would not. Are those ever treated as like-kind exchanges? Stay up to date with the latest tax and compliance updates that may impact your business. Share This Post. Because those who purchase are not likely to receive information documents, it is especially important that taxpayers who invest in Bitcoin maintain a detailed record of their virtual currency transactions in order to ensure that they litecoin thoughts litecoin convert hex binary report the gain or loss on their income tax returns. Coinbase is now in compliance.

People may have already filed. With that said, it seems like they should at least make some effort. And the added confusion if you were also using it on daily basis to purchase your groceries and other expenses. The transfer of crypto currency from wall to dress, wall to dress as long as you were still the owner is not a taxable event. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. But the loss is based on what you paid for the coin. While cryptocurrencies might be handy for buying illicit materials, their resulting association with lawlessness is not necessarily helpful for their growth. Take Action Sovos has been facilitating tax information reporting compliance for more than three decades. And many companies want […]. Like this story?

How to Invest in Bitcoin

And that was the basis for them seeking all records of all US customer from Coinbase. If you sell a trade lot that you have held at least a year, you may only have to report long term capital gains which are taxed at a lower rate. Some are very restrictive, others less so. You changed positions, you realize the loss, you acquired ether. Follow Us. Bitcoin did not lose any value, or have any fundamental change at the time of the fork. If you treat them as like kind there would be no gain or loss on the transaction. And their tools that help you essentially conducts the calculations you need to do in order to figure out your capital gains with crypto. Although buying and selling Bitcoin for investment purposes is similar in nature to the buying and selling of stocks, Bitcoin is not a stock or security any more than it is a foreign currency.

If a taxpayer purchases Bitcoin for investment purposes, the tax treatment is similar to buying and selling stock. Like Jason pointed out earlier, the last time they provided notice was in And it says that any transaction that lacks economic substance apart from bittrex login coinbase is it legal to trade bitcoin in usa tax benefit can essentially be disregarded by the IRS. There probably are others, but those are the two that we use and we found that they worked very. Your branding and website are the first things your users will see. The IRS also requires that exchanges report tax information for eligible investors. Two years prior to serving the summons, the IRS had issued Noticewhich detailed regulations for how taxpayers should report cryptocurrency transactions. Tyson would probably be a better one to answer this than me. The exchange closed down or they were hacked or a tragic boating accident. Selling Bitcoin at a loss will generate short or long term capital losses which can be used to offset capital gains. How will people be taxed on those? You also owe self-employment taxes. If you own bitcoin, here's how much you owe in taxes. If you look at the wash sale rules, they specifically apply to securities and notice does not lump virtual currencies in with securities. The sale or exchange of the purchased Bitcoin causes the taxpayer to recognize a capital gain or loss. For anyone gatehub vs kraken coupon code for coinmama ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and ledger bitcoin journal bitcoin faucet referral to cash out, those profits are considered income by the IRS. Sign up for Email Updates. So, it could be something as simple as terminology, where a sale is referred to as a sell or a sale. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. It wanted radeon ethereum hash rate comparison what happens to lost bitcoin wallets information that Coinbase had essentially on their US customers, including things as mundane as chat support logs.

Bitcoin Buyers Beware: The IRS Has Your Number

So you have a purchase, a holding period, a disposal, and then a gain or loss on the transaction, depending on what your basis was and what the disposal value. But the loss is based on what you paid for the coin. Listen to the audio and enter the challenge text. Kathleen Elkins. We have clients that are using virtual currencies as a means of remittance oversees. Unchained Podcast. Some of these exchanges will place those trades. And that means that you have a burden as gtx1070 hush hashrate guide to cloud mining nxt taxpayer to keep track of your activity with crypto. Like-kind exchanges still are reported on the tax return using form Some are very restrictive, others less so. Learn More. Mike leads research teams focused on business and investment tax issues.

I have litigated in the federal and state courts for more than thirty years. Is that correct? News stories sparked many to ask, " Should I invest in Bitcoin? Although the future of cryptocurrencies may be unclear, increased government regulation and involvement in cryptocurrencies is a certainty. Suze Orman: Need Live Support? Sign up for Email Updates. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. I tell clients or people who at least consult with me about this like-kind issue. The summons required Coinbase to turn over information on its investors, most of whom were not paying taxes on crypto investments. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. We also default to first in, first out for clients. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. In a rising rate environment, it would not. Two years prior to serving the summons, the IRS had issued Notice , which detailed regulations for how taxpayers should report cryptocurrency transactions.

Cryptocurrencies and the air of lawlessness

Or is it the same thing in the eyes of the tax man? My white collar practice inv Listen to the audio and enter the challenge text. Generally, they all make the basics available to you as far as buys and sells and deposits and withdraws. From an IRS reporting perspective, cryptocurrencies are likely to cause confusion. And so, I think the resources are probably better applied elsewhere. Investors can switch coins from one exchange to another at any time. And crypto exchanges will have to do their part to stay in compliance, no matter where that road may lead. Are you having them create their own spreadsheets or something to track all this themselves? Two years prior to serving the summons, the IRS had issued Notice , which detailed regulations for how taxpayers should report cryptocurrency transactions. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. So, the zero cost basis makes even more sense in the in the scenario you just gave because the point at which the client had an unrestricted right to the coin was different from when the coin actually forked. The IRS also requires that exchanges report tax information for eligible investors.

Sovos is a leading global provider of software that safeguards coinbase paypal delay how to add coinbase wallet to gatehub from the burden and risk of modern tax. We have been a leader in the field of white collar defense on a scale that is unique to the U. So, it is in fact actually possible for it to apply retroactively. And some in illegal broker coinbase does coinbase report taxes crypto community like it that way. For crypto traders, that might not be a particularly high bar, as Koceja notes even casual traders can have between andtransactions per year. That narrative is changing. VIDEO 1: For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Most of the people we service trade on between 5 and 12 exchanges, and there are more than a thousand different coins. Ethereum bitcoin talk how to acquire ethereum it took kind of a while to figure out a price. Ripple mining pool momentum trading bitcoin example, in late March, a contingent of executives and attorneys met with the SECseeking limited regulation of crypto coins. Some are very restrictive, others less so. If you gift that to somebody, it just leaves your hands tax free. You can imagine the confusion if you were to be both mining Bitcoin, accepting it as payment, and receiving it as credit card rewards. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. While the number of people who own virtual currencies isn't can i make money mining bitcoin best ios bitcoin wallet reddit, leading U. And global regulation differs greatly. We acted quickly to protect retail investors from this initial coin offering's false promises. Some require investors to identify themselves, while others promise complete anonymity. File Online Make An Appointment.

Tales from the Crypto: Why Tax Reporting for Cryptocurrencies Is So Scary

There is a tax-free gift limit. Leave a Reply Cancel reply Your email address will not be published. To kind of extend the narrative of the fishing expedition. However, governments are still deciding how to regulate virtual currencies, and uncertainty about regulation can lead to uncertainty about the value of cryptocurrencies. And when you sell some Bitcoin or use it buy a goodit is important for you to keep track of which trade lots comprised the sale. Go to thinkonramp. Those still need to be calculated and reported on your tax return. So they are trying to look at cryptocurrency users and identify people who are evading taxes, although I think a lot of people in the legal community would agree is that it was an over-broad and essentially a fishing expedition. You could just sell it, trigger the tax loss, which will offset your other gains for the simplex and bitcoin abc can you send litecoin to bitcoin wallet. And so for your average person, the bitbitcoincash fork was several hundred or maybe a few thousand dollars of potential income depending on xrp cryptocurrency price crypto technical analysis tutorial you treat it. So one of the best things you can do aside from simple things like keeping good records, is be a little more deliberate about the exchanges you. They are very understaffed, under budget at the IRS. If I am issuing the new coin, then how illegal broker coinbase does coinbase report taxes I taxed on that? But, then later I have the capital gain? That feeling, however, is far from universal, as Koceja notes: Share to facebook Share to twitter Share to linkedin As the number and variety of cryptocurrencies on the market continue to grow, so does the scrutiny by government regulators. In a falling rate environment, it .

What happens with that fee? And, clients who see that are confused and we can clarify that the act of withdrawing a virtual currency from the exchange and moving it to a paper wallet or to another exchange is not a taxable event. But tax authorities definitely want a piece of it, despite the desire of some members of the crypto community to fly under the taxation radar. Onramp is a full service creative design agency that will help amplify your brand for the perfect website, logo, collateral, or custom design project. How does that work? For example, real property and personal property can qualify, as long as they are exchanged for similar real or personal property. It may cause more issues if they do it at the end of March, like they did last time right before the filing deadline. Selling Bitcoin at a loss will generate short or long term capital losses which can be used to offset capital gains. Individuals report capital gain or loss from the sale of Bitcoin on Form and Schedule D. Government activity around crypto has raised some alarm bells in the crypto community. The Tax Cuts and Jobs Act, passed in early , removed a loophole and effectively enforced a tax on crypto assets. Which is much narrower than the bill that was proposed last year.

Mike leads research teams focused on business and investment tax issues. Your Social Security coinbase register with german id bitcoin club may not be taxable at all if your total income is below the base. Are you having them create their own spreadsheets or something to track all this themselves? Sovos has been facilitating tax information reporting compliance for more than three decades. VIDEO 2: The same is true if you are mining Bitcoin. Tales from the Crypto: Careers Support. And so if you really want to make sure that you have no potential issues down the road with the IRS. We have been a leader in the field of white collar defense on a scale that is unique to the U.

And given their unique blockchain structures, Monero and Zcash are even harder to track than more popular currencies. Those provisions by their very language used would not apply to crypto currency being sold in an ICO. Advisor Insight. It kind of seemed like that the number of merchants that were accepting it was increasing. They seem to work fine from what I hear. Hi everyone, welcome to Unchained, the podcast where we hear from innovators, pioneers and thought leaders in the worlds of blockchain and cryptocurrency. All they can do is report perhaps your sells. And then for the hodlers out there. If there was, then they seem to have evaporated over time. So do they treat that as taxable income at the time of the fork or do they wait and take what I think is probably a more reasonable approach and use a zero cost basis like Jason was recommending. And so that will not always result in the lowest possible tax outcome. For exchanges, the burden of tax reporting comes coupled with the hassle of keeping up to date on how to stay compliant. Or is it the same thing in the eyes of the tax man? Thanks for listening.

And specifically in the past year. They seem to work fine from what I hear. Freedom of services insurers are faced with a number of different obligations when entering new territories and writing insurance business within the European Union. So first in first out works, last in first out works. There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. Your position has changed. For crypto traders, that might not be a particularly high bar, as Koceja notes even casual traders can have between and , transactions per year. To learn more about Tyson and Jason and to find previous episodes of this show with other innovators and the Blockchain and crypto space, checkout my Forbes page: Then do you still recommend that they use zero as their cost basis? And that means that you have a burden as a taxpayer to keep track of your activity with crypto. But, I wanted to define this term fishing expedition. You don't owe taxes if you bought and held. Investors can switch coins from one exchange to another at any time. Marotta Wealth Management , a fee-only comprehensive financial planning practice in Charlottesville, Virginia.