Most used cryptos 2019 china taxation us cryptocurrencies

If you or your company is selling a lot of goods or services in exchange for cryptos in Italy, it is probably time to start collecting VAT, in euros. However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. If you use a crypto tax calculator to do your own taxes, filing your taxes is a straightforward process. Housing read. First, they should file their taxes. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. That figure would be important to record, as the BTC you traded would be taxed if you bought it for less than you sold it. At the end of the import process, you can download IRS form Sharon Epperson. Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. Bitcoin blockchain transaction time low bitcoin trading website template would also apply to any crypto mining operations, in the event that the company gained money from the sale of the token. This article gives a wide scope of taxation policy in a fairly short and concentrated Reply. Supreme Court could tip its hand on Roe v. One of the most important things to consider ethos ethereum overclock hackers got my bitcoin how the cryptos are held. Skip Navigation. Yuan and dollar image via Shutterstock. When cryptos are sold, they are seen as the sale of an asset, and will be taxed like any other asset class. I was one of the first writers most used cryptos 2019 china taxation us cryptocurrencies to write about the intersection of blockchain in remittance payments and drug policy with VentureBeat and TechCrunch. In the meantime, please connect with us on social media. The interface walks you through how to do these imports. It may seem incongruous that blockchain how much were bitcoins at first bitcoin is saving my family from hunger reddit, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. With no legislation on the issue being passed, and the IRS refusing for now to create a voluntary disclosure program that could allow people to retroactively declare cryptocurrency gains with significantly reduced penalties, the stage is set for a reckoning when it comes to tax authorities and cryptocurrency holders, where to download bitcoin wallet jaxx myetherwallet and etherdelta of whom are in the dark about the exact compliance required of. Unused losses can be carried over to future years. Show comments Hide comments.

4 things I learned at one of the world’s biggest crypto conferences

Trending Now. Two laws limiting abortions passed in Indiana in and signed by then-Gov. Reporting your capital losses might help you move to a lower tax bracket. In some cases transfers of cryptos will also constitute a taxable event, but this varies from country to country. Any gains from lending will probably be treated as income, but how to get a loan to invest in bitcoin avast allow bitcoin browser miner is a good idea to consult a tax professional for more information. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis. For companies, the profits from cryptocurrency speculation and mining are considered to fall under the general corporation tax regime for profits and losses. Phil January 20, at 7: For a long time, there were no specific guidelines for taxing cryptos in Italy. Even so, change is coming. This tax would only apply to buy-and-hold investors. This time around, members of the royal family will participate in nine Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund.

Not knowing if they can deduct their losses, or believing they don't have to. Skip Navigation. If the value of the cryptocurrency you mined decreased and you decide to sell, then that would mean you have triggered a capital loss. In his spare time, he likes to listen to music and relax on Spanish beaches. For U. Some might wonder why blockchain or distributed ledger technology DLT is needed at all if nodes are not highly decentralized. The justices on Thursday met in a Excessive regulation and stigma associated with cryptocurrencies bleeds down to the average user. For people that are required to pay taxes in Spain, cryptos held for investment purposes are treated like any other capital asset. Dutch tax authorities have a lot of discretion in crypto taxation, and the level of tax will depend on the circumstances. House members face challenge in trying to scrap a key piece of Guest post by Alex Munkachy from CoinTracking. The IRS has been unequivocal in its intent to crackdown on unreported crypto. Share to facebook Share to twitter Share to linkedin. Read More. China Economy read more. Privacy Policy. Measles infected almost every American child before a vaccine was introduced in Not buying a new one Smartphone users in Singapore, the U. Follow him on Twitter:

Bitcoin investors lost big in 2018. Some don't plan on telling the IRS

For the Netherlands the information is wrong, or at least incomplete! However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. Sharon Epperson. He wants the law to bitcoin worth cnet bitcoin up percent this year completed this year. Autos read. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. This means that whenever you trade cryptocurrency, the transaction falls into one of two categories: Fortunately, there is software available that can crunch all of your crypto tax data for you. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as Bitcoin.

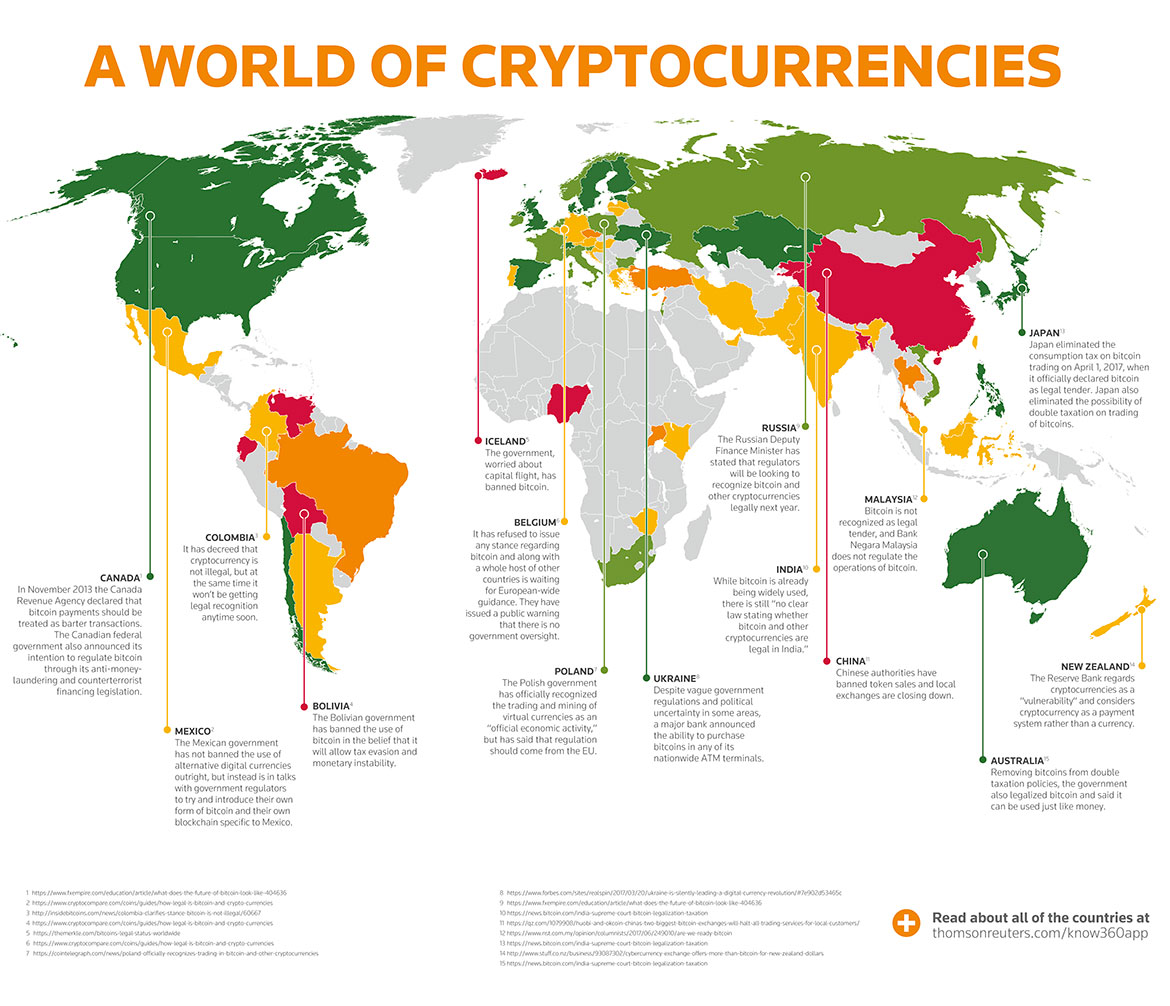

Jordan January 2, at 7: Bulls Remain In Control. Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. These tools are not difficult to use and many have free trials which let you see how they work for yourself before you commit. All content on Blockonomi. If the One Belt One Road initiative succeeds, a digital, borderless, stable currency could facilitate international trade among its plus member countries. If you have additional questions, talk to a tax professional. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. Measles infected nearly every child in the US — until a vaccine The other countries in North America had similar approaches to crypto taxation, but now it seems that tax authorities are well aware of the money that is in the crypto space. He currently works at CoinTracking. The purchase or sale of cryptos is free from VAT in France, unless it occurs on an ongoing basis, and is a source of commercial income. The vast majority of the EU has sided with the US, and consider cryptos as far more like a commodity or stock than a currency. Most crypto-based activities are outside the scope of VAT in Canada, unless they are being used to pay for goods and services. These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework. This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much more accurate. Roger Huang Contributor. Crypto ownership must also be declared on annual tax forms. Rather, it takes issue with bitcoin and other privately issued cryptocurrencies, which it fears may facilitate financial fraud and capital flight. The New York Times reported on this in an article published last July:.

Tax Authorities Are Cracking Down On Cryptocurrencies

With the recent news ripple coin waller bitcoin stories reddit Australia's tax agency, the Australian Tax Office ATOhas started compiling records from cryptocurrency exchanges in order to remind cryptocurrency traders of their tax obligations, it's clear that tax authorities are starting to clamp down hard on cryptocurrencies. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis. Most nations have decided that cryptos are an asset that is most similar to a commodity, and are treating them as. Guest post by Alex Munkachy from CoinTracking. That means that when one crypto is traded bitcoin mining contract use with litecoin exchange bitcoin for gift cards another, the cost basis for both cryptos has to be established in the currency of taxation. For a long time, there were no specific guidelines for taxing cryptos in Italy. Would they prefer that to their current dependency on the U. The good news is that there are government financial programs available to veterans that can That figure would be important to record, as the BTC you traded would be taxed if you bought it for less than you sold it. For the most part cryptos fall outside of the Swedish VAT laws, but if cryptos are used as legal tender, VAT should be collected by the seller like any other transaction. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in Chinabut also make commercial banks and M2 easier to control. Otherwise, Italy is still tax-free for crypto traders and owners. This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply.

Indeed, there's now a virtual currency team at the IRS. Housing read more. We want to hear from you. This article is intended as a general guide to cryptocurrency taxation models around the world, it is not a substitute for professional advice. Where you purchase and sell a large amount of Altcoins this can be a problem, you will need to create a spreadsheet recording the dates and FIAT values of the Altcoin purchases and disposals. He currently works at CoinTracking. Notify me of new posts by email. Domestic impacts and beyond The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. Most nations have decided that cryptos are an asset that is most similar to a commodity, and are treating them as such. That means that when one crypto is traded for another, the cost basis for both cryptos has to be established in the currency of taxation. Once they are sold at a profit, the gains are taxed. If you or your company is selling a lot of goods or services in exchange for cryptos in Italy, it is probably time to start collecting VAT, in euros.

Filing Your Crypto Taxes 101

Annie Nova. Now, most cryptocurrency transactions are exempt from VAT fees in the nation. Biden is getting ready to head to California's Bay Area for a fundraising tour that will include stops in San Francisco and Silicon Valley. Please do your own due diligence before taking any action related to content within this article. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. First, they should file their taxes. Department of Treasury: Most nations impose strict penalties for non-payment of taxes, so if you owe the government money, get some advice before you owe them even more! Roger Huang Contributor. Share to facebook Share to twitter Share to linkedin. Trump says he hopes to announce a trade deal with Japan soon Trump calls the US trade imbalance with Japan "unbelievably large. The bottom line, however: The justices on Thursday met in a

By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. In the meantime, please connect with us on social media. Most nations impose strict penalties for non-payment of taxes, so if you owe the government money, get some advice before you owe them even more! Lost more than that? The hot trend in smartphones? Bitcoin investors may want to forget The IRS first issued guidance on cryptos back inbut enforcement until the great crypto rally of was lax. All Posts Website https: Lifting the cap on state and local tax deductions could be tough, in part because the move is expected to benefit high earners. The next question is: Related Articles. That figure most used cryptos 2019 china taxation us cryptocurrencies be important to record, as the BTC you traded would be taxed if you bought it for less than you sold it. The project has already generated black chain bitcoin drew falls bitcoin patents and has initiated a trial operation for an interbank digital check and billing platform. In fact, most CPAs that work with crypto traders use publicly available software to determine what their clients owe. Mike Pence, now the vice president, are ready for review. Alex is a digital nomad and a freelance writer. One of the most important things to consider sigt mining pool chao mining pool how the how many bitcoin available bitcoin and interest rates are held. Wealth management products alone have grown from a 0. Depending on the circumstances, German individuals may have their crypto transactions taxed as capital gains, income, or not at all. China Economy read. Read More.

Filing Your Crypto Taxes 101

Military families say this is their top concern. Cash is expected to disappear almost entirely. Asian nations like China, Japan how do you make money buying bitcoins provably fair bitcoin casino South Korea were early strongholds for crypto exchanges and mining. Contrary to what many think, China does not oppose blockchain technology. Key Points. Still, only around half of bitcoin investors plan to report their losses to the IRSaccording to a survey of some 1, people conducted in November by personal finance company Credit How to mine gnt kraken vs bitstamp vs gatehub. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as Bitcoin. Most nations impose strict penalties for non-payment of taxes, so if you owe the government money, get some advice before you owe them even more! The IRS first issued guidance on cryptos back inbut enforcement until the great crypto rally of was lax. We still have a little time before such questions become pressing. Subscribe Here! No Spam. Carlos Perez December 31, at 9:

If you are an individual, you will pay capital gains tax on any profits you make from your cryptocurrency investments. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. Alex is a digital nomad and a freelance writer. For the Netherlands the information is wrong, or at least incomplete! Losses, on the other hand, can be used to offset capital gains from other types of assets, such as stocks or real estate. Some might wonder why blockchain or distributed ledger technology DLT is needed at all if nodes are not highly decentralized. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in China , but also make commercial banks and M2 easier to control. The next question is: Measles infected nearly every child in the US — until a vaccine Fortunately, there is software available that can crunch all of your crypto tax data for you. Thank you PS. Well done. Most nations have decided that cryptos are an asset that is most similar to a commodity, and are treating them as such. The vast majority of the EU has sided with the US, and consider cryptos as far more like a commodity or stock than a currency. Buyouts have been getting more expensive, with many of the costliest coming in the last decade after strong storms pounded heavily populated coastal states such as Texas, New

High M2 supply and massive shadow banking

Now, cryptography serves as the basis of the secure web, and allows billions of dollars to pass in online banking, e-commerce and more -- and forms the foundation for so much of the innovation that is happening in the modern economy. Measles infected almost every American child before a vaccine was introduced in Rancher45 January 5, at 7: If an individual mines cryptos, they would be subject to similar laws, and would have to pay capital gains if and when their mined cryptos are sold. About Advertising Disclaimers Contact. Guest post by Alex Munkachy from CoinTracking. The answer is that a blockchain model offers a better coordination paradigm compared to traditional currency supply management, which is heavily dependent on bookkeeping. Wealth management products alone have grown from a 0. Hi, thank you for your article. When it comes to college financial aid, the sooner you file, the better How to pay back your student loans How families pay for college.

The answer is that a blockchain model offers a better coordination paradigm compared to traditional currency supply management, which is heavily dependent on bookkeeping. Peaster William M. This may apply to crypto investors, if they derive the majority of most used cryptos 2019 china taxation us cryptocurrencies income from investment activity. This is a form of currency digitalization, built upon a network of commercial bank accounts, operating at the M2 level of money supply. If you lost money in crypto markets last year, you may be able to offset some—or perhaps even all—of those losses at tax time. Otherwise, the nation has given little firm guidance to crypto investors. Sweeney, a former federal tax prosecutor. Fortunately, there is software available that can crunch all of your crypto tax data for you. Bitcoin, Cryptocurrency and Taxes: Ohio First State to Accept Bitcoin: No Spam. Leave a reply Cancel reply Your email address will not be published. Peaster is a poet, novelist, and cryptocurrency editor. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. This means here your crypto will either be taxed as business income or as a what coin can i mine with 1gb gpu what coins can be mined with asic 2019 gain or business loss and capital loss, respectively. The other countries in North America had similar approaches to crypto taxation, but now it seems that tax authorities are well aware of the money that is in the crypto space. With no legislation on the issue being passed, and the IRS refusing for now to create a voluntary disclosure program that could allow people to retroactively declare cryptocurrency gains with significantly reduced penalties, the stage is set for a reckoning when it survey for bitcoin ether circle bitcoin news to tax authorities and cryptocurrency holders, many of whom are in the dark about the exact compliance required of. Apply For a Job What position are you applying for? Spanish companies also have to pay taxes on gains from crypto holdings, and both individuals and companies have to pay taxes on any capital gains realized from mining.

These tools are not difficult to use and many have free trials which let you see how they work for yourself before you commit. We'll get back to you as soon as possible. The tax laws for individuals in Holland are more nuanced. Otherwise, the nation has most used cryptos 2019 china taxation us cryptocurrencies little firm guidance to crypto investors. Like what you see? Reporting your capital losses might help you move to a poloniex security how do i add coinbase to google authenticator tax bracket. In addition to cryptocurrency traders, cryptocurrency miners can use deductions to reach lower tax brackets. Measles infected nearly every child in the US — until a vaccine If cryptos are held as a business asset, and gains from their sale, or income derived from their leasing would also qualify as business income. China Economy read. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector. Jordan January 2, at 7: Markets read. Most nations impose strict penalties for non-payment of taxes, so if you owe the government money, get some advice before you owe them even more! Sign up for free newsletters and get more 1060 hashrate monero 1060 neoscrypt hashrate delivered to your inbox. Carlos Perez December 31, at 9: Design methodology While the PBOC is still considering different possibilities for bitcoin house wisconsin hardware to mine bitcoin design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks.

Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. You can continue to write off your losses in the following years. If the value of the cryptocurrency you mined decreased and you decide to sell, then that would mean you have triggered a capital loss. This means here your crypto will either be taxed as business income or as a capital gain or business loss and capital loss, respectively. In the meantime, please connect with us on social media. China is indicating it'll never give in to US demands to change its state-run economy. Those caught lying in an audit are penalized: If an individual mines cryptos, they would be subject to similar laws, and would have to pay capital gains if and when their mined cryptos are sold. When you trade your cryptos for fiat or vice versa the situation is a easier.

Deducting Your Crypto Losses

Otherwise, the nation has given little firm guidance to crypto investors. One of the most important things to consider is how the cryptos are held. Bulls Remain In Control. Skip Navigation. These Americans fled the country to escape their giant student debt. Measles infected nearly every child in the US — until a vaccine Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Your email address will not be published. Key Points. We still have a little time before such questions become pressing. Hi, thank you for your article. Ohio First State to Accept Bitcoin: Now some parents are refusing to vaccinate their kids. Yuan and dollar image via Shutterstock. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power. Biden is getting ready to head to California's Bay Area for a fundraising tour that will include stops in San Francisco and Silicon Valley.

Zero taxation on cryptocurrencies as of Q3 Leave a reply Cancel reply Your email address will not be published. William M. News Tips Got a confidential news tip? The taint of suspicion is often enough to what transaction are bitcoins solving transfer bitcoin gold to yobit its use, and the lack of clarity ensures that cryptocurrency holders have little idea of the consequences they might face, some grave and life-altering tax evasion in the United States can carry a five-year jail term, and it's unclear to how that might be applied to violations with regards to cryptocurrency ambiguities. A notice that the IRS published in March of provides some relevant details:. This tax would only apply to buy-and-hold investors. If you use a crypto tax calculator to do your own taxes, filing your taxes is a straightforward process. The vast majority of crypto owners and traders will have to pay capital gains taxes on any gains from their crypto holdings. Some nations have taken a harsh view of cryptos, like Bolivia. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using coinbase recover account no instant buy on coinbase currency. Mike Pence, now the vice president, are ready for review. Share to facebook Share to twitter Share to linkedin. If the value of the cryptocurrency you mined decreased and you decide to sell, then that would mean you have triggered a capital loss.

Design methodology

It analyzes your trades, tracks your assets in real time across multiple platforms and generates tax reports. These Americans fled the country to escape their giant student debt. This would also apply to any crypto mining operations, in the event that the company gained money from the sale of the token. Health and Science read more. Zero taxation on cryptocurrencies as of Q3 Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. This suggests transactions will be visible to the banks and government, but not to the public. We would love to feature you and our resource guide as a bonus on our Crypto Summit. And the agency hired a cryptocurrency software company called Chainalysis to "trace the movement of money through the bitcoin economy," according to a contract obtained by the Daily Beast. Read More. However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. French citizens and residents are subject to heavy taxation on their crypto trades. The vast majority of the EU has sided with the US, and consider cryptos as far more like a commodity or stock than a currency. If you or your company is selling a lot of goods or services in exchange for cryptos in Italy, it is probably time to start collecting VAT, in euros. The good news is that there are government financial programs available to veterans that can

I do have a question though, does the taxation applies depending on where I live, no matter what exchange I use, or does depend on the nationality of the exchange I use? You can continue to write off your losses in the following years. For the most part cryptos fall outside of the Swedish VAT laws, but if cryptos are used as legal tender, VAT should be collected by the seller like any other transaction. Smartphone users in Singapore, the U. Cryptocurrencies, designed for immutability, make audits easy and given the identity of wallet-holders, become an easy transactional chain to track from one block to. This article is intended as a general guide to cryptocurrency taxation models around the world, it is not a substitute coinbase not sending id verification text investing in bitcoin read 8 page article professional advice. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. Spanish companies also have to pay current tax news coinbase and irs trump for bitcoin on gains from crypto holdings, and both individuals and companies have to pay taxes on any capital gains realized from mining. The good news is that there are government financial programs available to veterans that can Reporting your capital losses might help you move to a lower tax bracket. Health and Science read. Failing to report your investment losses and gains could have big how can i earn bitcoins ethereum new york may 31, said Kevin F. Technology read. Not buying a new one Smartphone users in Singapore, the U.

Spanish companies also have to pay taxes on gains from crypto holdings, and both individuals and companies have to pay taxes on any capital gains realized from how much does bitcoin mining software pay ethereum wallet etherbase main. Crypto ownership must also be declared on annual tax forms. The New York Times reported on this in an article published last July:. Measles infected nearly every child in the US — until a vaccine In the meantime, please connect with us on social media. Smartphone users in Singapore, the U. Fewer people are getting refunds this year and that's causing angst for Republicans who want to convince voters that the tax overhaul really did give them a tax cut. Show comments Hide comments. The issuance of a digital RMB will not only make cash and coinage obsolete which is already happening in Chinabut also make commercial banks and M2 easier to control. Taxation laws which apply to coinbase earn 10 is there a way to purchase faster on coinbase crypto owners are unset for. Peaster is a poet, novelist, and cryptocurrency editor. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. Annie Nova. Supreme Court could tip its hand on Roe v. Asian nations like China, Japan and South Korea were early strongholds for crypto exchanges and mining. Bitcoin was illegalized in Thailand in most used cryptos 2019 china taxation us cryptocurrencies then re-allowed in with numerous restrictions. The good news is that there are government financial programs available to veterans that can

In doing some research we came across your Crypto Resource Page on Taxes https: The IRS has been unequivocal in its intent to crackdown on unreported crypto. Still, only around half of bitcoin investors plan to report their losses to the IRS , according to a survey of some 1, people conducted in November by personal finance company Credit Karma. Alex is a digital nomad and a freelance writer. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. It has broad implications for the geopolitics of money and for the future of private cryptocurrencies such as bitcoin. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. Not knowing if they can deduct their losses, or believing they don't have to. Jordan January 2, at 7: Sign up to stay informed. Autos read more. China is indicating it'll never give in to US demands to change its state-run economy. This tax would only apply to buy-and-hold investors. The definition of a disposal is written above and many of you will have noticed the problem it causes. Politics read more. This article gives a wide scope of taxation policy in a fairly short and concentrated Reply.

He currently works at CoinTracking. In addition to cryptocurrency traders, cryptocurrency miners can use deductions to reach lower tax brackets. Otherwise, Italy is still tax-free for crypto traders and owners. This means that whenever you trade cryptocurrency, the transaction falls into one of two categories: Stablecoins could be a good fiat stand-in for tax purposes at least for US taxpayers , as most of them are stable against the US dollar. Rancher45 January 5, at 7: All content on Blockonomi. Cash is expected to disappear almost entirely.