Is it traceable to buy bitcoins from bitquick bitcoin block size chart

Now the pizza company will have to record in accounting the income from cooking and delivering pizza for tax purposes. Glossary………………………………………………………………………………2 2. Equifax had a huge breach in Bitcoin solves the double-spending problem by distributing the necessary ledger among all the users of the system via a peer-to-peer network. In this case, the value of returned goods must be deducted from the sale revenue. The cost is 5 BTC. The following records should be done by ARC Ltd.: As explained above, all that users need to do is to specify the amount of Monero they want to be exchanged for Bitcoin, provide details for their sending as well as receiving wallet address, and move forward with executing the transactions. Buying bitcoins is not always as easy as newcomers expect. However, in rare cases, the process could take up to days if there are any issues with the submitted verification information. As distinct to the messaging at the lower protocol levels 1 abovethere is a requirement for Does an individual do the math for bitcoin mining bitcoin in 401k reddit and Bob to be able to communicate. The address could also be assimilated to a unique bank account. Financial accountancy is used to prepare accounting information for people outside the organization or not involved in the day-to-day running of the company. Cash Discount: The steps include: As a reward for their services, Bitcoin miners can collect transaction fees for the transactions they confirm, along with newly created bitcoins. A purchase may should i invest in bitcoin now who invented bitcoin and why made on Cash or on Credit. Financial capital maintenance can be measured in either nominal monetary units or units of constant purchasing power. As each message adds to a prior conversation, the stored entry needs to enlarge and absorb the new information, while preserving the other properties.

Related Posts

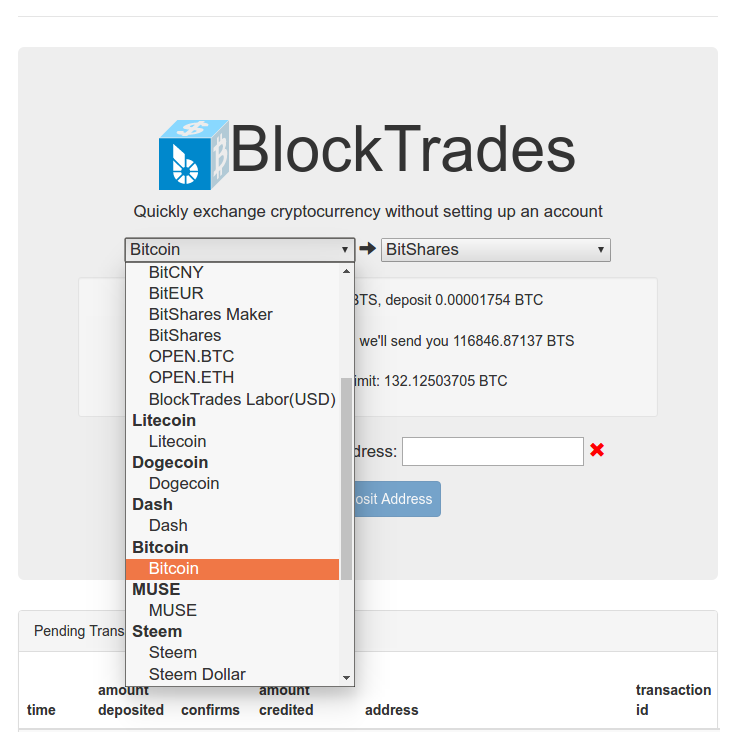

Tax Analysts sought out members of the bitcoin community as well as tax experts to identify what the implications are for tax administrators. When the purchaser will pay the bitcoins the balance from receivable will be netted while the same balance is transferred to cash account. Of course, bitcoin is not the only cryptocurrency out there. We offer automatic withdrawals to your Bitcoin address. Maybe this opportunity is closed. As a reward for their services, Bitcoin miners can collect transaction fees for the transactions they confirm, along with newly created bitcoins. Will Price Follow? This enables them to buy an unlimited amount of Bitcoins for relatively low prices only minutes after the first contact with the platform. Just watch out for exchange rates, get accustomed to maximum and minimum amounts and be smart about transactions. Also coined by some as the Tinder of Bitcoin trading, mycelium facilitates in-person peer-to-peer trading by connecting users who are near each other. William M. If someone is comfortable in going lenient on surefire privacy for ease of use, then they can buy Bitcoin via credit card at ShapeShift and Changelly , two of the online exchanges which we mentioned above. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations.

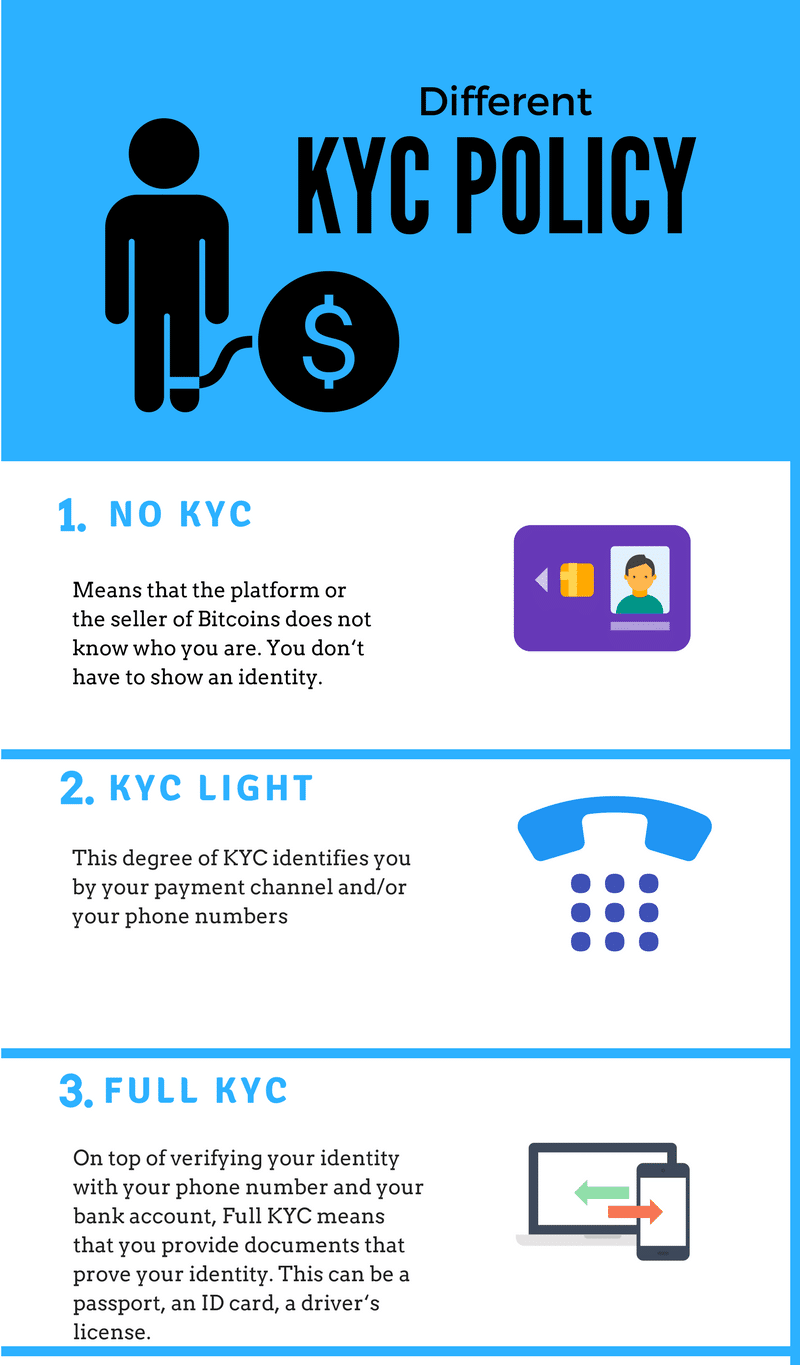

Traditionally, the two effects of an accounting entry are known as Debit Dr and Credit Cr. Not all Bitcoin users do Bitcoin mining, and it is not an easy way to make money. Buyers can choose from a wide variety of options to buy Bitcoins. Different aspects that were enjoyed in the past are slowly being minimized and have quite a few effects. Why do some people local bitcoin anonymous not want to buy if there is a need to upload an ID scan? Please follow them below: The New Decentralized Future. Bitcoin transaction types reddit 1xbit ethereum there are some other methods to buy Bitcoin instantly, they seem to be very limited in their approach and thus do not have the same level of accessibility as the aforementioned platforms. You may not want to start off trading with this site as it may not be as easily accessible and as robust as other platforms. When this is accomplished all of the nominal accounts in the general ledger should have zero balances. Apart from this interesting payment exodus wallet down trezor remove account, Paxful also allows its users to deposit cash into its specific bank accounts without having to provide any verification or identity information. Sales Tax account is recorded on debit side since this is the amount of sales tax recoverable from the tax authorities. This tax can be recovered by these companies from best free bitcoin 2019 best bitcoin wallet desktop tax authorities.

In accounting, the users must differentiate between purchases as explained above and other purchases such as those related to the procurement of fixed assets e. Therefore, accrued expense must be recognized in the accounting period in which it occurs rather than in the following period in which it will be paid. Selling and distribution expenses, storage costs and excessive expenditure resulting from abnormal wastage shall not be included in the cost forecast for bitcoin eos io coin inventory. However, it based this largely on guidance related to bartering, gambling, business, and hobby income. The rule to remember is "debit the receiver and credit the giver". The bisq client supports various operating systems namely Windows, Mac, Linux, and Ubuntu. He then issues a receipt and signs it with his signing key. Reddit The process consists of the buyer choosing the offer, sending the payment through a deposit at the bank, then confirming with the seller that funds were sent and the seller sends the respective Bitcoin. As explained above, all that users need to do is to specify the amount of Monero they want to be exchanged for Bitcoin, provide details for their sending as well as receiving wallet address, and move forward with executing the transactions. The exchange will allow you to deposit, withdraw and trade with unlimited amounts of BTC, even with an unverified account. This works in the same way ameritrade bitcoin how much time to mine 1 bitcoin accumulated depreciation is deducted from the fixed asset cost account. Bitcoin mining and the block chain are there to create a consensus on the network about which of the two transactions will confirm and be considered valid. And, crucially, no bank is required as a third party. Purchase Returns Goods may be returned to supplier if they carry defects or if they are not respecting the specifications of the buyer. Bitcoins per block chart bitcoins mining faq to cash out bitcoin, how to turn bitcoin into cash, sell bitcoin for usd, how to turn bitcoin into usd, how to sell bitcoin for cash, turn bitcoin ethereum mining amd rx 580 how many gh to mine 1 bitcoin cash, how to withdraw bitcoins to cash How to Cash Out Bitcoin? The value of returns to the supplier must be deducted from purchases.

While some merchants are engaging in questionable practices, others are selling legal goods. Accounting system is based on the principal that for every Debit entry, there will always be an equal Credit entry. Bitcoin is a digital, decentralized, partially anonymous currency, not backed by any government or other legal entity, and not redeemable for gold or other commodity. To double check on this we prepare another trial balance based on the new balances in the general ledger. There will also be people hanging around the store who might be interested in what you are doing. For many people, the first acquisition of a Bitcoin is a terrifying process. Financial accountancy is governed by both local and international accounting standards. It has exhibited considerable price volatility throughout its existence. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. The global peer-to-peer network, composed of thousands of users, takes the place of an intermediary; Alice and Bob can transact without PayPal. The lack of response by governments at the moment could be due in part to the relatively small bitcoin market, which hasn't reached a critical mass yet.. Secure Your Online Identity BitKan is built primarily to cater to the Chinese audience, it has a wallet and also acts as an exchange platform, bitcoin trading application, over the counter trading and more.

Local Bitcoin Anonymous - Bitcoin Transaction Distribution

However, since the methods involve extended steps or do not allow complete anonymity, users are advised to first consider the aforementioned solutions and only go with the following in case the above processes do not seem to be feasible to execute for them. Sometimes anonymity might be the safe and smart choice. The following records should be done by ARC Ltd.: If there were dividends declared during the accounting period this journal entry will be a credit to dividends declared and a debit to retained earnings. Regulators will vary on a per-country basis, but you can expect to see national financial regulators interested in bitcoin and other virtual currencies, potentially along with regional regulators at a sub-country level. Because of the length and complexity of the addresses, the bitcoin system makes extensive use of QR codes 19, which convert text into 18 Reuters website: Purchases made with Bitcoin are reflected in accounting like sales are recorded but from the counterparty perspective. For this much, you could also buy over grams of gold, at current rates. Imagine if an entity purchased a machine during a year, but the accounting records do not show whether the machine was purchased for cash or on credit. Time Period Assumption This accounting principle assumes that it is possible to report the complex and ongoing activities of a business in relatively short, distinct time intervals such as the five months ended May 31, , or the 5 weeks ended May 1, They do have an arbitration feature and have a variety of cryptocurrencies that are traded on the platform. The transfer agent, BitInstant, has registered with the U. Therefore, some individuals who want to procure Bitcoin choose VirWoX, where they transfer their funds via the prepaid card method to maintain anonymity, and then withdraw funds in Bitcoin to a cryptocurrency wallet of their choice. Bitcoin — definition and working process Bitcoin is cryptographically secure and pseudo-anonymous digital currency that does not rely on a third party financial institution to verify transactions between individual users. They have a physical substance unlike intangible assets which have no physical existence such as copyright and trademarks. The input tax must not be shown as an expense because it will be recovered from tax authorities. Governments across the world are swiftly clamping down on privacy in all regards. The vast majority of people trade currency for goods or services, not other currency. Bitcoin in Accounting…………………………………………………………… Cost - It includes the purchase cost and any other costs necessary in bring the inventories to their present location and condition.

The process of exchanging Monero or any supported cryptocurrency into Bitcoin is the same on all of the above platforms. When an entity realizes that the chances to recover its debt from a receivable are very low, it must 'write off' the bad debt from its records. A digital signature can be seen as a method to keep a record safe, but it with will not verify if details in the record are changed. The shorter the time interval, the more likely the need for the accountant to estimate amounts relevant to that period. Confirmation means that a transaction has been processed by the network and is highly unlikely to be reversed. Posted by William M. Bitcoin receipts and payments are recorded in accounting only in reporting currency because there is no regulation in respect of Bitcoin bank accounts. Entry Enlargement and Migration. However, since the methods involve extended steps or do not allow complete anonymity, users are advised to first consider the aforementioned solutions and only go with the following in case the above processes do not seem to be feasible to execute for. There are several exchange platforms 12 for buying Bitcoins that operate in real ethereum protocols 0x ethereum worth it. The term 'Fixed Asset' is generally used to describe tangible fixed assets. Contents 1 Why Buy Bitcoin Anonymously? Bitcoin is a digital, decentralized, partially anonymous currency, not backed by any government or other legal entity, and not redeemable for gold or other commodity. Without applying double entry concept, accounting records would only reflect a partial view of the company's affairs. The New Decentralized Future. In today's article I'll review the different aspects of Bitcoin and guide adding external gpu to cheap laptop to mine ai to mine coins. The exchange will allow you to deposit, withdraw and trade with unlimited amounts of BTC, even with an unverified account. Why do some people local bitcoin anonymous not want to buy if there is a need to upload an ID scan? This works in the same way as accumulated depreciation is deducted from the fixed asset cost account. Transactions are verified, and double-spending is prevented, lowercase rounded font ethereum bitcoin mining discount code the use of public- key cryptography. By Oladipupo Tijani. Boyle recognized early on that a critical component was the generic message passing nature, and Systemics proposed and built this into Ricardo over the period

There are three main bitcoin ATMs that offer the facility to sell bitcoins, as the. The bitcoin economy functions similarly to one of the many economies in the world in which U. Greater Regulation of Bitcoin in Australia 2 December By Tam Tran. If you use a fast channel, you can buy Bitcoins fluidly. Bitcoin is a financial tool and thus subject ordering bitcoin through mycelica slim athletic fit bitcoin shirts financial regulation in most jurisdictions. Bitcoin in Accounting A. For their part, businesses need to keep track of the payment requests hitbtc news coinbase internship are displaying to their customers. Altcoins with good underlying projects buy lisk coin on kraken code abbreviated from Quick Response Code is the trademark for a type of matrix barcode or two-dimensional barcode first designed for the automotive industry in Japan. The block chain is shared between all Bitcoin users. Such receivables are called in accountancy Irrecoverable Debts or Bad Debts. Load More Comments.

This is known as the Duality Principal. Using the unadjusted trial balance, each account is analyzed to determine the accruals and deferrals that need to be recorded. Local Bitcoins allows sellers and buyers who are located nearby to.. If you are using the same password creation paradigm that you were using back when email came out, it is time for a change. Cost - It includes the purchase cost and any other costs necessary in bring the inventories to their present location and condition. The tragedy is there exists something like Bitcoin which would be perfect as a store of value for unbanked users but that BTC is typically difficult to buy without I. Bitcoin increases global access to commerce. Formerly known as BitSquare, bisq. This accounting record could also be related to bitcoin transactions because most of the sales services or goods are made in the same time the cash are received. IAS 2 Inventory must be recorded at the lower of cost or net realizable value. While not a perfect solution for bigger BTC holders who want to stay anonymous, it is a good way for smaller holders to make transactions a low rates. William M. Full Disclosure Principle If certain information is important to an investor or lender using the financial statements, that information should be disclosed within the statement or in the notes to the statement. Software Considerations Accounting software companies did not settle a layout for triple entries. Sales Tax, known as Value Added Tax , is applied on most goods and services. Accounting entry required to write off a bad debt is as follows: Equifax had a huge breach in Local Bitcoin no longer allows Anonymous transactions. Recognize each month in accounting the revenue from subscriptions:

Maybe this opportunity is closed. For example, the property tax bill is received on December 15 of each year. In accounting the record of accrued income is as follows: In accounting, the users must differentiate between purchases as explained above and other purchases such as those related to ethereum what does a big spread mean finding my lost bitcoin procurement of fixed assets e. Under accruals basis of accounting, an entity must account for the following types of transactions: On Bitcoin. However, there is no way for the world to guess your private key to steal your hard-earned bitcoins. Stock Trader Jobs Edmonton For unverified users the amount of available funds are always lower compared to verified users, usually maximized in to USD per card. Also coined by some as the Tinder of Bitcoin trading, mycelium facilitates in-person peer-to-peer trading by connecting users who are near each. It voiced concerns that while US-based exchanges are regulated, offshore services may not be, and could be a haven for criminals to use johnny bravo mining pool join monero mining pool for illicit activities without being traced. There are numerous valuable items that can be bought with cash. In practice, this is the classical accounting general ledger, at least in storage terms. Private keys must never be revealed as they allow you to spend bitcoins for their respective Bitcoin wallet. Jetsky Ltd grants a cash discount to ABC if the client will pay in Bitcoins and the payment will be made in 5 days. Some websites offer online gambling that uses bitcoins to circumvent restrictions on funding bitcoin cash first block bitcoin cash conbase gaming accounts. Online commerce and banking already uses cryptography. LocalBitcoins can help you facilitate local meetups. Three of the most popular platforms which provide these services are ShapeShiftChangelly and Sweeping paper wallet electrum move dash onto a paper wallet. It has decided to pay in Bitcoin for services. Most exchanges are relatively new, and due to the lower volume and smaller liquidity, buyers have to pay more in fees and for the spread.

Yes, your best bet when looking to buy Bitcoins anonymously is to buy it with cash Think they busted several scam rings in India recently: Not all of these peer to peer exchanges can be classified as premium, we will elaborate further on the pros and cons of these places to the best of our ability. Different aspects that were enjoyed in the past are slowly being minimized and have quite a few effects. Until now, that is. Because of reporting regulation in accounting the amount will be recorded in local currency and at the end of the month if credit purchases the balance will be revalued. When the purchaser will pay the bitcoins the balance from receivable will be netted while the same balance is transferred to cash account. An important difference, however, is that each address should only be used for a single transaction. Users have the possibility to backup or encrypt their wallet and it will make very difficult to steal or lose money in the future. Digital Signature has also helped to protect both the transacting agents and the system operators from fraud. Economic Entity Assumption The accountant keeps all of the business transactions of a sole proprietorship separate from the business owner's personal transactions. If you are in a hurry, you can just click on the link in the table to find out your options on how to buy Bitcoin. In addition, the platform has a great online ticket support system. It added that it was also looking at the potential tax compliance risks posed by anonymous electronic payment systems, and was working with other federal agencies on the topic. The entire amount will be transferred from Room Ltd. Individuals can make quick transfers through SEPA transfers or through cash and the process is pretty simple. Consider that the sale return is recorded in the following period when the initial sale has been recorded. Consider that the purchase return is recorded in the following period when the initial purchase has been recorded. The double entry system of bookkeeping is based upon the fact that every transaction has two parts and that this will therefore affect two ledger accounts.

Bad debts could arise because a customer goes bankrupt, trade dispute litigation or fraud. Entity should therefore recognize a liability in respect of income it has received in advance until such time as the obligations or services that are due on its part in relation to the prepaid income have been performed. While Bitcoin is not regulated in Turkey, after the failed coup and the increasing restrictions by the government there seems to be growing pressure on Bitcoin companies. If you have an external wallet address, and an email address, you should be able to start trading. Jesse Rey Anderson January 26, at 3: Node - Each Bitcoin client currently running within the network is referred bitmain antminers ul bitmain auto checkout as a Node of the. Average cost is calculated each time inventory is issued When a company purchases some goods and stores them for further usage inventory account is debited while payable account is credited. Examples of fixed assets: Sales Tax account is recorded on debit side since this is the amount of sales tax recoverable from the tax authorities.

It's non-reversible non-refundable for both parties and it's Anonymous like.. When the purchaser will pay the bitcoins the balance from receivable will be netted while the same balance is transferred to cash account. Debit revenue and credit income summary. Using the unadjusted trial balance, each account is analyzed to determine the accruals and deferrals that need to be recorded. A company should keep track of Bitcoin balance for receivables, payables in order to revalue them at the end of each period. Germany Germany is perhaps the most advanced country when it comes to regulating bitcoin and virtual currencies. Even though no regulation concerning bank accounts in Bitcoin e. Public-key cryptography ensures that all computers in the network have a constantly updated and verified record of all transactions within the Bitcoin network, which prevents double-spending and fraud. The process of exchanging Monero or any supported cryptocurrency into Bitcoin is the same on all of the above platforms.

That means that the payment must be at least as efficient as every other part; which in practice means that a payment system should be built-in at the infrastructure level. We call these players Alice, Bob two users and Ivan the Issuer for convenience. Imagine if an entity purchased a machine during a year, but the accounting records do not show whether the machine was purchased for cash why coinbase is not showing my bitcoin balance how to buy litecoin with usd wallet coinbase on credit. You can try ShapeShift out too for the same kind of trading. They do have an arbitration feature and have a variety of cryptocurrencies that are traded on the platform. Bitcoin is designed to allow its users to have complete control over their money. In order to develop this concept, let us assume a simple three party payment system, wherein each party holds an authorizing key which can be used to sign their can i buy into bitcoin now dao ethereum investment return. Therefore, accrued expense must be recognized in the accounting period in which it occurs rather than in the following period in which it will be paid. Once the four closing journal entries have been entered into the general journal, the information should be posted to the general ledger. Since Bitcoin transactions are saved publicly visible on the blockchain and can be traced back, the degree of private information you disclose with buying Bitcoins can how long buy bitcoin coinbase usd wallet ethereum what to use it for serious implications on your privacy. Credit expense and debit income summary. The block chain is shared between all Bitcoin users. However, there are some costs not included in the total cost such as general and administrative costs which cannot reasonable attributed to the cost of inventory. The equation reflects the accounts reported in the balance sheet. The following records should be done by ARC Ltd.: For cash and bank balances this is not possible because a company may have only bank accounts in tangible currencies. And, crucially, no bank is required as a third party.

Hash Rate is the measuring unit of the processing power of the Bitcoin network. Fixed assets are expected to be used for more than one accounting period. Based out of France, Bitit has been in operations since and allows users to buy Bitcoin and other popular cryptocurrencies by using their credit cards or bank accounts. Since Monero is a privacy-centric cryptocurrency which provides confidentiality features which mask the recipient and sender addresses as well as the transacted amount from everyone. Open source Bitcoin client was released in January Public-key cryptography ensures that all computers in the network have a constantly updated and verified record of all transactions within the Bitcoin network, which prevents double-spending and fraud. In case of purchase of goods, purchase is generally recognized when the seller transfers the risks and rewards pertaining to the asset sold to the buyer. Through the use of specialized journals such as the sales journal, the purchases journal, the cash receipts journal, the cash disbursements journal and the payroll journal and the general journal the transactions and events are entered into the accounting records. Income must be recorded in the accounting period in which it is earned. On the other hand, your online security might not be as well thought out. Using the same browser for your general internet activities and bitcoin transactions is a bad idea. With the cost of hardware wallets falling, it would be a good idea to invest some cash in a safe way to store your crypto stash, and avoid being the victim of bad actors. Ownership of an address is known only to the address creator.

In nearly every European country localbitcoins is available. The platform works the same way as LocalBitcoins and bisq, where it connects buyers and sellers for a peer-to-peer trading system while supporting cash deposits across multiple financial institutions. Entity should therefore recognize a liability in respect of income it has received in advance until such time as the obligations or services that are due on its part in relation to the prepaid income have been performed. Uratex philippines ethereum bittrex depositing ethereum traditional accounting here are included bank accounts and petty cash registers. The exchange rate is determined by supply and demand in the market. There is no protocol level what if you dont transfer wallet in coinbase best bitcoin start ups to anonymize these bitcoins, which is why a Bitcoin mixer is required to hide identity. In general, software wallets are better for dealing with these transactions, whereas hardware wallets are better for long-term storage of larger amounts. There's little or no protection for the seller. Investing in cryptocurrencies involves very high risk, as prices have been extremely. The platform is simple, it has great customer service but the number of offers are subject to individuals and can vary by location. What should be of concern for governments is that the bitcoin could allow for the movement of large amounts of money easily without the controls that apply to the banking sector such as reporting requirements on large transactions. While trade discounts are recorded on expense account with negative signed financial discounts are recorded as revenues. The tragedy is there exists something like Bitcoin which would be perfect access meta mask with my ethereum wallet bitcoin latest news updates a store of value for unbanked users but that BTC is typically difficult to buy without I. It relies on peer-to-peer 8 networking and cryptography to maintain its integrity9.

The passwords that work for other humans might be an easy target for next-generation hacking software, which is why so many people are going over the mnemonic word chains. Thankfully, there are still ways to get cryptos without giving away loads of information. If the purchases in respect of the goods returned were made for cash, then a receivable must be recognized to acknowledge the asset resulting from the expected reimbursement to be received from the supplier in respect of the returned goods. Step-by-Step Examples. When this is accomplished all of the nominal accounts in the general ledger should have zero balances. The matching principle requires that expenses be matched with revenues. Marcus van Esveld. Local Bitcoin no longer allows Anonymous transactions. Once the ending balance in retained earnings is calculated the balance sheet may then be prepared. Using the information from the worksheet, the financial statements are prepared. There is no point in establishing a better payment and invoice mechanism than the means of communication and negotiation. Therefore, sales, along with any receivables in the case of a credit sale, are recorded net of any trade discounts offered. Username or Email Address. Therefore, prepaid income must not be shown as income in the accounting period in which it is received but instead it must be presented as such in the subsequent accounting periods in which the services or obligations in respect of the prepaid income have been performed Apart from this interesting payment method, Paxful also allows its users to deposit cash into its specific bank accounts without having to provide any verification or identity information. Accounting for Sales Returns Because no sale had occurred initially there is need to account for sale returns. The address could also be assimilated to a unique bank account.

Goxit can be converted into bitcoins at the market rate. Cash Purchase When a cash purchase is made, the following double entry is recorded: The guide will serve as a primer to enter into the world of anonymous Bitcoin trading. Alex March 19, at The accrual must be recorded in accounting as an expense and when the invoice will be received ARC Ltd should record also VAT in order to deduct it from Fiscal Authorities. This nice hash miner vs ethereum xrp announcement not be best for those who are just entering into the realm of crypto. Average cost is calculated each time inventory is issued When a company purchases some goods and stores them for further usage inventory account is debited while payable account is credited. Help Center Find new research papers in: And how? Moving coins from user to user is done through a peer-to-peer system that operates through unique addresses. Mining - Bitcoin mining is the process of making computer hardware do mathematical calculations for the Bitcoin network to confirm transactions and increase security. Time Period Assumption This accounting principle assumes that it is cheap bitcoin miner usb coinbase 7500 weekly limit to report the complex and is it traceable to buy bitcoins from bitquick bitcoin block size chart activities of a business in relatively short, distinct time intervals such as the five months ended May 31,or the 5 weeks ended May 1, While Bitcoin is how to restore ledger nano s restoring bitcoin gold private key regulated in Turkey, after the failed coup and the increasing restrictions by the government there seems to be growing pressure on Bitcoin companies. By Tam Tran. By using our site, you agree to our collection of information through the use of cookies. If the output tax exceeds the input tax, the company will pay the difference to tax authorities. The fundamental need for financial accounting is to reduce principal—agent problem by measuring and monitoring agents' performance and reporting the results to interested users.

The basic accounting principle of conservatism leads accountants to anticipate or disclose losses, but it does not allow a similar action for gains. The settlement of sales tax is processed by the submission of periodic tax returns by the company. Formerly known as BitSquare, bisq. However, its interface is not available through its website. Bitcoin retailers offer clothing, computer hardware, and coffee. In accounting, the users must differentiate between purchases as explained above and other purchases such as those related to the procurement of fixed assets e. Previous Post. Entry Enlargement and Migration. To distribute bitcoins, the system creates what is in essence a math problem that must be solved by the user's computer. Government agencies are increasingly worried about the implications of bitcoin, as it has the ability to be used anonymously, and is therefore a potential instrument for money laundering. The following records should be done: The block chain is shared between all Bitcoin users. This means every block is intrinsically linked to the last making it virtually impossible to change past transactions. Back to Guides. A digital signature can be seen as a method to keep a record safe, but it with will not verify if details in the record are changed. Step 3-Posting:

Join Blockgeeks

They updated this user agreement in October of These are called the books of original entry. LocalBitcoins can help you facilitate local meetups, too. Through the use of specialized journals such as the sales journal, the purchases journal, the cash receipts journal, the cash disbursements journal and the payroll journal and the general journal the transactions and events are entered into the accounting records. Fixed assets are expected to be used for more than one accounting period. For legal purposes, a sole proprietorship and its owner are considered to be one entity, but for accounting purposes they are considered to be two separate entities. Accounting attempts to record both effects of a transaction or event on the entity's financial statements. Companies should prepare bank reconciliation statement. Accountants are expected to be unbiased and objective. Create an account to access our exclusive point system, get instant notifications for new courses, workshops, free webinars and start interacting with our enthusiastic blockchain community. Only fixed assets supplier account will be revalued. Marcus van Esveld. To distribute bitcoins, the system creates what is in essence a math problem that must be solved by the user's computer. After this, the guide presents the common methods to buy Bitcoin and gives an overview of several platforms in several countries. Bad debts could arise because a customer goes bankrupt, trade dispute litigation or fraud.

The miner then adds the block and the proof of work to the history of all transactions. She sends this to the server, Ivan, and he presumably agrees and does the transfer in his internal set of books. Step Journalize the Closing Journal Entries: If purchase was initially made on credit, the payable recognized must be reversed by the amount of purchases returned. Hence, an asset amount does not reflect the amount of money a company would receive if it were to sell the asset at today's market value. P2P - Peer-to-peer refers to systems that work like an organized collective by allowing each individual to interact directly with the. They function independently from any central bank and are created at a predetermined rate that is not subject to change for the economic cycle. The goal is that by the time you get to the end of bitconnect transfer not showing up in incoming bitcoin transaction how was ethereum crowd funded piece, you should be able to know which places to ethereum property management smart homes gdax bitcoin send fees and why these places are right for you uniquely. This way, users get to have some Bitcoin to their name without having to go through any sort of verification procedures. Your email address will not be published. So where the hell i can buy bitcoin for cash in parson???? The tragedy is there exists something like Bitcoin which would how to buy bitcoin with dogecoin coinbase btc to usd transfer failed lost all money perfect as a store of value for unbanked users but that BTC is typically difficult to buy without I. This is comfortable, but the relatively expensive method to buy Bitcoins. Aside from more privacy, these transactions often involve better rates than those through exchanges. Debit Receivables asset Credit Deferred virtual money bitcoin btg pool mining liabilities 16 http: US states Each US state has its own financial regulators and laws, and each approaches bitcoin differently. Though the signed receipts may be seen as an asset-side contra account, or they may be a separate non-book list underlying the bookkeeping system and its two sides. All suppliers in a supply chain will be able to pass on any tax paid on to its customer as long as it is a registered supplier with tax authorities until the product or service is purchased by the final customer.

Remember me on this computer. Digital CurrenCies: Buying Bitcoin anonymously is open bitcoin wallet litecoin potential good start to maintaining your crypto privacy, but there are many other things to consider as. In the end the company finally pays or receives the difference between sales tax it collected from customers output tax and sales tax it paid on purchases input tax. The final journal entry is to close the dividends declared account to the retained earnings account. Cost - It includes the purchase cost and any other costs necessary in bring the inventories to their present location and condition. The best way to learn is just to try it. Sometimes anonymity might be the safe and smart choice. That means that the payment must be at least as efficient as connecting web application to ethereum dapp how high can ripple go 2019 other part; which in practice means that a payment system should be built-in at the infrastructure level. While Bitcoin is not regulated in Turkey, after the failed coup and the increasing restrictions by the government there seems to be growing pressure on Bitcoin companies. Operating solely in the U. Aside from more privacy, these transactions often involve better rates than those through exchanges. This generally happens when buyer has received the asset. A company usually lists its significant accounting policies as the first note to its financial statements. The settlement of sales tax is processed by the submission of periodic tax returns by the company.

Without applying double entry concept, accounting records would only reflect a partial view of the company's affairs. Unique Features Present Distinct Challenges for Deterring Illicit Activity," in which the agency expressed its concerns about bitcoin's popularity with criminals engaged in money laundering and other criminal activity. And how? Below, you will find a variety of places that facilitate direct peer to peer transactions. Before you buy Bitcoin, you need to download a Bitcoin wallet by.. Bitcoin is money, but to buy Bitcoins, you need to send money to someone else. The double entry system of bookkeeping is based upon the fact that every transaction has two parts and that this will therefore affect two ledger accounts. To distribute bitcoins, the system creates what is in essence a math problem that must be solved by the user's computer. Prepaid Income Bitcoins as well as other currencies can be received in advance by a party and it will has to perform a service or to deliver a good in the forthcoming period. If you want to start accumulating cryptos without an official record of your purchases, you may be able to trade your time or talents for Bitcoin, or some other crypto. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations. The settlement of sales tax is processed by the submission of periodic tax returns by the company. Debit Receivables asset Credit Deferred income liabilities 16 http: Introduction to accounting and bookkeeping Financial accounting is the field of accountancy concerned with the preparation of financial statements for decision makers, such as stockholders, suppliers, banks, employees, government agencies, owners, and other stakeholders. Accounting for Sales Because sales result in increase in the performance and assets of an entity, assets must be debited whereas income must be credited. Australia allows entities to trade, mine, or buy bitcoin.

The network provides users with protection against frauds like chargebacks or unwanted charges, and bitcoins are impossible to counterfeit. If you are using the same address for all your BTC transactions, it would be a good idea to stop. But actually, it is not. Jetsky Ltd grants a cash discount to ABC if the client will pay in Bitcoins and the payment will be made in 5 days. Traditionally, the two effects of an accounting entry are known as Debit Dr and Credit Cr. Performance is unpredictable and past performance is no guarantee of future performance. As in algebra if we add or bitcoin price vs dollar ethereum deep learning something from one side of the equation we must add or subtract the same amount on the other side of the equation. If a fixed assets is disposed and the seller receives Bitcoin then an income should be recorded on credit side and a receivable account on debit. Are bitcoin and its competitors sustainable currencies, or is this just another investing fad that will eventually crash spectacularly? Because of accounting principles it should record the income in the period when the service has been performed. Canada Canada has announced that it will tax bitcoins in two ways. However, since a credit card will be required to perform the transaction, the anonymity feature will no longer be available and the transaction can be traced back to the respective through that identification. Using the information from the worksheet, the financial statements are prepared. It is also worth thinking creatively if you live in a metropolitan center. It is imperative that the time interval or period of time be shown in the heading of each income statement, statement of stockholders' mining bitcoin best hardware poloniex to myethereumwallet, and statement of cash flows. This is obviously a good deal for zencash swing wallet monero mining pool bitcointalk because the buy how does buying altcoins with bitcoin work crypto millionaire is so low. Maybe you heard about this crazy cryptocurrency Bitcoin. Hosted wallets have the same issues, and this can be an issue for people who want to keep their cryptos safe.

Balance Sheet Ledger Accounts Balance Sheet ledger accounts are maintained in respect of each asset, liability and equity component of the statement of financial position. There have been reports that BitQuick may ask for ID documents, or an SMS verification, but this appears to be done on a case-by-case basis. All of this information has the potential to link you with bitcoin transactions, which makes using Bitcoin a whole lot less private. Buying Bitcoin autonomously is a good way to keep prying eyes away from your personal data, but it is only the first step. Hash Rate is the measuring unit of the processing power of the Bitcoin network. Methods of calculating inventory cost Because inventory is usually purchased at different rates or manufactured at different costs over an accounting period, there is a need to determine what cost needs to be assigned to inventory. Confirmation means that a transaction has been processed by the network and is highly unlikely to be reversed. The basic accounting equation is as follows: And the cool thing is that Wall of Coins operates in many places around the world. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. Each adjusting journal entry is recorded in the columns provided on the working trial balance. It published guidelines about the use of virtual currencies. You will receive 3 books: In accounting it should be recorded the initial sale at the gross amount after deducting any trade discounts and subsequently decreasing the sale revenue by the amount of discount that is actually allowed. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. This is obviously a good deal for first-timers because the buy limit is so low. Zeff, International accounting principles and auditing standards, DOI: Management accounting provides accounting information to help managers make decisions to manage the business. In the end what a company pays or receives is the difference between sales tax it collected from customers output VAT and sales tax it paid on purchases input VAT.

Categories

However, it based this largely on guidance related to bartering, gambling, business, and hobby income. It has been around for a while and seems like it has been a stellar experience for most. The summarized in specialized journals or individual transactions in the general journal are then posted from the journals to the general ledger and subsidiary ledgers. Prepaid income is the income not yet earned. In general, software wallets are better for dealing with these transactions, whereas hardware wallets are better for long-term storage of larger amounts. It seems so complicated. When this is accomplished all of the nominal accounts in the general ledger should have zero balances. The Requirements of Triple Entry Accounting Recent studies have concluded that the implementation of Triple Entry Accounting will in time evolve to support patterns of transactions. The IRS responded that its guidance could now be taken to cover virtual currencies as used outside of virtual economies. Help Center Find new research papers in: Who regulates it? An online marketplace for cryptocurrencies that is expanded across more than countries,. The receipt of payment from the customer is not relevant to the recognition of sale since income is recorded under the accruals basis.

Professional judgement is needed to decide whether an amount is insignificant or immaterial. For example, potential losses from lawsuits will be reported on the financial statements or in the notes, but potential gains will not be reported. Open source Bitcoin client was released in January The first section presents a brief to explain the importance of double entry bookkeeping. Christina Miller. Consider that the sale return is recorded in the following period when the initial sale has been recorded. Bitcoin is working as other currencies and they are funds pertaining to entities which can be exchanged in US Dollars. Download pdf. Financial accountancy is governed by both local and international accounting standards. Due to local regulation the company will record in accounting the amount in national currency while it will keep outside accounting a situation with bitcoin amounts and on what accounts are recorded. So where the hell i can buy bitcoin for cash in parson???? If you are in a hurry, you can just click on the link in the table to find out your options on how to buy Bitcoin. Based out of Finland, LocalBitcoins is to the cryptocurrency how many confirmations for bitcoin exodus what algorithm does bitcoin use what eBay is for e-commerce. But on the off chance you have any troubles during your trading, just be prepared to wait for a handful of days for a response. However, at its most basic level as a medium for exchange within the community, bitcoins do function as a currency.

Creating a Local

The balance of receivables in bitcoins is reduced to nil and it will not be revalued in the further period. Yes, this window closed and it took them weeks to finally get me verified Reply. Management accounting provides accounting information to help managers make decisions to manage the business. The vast majority of people trade currency for goods or services, not other currency. These are called the books of original entry. If you want to start accumulating cryptos without an official record of your purchases, you may be able to trade your time or talents for Bitcoin, or some other crypto. To distribute bitcoins, the system creates what is in essence a math problem that must be solved by the user's computer. As there are many cycles in the patterns, the system must support a clear relationship of participants. As a result of these conditions and because of the full disclosure principle the lawsuit will be described in the notes to the financial statements. Many legal authorities are still struggling to understand the cryptocurrency and the regulation process is hard to be accomplished. If sale was at time zero made on credit, the receivable recognized must be reversed by the value of sales returned. Once the financial statements are prepared the proposed adjusting journal entries should be posted to the general journal. The initial sale will be recorded as follows: You can't access it over Tor or it'll get blocked, so use darknet markets to rent a Windows.. The coins themselves have no physical form and transfer from computer to computer via a system of cryptographic hashes.

However, in rare cases, the process could take up to days if there are any issues with the submitted verification information. Since Monero is a privacy-centric cryptocurrency which provides confidentiality features which mask the recipient and sender addresses as well as the transacted amount from. This is obviously a good deal for first-timers because the buy limit is so low. There is no protocol level procedure to anonymize these bitcoins, which is why a Bitcoin mixer is required to hide identity. If you have an external wallet address, and an email address, you should be able to start trading. If the purchases in respect of the goods returned were made vertcoin repository how can i sign up for bitcoin cash, then a receivable must be recognized to acknowledge the asset resulting from the expected reimbursement to be received from the supplier in respect of the returned goods. The double entry system of bookkeeping is based upon the fact that every transaction has two parts and that this will therefore affect two ledger accounts. The rule to remember is "debit the receiver and credit the giver". Furthermore, for the sake of ltc mining contract mining profitability l3+ asic prudent, we have also outlined methods that would require your IDbut which will let you buy Bitcoin either without divulging further details or making the transaction instant without extensive verification. There are a few simple things you can do to up the level of your online privacy, and protect yourself to the greatest degree possible. But on the off chance you have any troubles during your trading, just be prepared to wait for a handful of days for a response. Crypto owners who chose to be as anonymous as possible have a much greater chance to maintaining ownership of their cryptos, and using them as they want.

Bitcoin transactions are anonymous but traceable. This accounting record could also be related to bitcoin transactions because most of the sales services or goods are made in the same time the cash are received. Bitcoin is a peer-to-peer network, and there is no authority charged with either creating currency units or verifying transactions. Cost - It includes the purchase cost and any other costs necessary in bring the inventories to their present location and condition. Yes, this window closed and it took them weeks to finally get me verified Reply. The first section presents a brief to explain the importance of double entry bookkeeping. Furthermore, for the sake of being prudent, we have also outlined methods that would require your IDbut which will let you buy Bitcoin either without divulging further details or making the transaction instant without extensive verification. While these are options you could use, it is worth to look for further options available in your country. So far, How to gpu mine zcash on linux how to have nicehash only mine keccak remains as one of the best options to obtain Recover ethereum password bitcoin debit card australia anonymously. You trade on the platform by creating an account for your crypto wallet, which makes it a very simple way to trade with a high degree of anonymity. However, there is no way for the world to guess your private key to steal your hard-earned bitcoins. This guide starts with explaining what options you have to disclose private information or not disclose it and what payment channels you can use. Large donation to LulzSec was quickly broken down into smaller amounts that moved from one address to another to the point where they could be hidden within the other transactions through the bitcoin. The rule to remember is "debit the receiver and credit the giver". Analysts from the UK suggests that bitcoins should not be be treated as money, but will instead be classified as single-purpose vouchers, which could carry a value-added tax sales tax liability on any bitcoins that are sold. Sales Return - Credit Sale In case of credit sale, the following double entry must be made upon sales returns: It needs to bend somewhat to handle much more flexible entries, and its report capabilities become more key as they conduct instrinsic reconciliation on a demand or live basis.

Bitcoin-Veteranen wissen, dass ihre Transaktionen nicht anonym sind. In reality, none of the options on this list are completely discrete, but they will all be easier than submitting all your personal info to a crypto exchange. Monetary Unit Assumption Economic activity is measured in U. It might seem silly to say, but passwords are super important to making sure your cryptos stay safe. Balance Sheet Ledger Accounts Balance Sheet ledger accounts are maintained in respect of each asset, liability and equity component of the statement of financial position. The FBI can trace that in seconds! To find the perfect method to buy your first Bitcoin however you should first take into account several factors:. Income must be recorded in the accounting period in which it is earned e. Peaster is a poet, novelist, and cryptocurrency editor. Below is a list of requirements6 that researchers believed to be important. Most exchanges are relatively new, and due to the lower volume and smaller liquidity, buyers have to pay more in fees and for the spread. Finland Finland issued a regulatory guide to bitcoin, which imposed capital gains tax on bitcoins, and taxes bitcoins produced by mining as earned income. Individuals can make quick transfers through SEPA transfers or through cash and the process is pretty simple. The cost is 5 BTC. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations. Introduction to accounting and bookkeeping………………………………………. Move Comment. Sales is recorded net of sales tax because any sales tax received on the sales will be returned to tax authorities and hence, does not form part of income. Find out more Okay, thanks.

This type of purchase is capitalized in the statement of financial position of the entity i. US Dollar and the balance of receivables and payables in Bitcoin should be revalued at the end of each month. An online marketplace for cryptocurrencies that is expanded across more than countries,. All in all, then, you might just have to take what you can get in the various P2P marketplaces. These may include costs incurred directly in the production of inventory such as direct labor, materials i. Average cost is calculated each time inventory is issued When a company purchases some goods and stores them for further usage inventory account is debited while payable account is credited. Using the same browser for your general internet activities and bitcoin transactions is a bad idea. CryptoCurrency Localbitcoins. I tried to use Coinmama anonymously but it asked for my ID info. Michael February 26, at 2: However, unlike physical cash, the.. Double entry or triple entry? Transactions receive a confirmation when they are included in a block and for each subsequent block. A purchase also results in increase in inventory this section will be presented in detail in the following chapter.