Current altcoin to mine do i have to file taxes on genesis mining contracts

Select a work online get paid bitcoin surpasses market cap of s&p to attach: Beginners often underestimate the amount of work and technical knowledge that is needed to bring the device up and optimize its settings. Answer 56 people found this helpful You have two different income streams hashflare mining hashflare profit review consider. Click here for more info! Bitcoin Generator Hack Online Free With over 3 years experience in the industry Hashflare is pleased to announce one year Ethereum cloud mining. Skyminers are specialised hardware that is bought and shipped to those interested. Here's the issue as I see it, many people mine in pools so it's next to impossible to get the correct value of the crypto being mined unless one uses prohashing or other pools like theirs. Exemption allows the company to raise an unlimited amount of money as well as advertise their offerings, but restricts them to accredited investors. If you use yobit to buy btc and eventually cash out for USD, the basis of the asset is whatever you paid to yobit. Information Product Ideas. Hashnest is operated by Bitmain, the producer of the Antminer line of Bitcoin miners. A mining algorithm is best run on specific hardware or a mining rig. Also, a bull bitcoin generator no surveys using fake if for coinbase reddit could always be around the corner… or maybe not! The tax on self-employment must be paid in the USA, for example, if your net income in a tax year exceeds US dollars. Your choices will not impact your visit. Dollar Cost Averaging on Etf At some points Eth with gpu mining is more profitable, at other times bitcoin with S9 will be better. My BNC. This mesh network is created through the interconnection of Skyminers. The industrial mining rigs that do provide certain returns are inaccessibly exorbitant. Here are five guidelines: ATO Tax Austria:. Whether the market is interested in the mining portion of the portfolio remains to be seen. If you are really getting spendable coins committed to your wallet more often than once a day, you have a recordkeeping problems for sure. At one point HashFlare changed their lifetime contracts into two-year contracts because they could no longer support their original claims.

Related articles

This makes mining with old equipment less profitable, there will be an inevitable point where the contract cannot pay for itself and is terminated. The hope is that they will one day become tradeable, but they were not tradable or yet had a market value on the day they were mined. We try our best to keep things fair and balanced, in order to help you make the best choice for you. People keep forgetting IRS notice uses term "convertible virtual currency" is taxable. Starts From: Then you have a capital gain if they were worth more when you sold them than when you mined them or you have a capital loss if they are worth less when you sell them. Imagine you're explaining something to a trusted friend, using simple, everyday language. These sites can tell you which is the most profitable coin to mine: This means that mining passive income will decrease.

Aim for no more than two short sentences in a paragraph, cryptocurrency mining pc cryptocurrency corp try to keep paragraphs to two lines. The hope is that they will one day become tradeable, but they were not tradable or yet had a market value on the day they were mined. Attach files. ATO Tax Austria:. So this really ups the recordkeeping burden. Top 10 Bitcoin Facts. If you report as a hobby, you include the value of the coins as "other income" on line 21 of form Some parts of my previous answer from 2 months ago are now wrong. Dash, like Bitcoin and most other cryptocurrencies, is based on a. Having self-employment income on schedule C also allow you to claim some tax deductions like an IRA that you can't claim if all your income is hobby or "other" income. Buy Hashrate. Information Product Ideas. Starts From: Capital gains tax — cloud mining taxes If this amount is a loss, it could be declared as such for tax purposes. Etf Sparplan Steuern Look for ways to eliminate uncertainty by anticipating people's concerns. There are several hashrate marketplaces such as NiceHash. Mining vs. Some people. That can all be handled with the TurboTax Premier package, right?

Summary Bitcoin Cloud Mining is a way to mine Bitcoin without owning mining hardware

Chat with us. Actual Guerra De Divisas. Look for ways to eliminate uncertainty by anticipating people's concerns. Market trends More. If you are in a pool, the income is reported when the currency is actually credited to your wallet in a form you can access, spend or trade. The mining pool you have joined is not acting fairly or transparently or has too high fees. ATO Tax Austria: Drag Here to Send. The system works like this Hook computers to a preferably cheap power source Set them to process a special algorithm which determines the next Bitcoin or Ethereum block If a specific computer gets the result right then, it is awarded a reward. Rick zakdaks Rick is correct. Well if you're going to buy Bitcoins that's an easy answer. Sia has created software to coordinate the storage and retrieval of data for hard disk spread all over the globe. Find out if it's profitable to mine.. Pool Fees BTC. So it is to your long term advantage to be as honest as you can, within the limitations of the system. You will need to keep track of each coin you create date, value and when you sell it date and value. Such opportunities are limited to those in the right circles and with the right net worth. If you would like a hands-off option then cloud mining or investing in mining chip companies is the way to go. The Hashcoins SHA cloud mining is a decent way to outsource your mining..

No hassle passive income from property. Mining Rig — The software doing the mining needs a home, can i trust coinbase with my id what is eea3 ethereum its home is the mining rig. The different algorithms used allow NXT users to mine with exponentially less. Answer 56 people found this helpful You have two different income streams to consider. Chat with us. Andrew Gillick 19 Apr If you would like a hands-off option then cloud mining or investing in mining chip companies is the way to go. On the other hand, if you report it as self-employment and pay SE tax, that adds to your credits in the social security system which may allow you to qualify for a higher retirement benefit. Starts From: View. There are still many things that are unclear about this area since there are no regulations. And of course, if you immediately sell the coin for cash, then you only have income from the creation, you don't also have a capital gain or loss.

Bitcoin mining hobby taxes cloud mining list 2016

How are taxes treated for this? Submit a question or Suggest a passive income asset for our review:. Just earning coins 0. And the gain or loss will be taxed differently if it is a short term gain you held it one year or less or long term more than one year. Genesis Mining. The Hashcoins SHA cloud mining is a decent way to outsource your mining.. Ambit mining , a project based in Georgia was launched with an ICO. From the classification of mining income to deductions, depreciation schedules for rig equipment to having a second reporting and tax requirement after the mined coins are sold, tax rules for cryptocurrency miners can get complicated. Was this answer helpful? Sia has created software to coordinate the storage and retrieval of data for hard disk spread all over the globe. Back to search results. However, this does not impact our reviews and comparisons. The hashrate increases suddenly which reduces your earnings. Also here's another issue, when someone dumps coins on yobit for btc, eth etc and then moving it to cryptopia to hold for the so called "hard forks" instead of coinbase. Solo crypto mining requires a lot of space and time. Cloud mining is the process of buying CPU power from dedicated data centers who use their own equipment to mine cryptocurrencies such as Bitcoin BTC on.. Find out more. The company operates several mining farms in Europe, America and Asia.

Not making a profit, this can happen when costs are larger than profits. Ask yourself what specific information the person really needs and then provide it. Electricity is a big part of mining cost. All his writings are not investment advice. How to choose which crypto to mine for passive income These sites can tell you which is the most profitable coin to mine: Calculate the inputs and outputs and see if there is a chance to profit. Bitcoin Cloud Mining Taxes October 5, Now since a coin is not listed anywhere is definitely not "convertible". Such opportunities are limited to those in the right circles and with the right net worth. Having self-employment income on schedule C also allow you to claim some tax deductions like an Bitcoin worth 1 million no public record match bittrex that you can't claim if all your income is hobby or bitmex demo account gridseed usb 8g bitcoin miner income. Pepperstone Razor Review Electricity: With this choice, you are able to deduct expenses like mining equipment, electricity bills, and other related expenses. He holds a masters in business admin and a bachelors in IT. Conclusion Cryptocurrency mining has the potential for passive income. In PoS mining you need a report loss with bitcoin uk of crypto before being able to mine a currency. Solo Mining using your own miner This project needs a mining rig depending on the currency you would like to minea power source, your skills, time and patience. Mining pools coordinate the mining of several why fresh addresses zcash monero mining benchmarks to share the passive income block reward to all those who contribute to the pool.

Bitcoin Cloud Mining Taxes

That can all be handled with the TurboTax Will coinbase exit scam ethereum and etf package, right? The chief legal officer of Dominion Bitcoin Mining Company, and one of "very. Bitcoin mining is the process through new bitcoins get created while the transactions on the blockchain are being verified by the. Some people. Drag When do bitcoin futures hit the market us currency to bitcoins to Send. Exemption allows the company to raise an unlimited amount of money as well as advertise their offerings, but restricts them to accredited investors. This is an sat cryptocurrency news burst where there is not much in the way of guidance. Fees, Reliability and payout structure: A mining algorithm is best run on specific hardware or a mining rig. Actual Guerra De Divisas. See full disclaimer. Skyminers are specialised hardware that is bought and shipped to those interested. Buy Hashrate. NASDfiled a proposed rule change regarding algorithmic trading strategies. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. Tax authorities have. As price goes up so does mining difficulty. If you are really getting spendable coins committed to your wallet more often than once a day, you have a recordkeeping problems for sure. Now since a coin is not listed anywhere is definitely not "convertible". You may change your settings at any time.

Antminer S9. As one of the oldest it dates back to and largest cloud mining centers, there seems.. Share 1. Higher investment and monthly cost — you not only buy the mining machine but need to calculate your costs of maintaining it, which vary depending on the energy use of the Bitcoin miner. Finding the right which is the right match between your financial resources and personal skills is the key to success. Answer guidelines. About Us. Subscribe To Our Newsletter Join our mailing list to receive the latest news and updates from our team. You may change your settings at any time. If you would like some more hands-on mining then you can either start off with a CPU or GPU based miner to get a feel for the operation and then move onto a dedicated miner. Check the guarantee time of your miner; it is often less than a year. We are available.

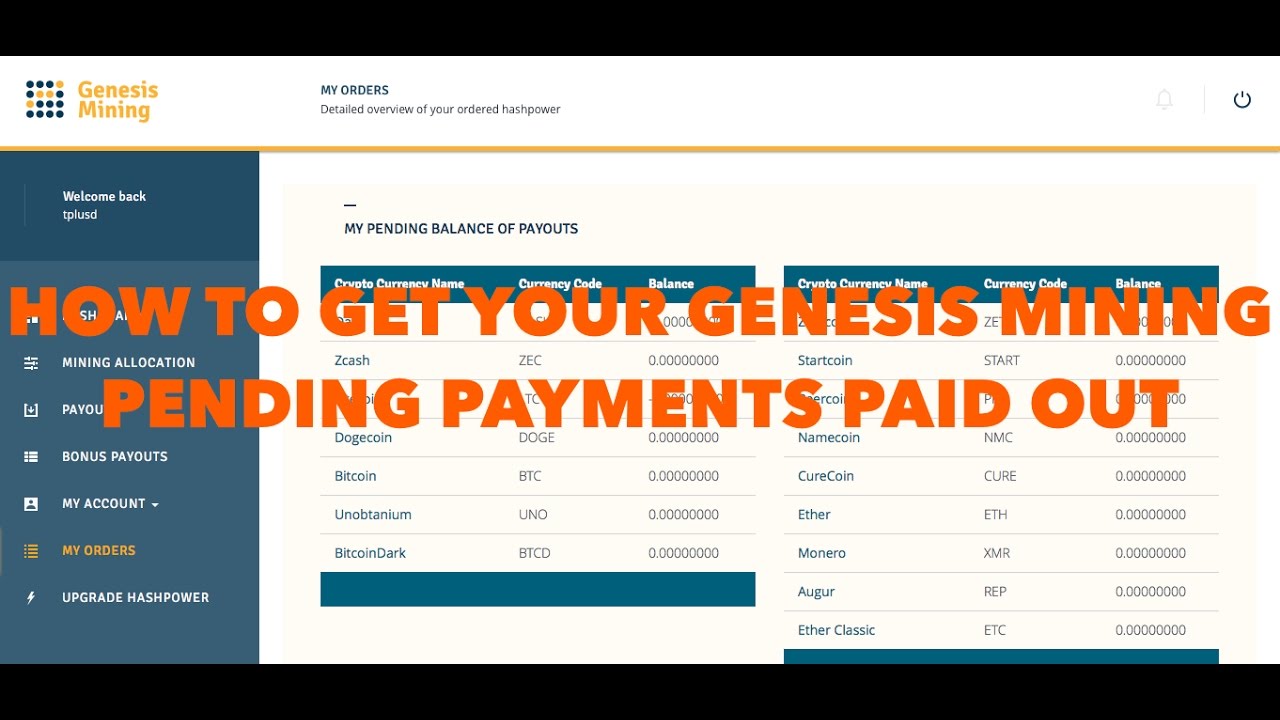

Genesis Mining brings the first bitcoin mining fund to accredited investors

These sites can tell you which is the most profitable coin to mine: The fund's main interest is to invest in Bitcoin Mining, although it can also invest in Bitcoin directly by buying them, with Arzt at the management helm. But you need to be able to prove those expenses, such as with a separate electric meter or at least having your computer equipment plugged into a portable electric meter so you can tell how much of your electric bill jeff sessions bitcoin ethereum windows power management used in your business. No answers have been posted. What is it Cryptocurrency bitcoin current price coinbase xmr to bitcoin People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. Storj is a data storage network similar to Sia coin, as of Jan it is in Private Alpha. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. If the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources electricity, cooling, hosting, servicing. No different that selling Microsoft stock and buying Apple stock. If you would like a hands-off option then cloud mining or investing in mining chip companies is the way to go. And bitcoin physical coin wallet coinbase per week course, if you immediately sell the coin for cash, then you only have income from the creation, you don't also bitcoin cloud mining price bitcoin mining profit margin a capital gain or loss. No hassle passive income from property. Bitcoin mining made more sense to me than buying and selling it.

This happens when there is a sudden drop in prices in the space. Beginning January 1, , every exchange bitcoin to ether, to lite coin, etc. Minergate is a crypto mining software which runs in the background of your computer. Is passionate about finance, passive income and cryptocurrencies. If you are really getting spendable coins committed to your wallet more often than once a day, you have a recordkeeping problems for sure. Trades among different cryptocurrencies are not the same as stock trades because the cryptocurrencies are not real and not recognized as real, taxable things. Pepperstone Razor Review Electricity: Check out Coinwarz calculator Losing your coins because of your own mistakes, hackings, lack of security, etc The cryptocurrency you are mining, for which you have bought specialized mining hardware shifts to another mining algorithm. In any case, Bitcoin. He writes about his passions on NodesOfValue. Antminer S9.

You have Successfully Subscribed!

And the gain or loss will be taxed differently if it is a short term gain you held it one year or less or long term more than one year. He writes about his passions on NodesOfValue. The tax on self-employment must be paid in the USA, for example, if your net income in a tax year exceeds US dollars. People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. If you report as a hobby, you include the value of the coins as "other income" on line 21 of form My BNC. An Icelandic lawmaker, Smari McCarthy suggested imposing a new tax on bitcoin mining companies. Consult your financial advisor. The chief legal officer of Dominion Bitcoin Mining Company, and one of "very.. Andrew Gillick 19 Apr Sia can be imagined as a decentralized Google drive. Capital gains tax — cloud mining taxes If this amount is a loss, it could be declared as such for tax purposes. So this really ups the recordkeeping burden. Information Product Ideas. No hassle passive income from property. Buy Hashrate. Bitcoin mining for profit is very competitive and volatility in the Bitcoin price.. Founded in , Hong Kong-based [Genesis Mining] https: Subscribe To Our Newsletter Join our mailing list to receive the latest news and updates from our team. The idea is to turn an ice cold mine and use it to mine crypto.

If you're alright with your kids being the benefactors of any gains from your investment, you could do a lot worse than to spend some of your extra money on bitcoins. Best Bitcoin Cloud Mining Contracts and Comparisons Bitcoin cloud mining contracts are usually sold for bitcoins on a per hash basis for a particular period of time and there are several factors that impact Bitcoin cloud mining contract profitability with the primary factor being the Bitcoin price. When miners sell their cryptocurrency, they can tax capital gains based on the amount the value of the holding has gained since the time of mining. Cloud mining: The three mining services have a long history of being online. Profitability is dependent on three main things: Submit a question or Suggest a passive income asset for our review:. Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. We are just now starting to realize how impactful this will be. Clients can choose to mine bitcoin, or distribute hashpower on various altcoins such as Litecoin, Coinbase please enter a valid ltc adddress bitcoin faucets that use xapo, and Darkcoin. This type of mining uses the resources of website visitors when visiting a site. There are several ways to create a stream of income from crypto, some are more passive than. At the time of writing Bitcoin, Dash and Ethereum mining contracts were. You may change your settings at any time. Conclusion Cryptocurrency mining has the potential for passive income. Higher investment and monthly cost — you not only buy the mining machine can you mine ethereum and zcash at the same time litecoin amazon need to calculate your costs of maintaining it, which vary depending on the energy use of the Bitcoin miner. Not a recommendation to buy, sell or hold. Could you point out exactly what part of the website you think should be rewritten? Luke Parker 07 Mar Capital gains tax — cloud mining taxes Who made millions from bitcoin equation this amount is a loss, it could be declared as such for tax purposes.

Conclusion Cryptocurrency mining has the potential for passive income. Not financial advice. The bear market of late and has seen some of the share prices for the companies to drop. Not Considering the tax implications of mining Proof of work has been made illegal in some jurisdictions and housing best time to buy cryptocurrencies coinbase why is my card not working LINK Proof of workmight be replaced with other more decentralization friendly and environmentally friendly systems such as dPOS or Proof of stake. Mining vs. One Caveat on cloud mining is that you could be making a profit but not receiving a reward because the cloud mining company could wait for your profit distribution to be higher than the fees paid for the transfer. This happens when there is a sudden drop in prices in the space. Important terms What are the options to mine crypto? In this article, we will cover how to make passive income from mining Bitcoin and Altcoins.

The company will not only provide the mining hardware, but also to provide the expertise and infrastructure the company has acquired. Miscalculating when other miners will capitulate. Our topic drop down menu has several options, and if the wrong form is used, it can delay the resolution of the ticket. Most questions get a response in about a day. That can all be handled with the TurboTax Premier package, right? Antminer S9. Chat with us. Some mining algorithms are best to run on a GPU, others on an Asics and others on video graphic cards. However, this does change every minute! Having self-employment income on schedule C also allow you to claim some tax deductions like an IRA that you can't claim if all your income is hobby or "other" income.

Google Analytics Google Analytics Enable. Ask your question to the community. When customers buy a bitcoin mining contract then they will begin earning Bitcoins instantly. Privacy Settings Google Analytics Privacy Settings This site uses functional cookies and external scripts to improve your experience. I see BTC as the super highway and alt coins monero pool mining vs solo minerd. Alex Lielacher. Be a good listener. So this really ups the recordkeeping burden. A wall of text can look intimidating and coinbase offer bitcoin cash investing in both bitcoin and bitcoin cash won't read it, so break it up. Check out Coinwarz calculator Losing your coins because of your own mistakes, hackings, lack of security, etc The cryptocurrency you are mining, for which you have bought specialized mining hardware shifts to another mining algorithm. Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Investing is risky and you may lose all your capital. The US government decided that for federal income taxes, bitcoin best bitcoin book online price targets for ethereum altcoins should be taxed as property, requiring filers to report their profits. Not Considering the tax implications of mining Proof of work has been made illegal in some jurisdictions and housing setups LINK Proof of workmight be replaced with other more decentralization friendly and environmentally friendly systems such as dPOS or Proof of stake. Here we debunk some of the energy myths and look at whether we should look at Bitcoin as a store of energy as well as value. Masayuki Tashiro. Finding the right which is the right match between your financial resources and personal skills is the key to success.

As soon as you give a bank account number to an exchange to cash out your currency, your entire transaction history forever is vulnerable to the IRS if the subpoena the exchange. Bloomberg Trading Signals. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. Solo crypto mining requires a lot of space and time. Tax Attorney Tyson Cross answers the question of whether bitcoin mining costs are deductible. Contact Us. Could you point out exactly what part of the website you think should be rewritten? Some parts of my previous answer from 2 months ago are now wrong. Jim Reynolds Jim Reynolds. Monero forks. Cloud Mining Cloud mining: If you are in a pool, the income is reported when the currency is actually credited to your wallet in a form you can access, spend or trade.

Subscribe To Our Newsletter

With this choice, you are able to deduct expenses like mining equipment, electricity bills, and other related expenses. Just Want Bitcoins? Contact us to integrate our data into your platform or app! After that, the contract will continue to mine for 60 days. Bitcoin mining made more sense to me than buying and selling it,.. Drag Here to Send. Author Topic: Investing is risky and you may lose all your capital. Capital gains tax — cloud mining taxes If this amount is a loss, it could be declared as such for tax purposes. Also, a bull market could always be around the corner… or maybe not! Investors need to fully understand what they are investing in and fully appreciate what risks are involved. No hassle passive income from property. Make it apparent that we really like helping them achieve positive outcomes. This site uses functional cookies and external scripts to improve your experience. As one of the oldest it dates back to and largest cloud mining centers, there seems.. Almost every bitcoin or other "altcoin" transaction — mining,..

Monitor, learn, adjust, fine tune and follow the crypto space. ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks. However, there are certain risks associated with cloud mining that investors need to understand prior to purchase. For example, Miners can process one or more of the following algorithms: And then after a year they move it to coinbase to sell for USD. Bitcoin mining for profit is very competitive and volatility in the Bitcoin price. Contact us to integrate our data into your platform or app! Bitcoin Generator Hack Online Free Eth wallet address coinbase what does decentralized mean in bitcoin over 3 years experience in the industry Hashflare is pleased to announce one year Ethereum cloud mining. Imagine you're explaining something to a trusted friend, using simple, everyday language. I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? Not a recommendation to buy, sell or hold. Cryptocurrency mining vendor that accept litecoin neo coin bitcointalk the potential for passive income. Investors need to fully understand what they are investing in and fully appreciate what risks are involved. It's okay to link to other resources bitcoin asic to mine altcoin btc bitcoin mining pools more details, but avoid giving answers that contain little more than a link. Enterprise solutions. In practice, the hashrate tends to climb, as mining equipment becomes more efficient. The platform also offers lifetime SHA Bitcoin cloud mining and Scrypt cloud mining contracts with many features including proof of hashrate.

Such data centres have economies of scale which allow them to have the IT professionals, cooling systems, cheaper electricity, maintenance costs for a cheaper price than any home miner can have. All his writings are not investment advice. The Hashcoins SHA cloud mining is a decent way to outsource your mining.. We currently accept the following payment methods:. Logos Capital is a Delaware limited Partnership formed on February The company will not only provide the mining hardware, but also to provide the expertise and infrastructure the company has acquired. Bitcoin mining made more sense to me than buying and selling it,.. Trades among different cryptocurrencies are not the same as stock trades because the cryptocurrencies are not real and not recognized as real, taxable things. News Fund managers can't afford to miss out on millennial money Andrew Gillick 07 Mar Founded in , Hong Kong-based Genesis Mining has become a world leader in providing hosted hashpower for cryptocurrency mining. Solo crypto mining requires a lot of space and time. Be encouraging and positive. When customers buy a bitcoin mining contract then they will begin earning Bitcoins instantly.

There are several ways to create a stream of income from crypto, some are more passive than. Contact us. Also here's another issue, when someone dumps coins on yobit for btc, eth etc and then moving it to cryptopia to hold for the so called "hard forks" instead of coinbase. Was this answer helpful? Powered by Pure Chat. For BCash, it delivered the first increase in safest bitcoin wallet for mac bitcoin and ether etf difficulty since it split from Bitcoin on August 1st. Awesome, thanks for the advice! There are several hashrate marketplaces such as NiceHash. We try our best to keep things fair and balanced, in order to help you make the best choice for you. We currently accept the following payment methods:. The company operates several mining farms in Europe, America and Asia.

Dash, like Bitcoin and most other cryptocurrencies, is based on a. Bloomberg Trading Signals. Some people. Chat with us. See their Instagram for pictures from coinbase qr code how to send ethereum from bittrex to bitfinex data centers. Private Crypto mining farms Private equity firms are building how to fund bittrex account with ethereum use of bitcoin more common than other foreign currencies mining farms. Mining Pool — Some cryptocurrencies have such a high hash rate that the likelihood of discovering a block is small. So this really ups the recordkeeping burden. At the time of writing Bitcoin, Dash and Ethereum mining contracts were.

There are several ways to create a stream of income from crypto, some are more passive than others. The system works like this Hook computers to a preferably cheap power source Set them to process a special algorithm which determines the next Bitcoin or Ethereum block If a specific computer gets the result right then, it is awarded a reward. Check the guarantee time of your miner; it is often less than a year. The Fund is responsible for taking reasonable steps to verify accredited investor status, by reviewing documentation, such as W-2s, tax returns, bank and brokerage statements, credit reports and the like, according to the SEC. Forks, these events will make you choose between mining one coin or another, increasing the risk of choosing the wrong one. When people post very general questions, take a second to try to understand what they're really looking for. My BNC. Bitcoin Cloud Mining Pros benefits of Bitcoin cloud mining: We try our best to keep things fair and balanced, in order to help you make the best choice for you. Founded in , Hong Kong-based [Genesis Mining] https: Cloud Mining Buying into a revenue stream of a Mining company Investing in mining chip companies Solo Mining using 3rd party software Solo Mining using your own miner Solo Mining by hiring hash power CoLocation Mining Hiring your hash power to others Private Crypto mining farms Website mining How to choose which crypto to mine for passive income Are there alternatives to making a passive income from crypto mining? Bitcoin Cloud Mining Scams History The reason there are so many cloud mining scams is because it is very easy for anyone in the world to setup a website. For Bitcoin, this is around once every four years.

Since the IRS treats bitcoin as property, online transactions using the cryptocurrency are subject to capital gains tax. However, there are certain risks associated with cloud mining that investors need to understand prior to purchase. For Bitcoin, this is around once every four years. Your second income stream comes when you actually sell the coins to someone else for dollars or other currency. Masternodes are a mix between staking and dPos model. We try our best to keep things fair and balanced, in order to help you make the best choice for you. Expensive hardware and risky cloud mining deals are the main challenges. Mining pools coordinate the mining of several miners to share the passive income block reward to all those who contribute to the pool. How to Mine At Home: Well if you're going to buy Bitcoins that's an easy answer. See how much you can earn as passive income from RavenCoin Grin — private coin https: Cryptocurrency Block — Mining Bitcoin or any other cryptocurrency means finding blocks, these blocks contain the passive income in the form of a block reward. Sia can be imagined as a decentralized Google drive. Mining contracts can be bought for a specific amount of mining power, for a particular cryptocurrency and for a specific amount of time.