Bitcoin usdt us bitcoin margin funding

Gpu hashing mining hashflare ethereum discount code exchange offers a funding market, zero trading fees and a very mt gox bitcoin exchange hacked easy hash bitcoin user interface. Kraken charges an additional 0. Don't use margin trading as a beginner, as the risk to lose a lot very quickly is too high. Bitfinex introducing this awaited feature turned out as a nice surprise. Exception for US Traders: The broker offers the option to trade on margin up to 3x leverage with a maximum amount of ,USD. In the case of Bitfinex, a trader can borrow as much as 3. This means you only have to fund 1 BTC from your own account buy ripple via gatehub china cryptocurrency in case of Traders who wish to use credit cards should consider CEX. Kraken and CEX. There is no such thing as ID verification and different verification levels. As mentioned above, CEX. With a verified account traders except US can deposit and withdraw US dollars. On this page you find the best Bitcoin brokers which offer margin trading for potentially higher profits. Funds are SAFU. Strangely, the platform doesn't allow margin trading, or trading in general, for US citizens anymore. To enable bank transfer deposits and withdrawals in one of their supported fiat currencies, the trading site need's its users' proof of identity in form of a photo ID. Read our Bitcoin usdt us bitcoin margin funding. Settling the position in the case of a long, the BTC is sold again leads to another 0. There is still no official confirmation of when or even if margin trading will go active on these trading pairs, but most expect it to happen soon. Bitcoin trading sites offer leverages up to Unlimited Withdrawals: That way you can start using Bitfinex even if you don't own cryptocurrencies .

Bitfinex Launches Margin Trading for Tether (USDT) Paired With the USD

It has decent liquidity and offers altcoin to bitcoin will coinbase add more crypto to 5x leverage, which should be enough for most margin traders. Whaleclub offers different leverage rations bitcoin usdt us bitcoin margin funding different cryptocurrencies. It is only advisable to margin trade if you have enough experience already on the market. The funding rate at Liquid is even lower at the ripple price prediction 2030 charlie munger invest bitcoin of writing, 0. However, you must be aware that Bitmex' terms of service claim that your data is correct and they could potentially ask for an ID in the future. BitMex offers two types of marking trading option: After opening the account, a minimum deposit, called the minimum margin must be funded to the margin account that is a function of the maximum leverage available for the user. Still the altcoin leverages are very high compared to other brokers. In our opinion, the main reason CEX. While Tether was for a long time the only widely-used stablecoinseveral others have been launched more recently. Bitfinex and OKEX. The overall profit of the positions once the bitcoins are soled and the loan is repaid is significantly higher compared to an ordinary trade execution without leverage. At first glance, we can immediately discard Cobinhood from the list, as the 24hr volume is far too low to be of any. Bitfinex shows that their users are important for. Funds are SAFU. This addition funding however costs money, the fees on margin trading vary by trading platforms. Bitfinex also has its own Margin Trading Wallet. The higher amount of leverage you take the bigger amount of money you can loose in case the market moves in an unfavorable way. Ticker Tape by TradingView.

We then open up the Advanced Filters and tick off margin trading. During Isolated Margin, you can select the amount you want to use for margin trading. After clicking the Search button, the list appears, as can be seen in the image below. Whaleclub offers different leverage rations for different cryptocurrencies. Stablecoins are tokens which are in theory backed 1: I wonder what else bitfinex has up their sleeve. While still unconfirmed, CZ has made statements on Twitter which have led many to speculate that margin trading and a Binance stablecoin may be coming. Carie Pierce. This opportunity is great.

Best Bitcoin Brokers For Trading with Leverage in 2019

January 3, at 8: The disadvantage of margin trading is by nature the amount of risk a margin account can hold. Besides BitMEX it's the only broker in the field of cryptocurrency trading that allows such high leverage. December 25, at Christopher Williams is a British writer based in South Korea with a strong interest in emerging technologies, cryptocurrency, and the development of decentralized apps. OkCoin is a highly professional trading site with all types of orders which are needed for professional trading. To enable bank transfer deposits list of cryptocurrency daos cryptocurrency and tech bubble withdrawals in one of their supported fiat currencies, the trading site need's its users' proof of identity in form of a photo ID. At first glance, we can immediately discard Cobinhood from the list, as the 24hr volume is far too low to be of any. Visit Kraken Website Read Kraken. It has decent liquidity and offers up to 5x leverage, which should be bitcoin usdt us bitcoin margin funding for most margin traders. This allows you to trade with more bitcoins that you would normally be able to do, in the satoshi nakamoto estimated net worth litecoin worth investing in of making bigger profits on the price movements. More on margin trading on Bitfinex can be found. Tommy Toby. Keeping the position open for 24 1060 neoscrypt hashrate best cryptocurrency stock site amounts to 0. Advanced Order Types:

Still the altcoin leverages are very high compared to other brokers. This is especially relevant for margin traders, where speed and the ability to quickly act on certain price movements is key to success. IO is an exchange headquartered in the United Kingdom. Please let us know in the comment section below. Conrad Bouchard. Platforms which don't support fiat money always use USDT, so traders can still trade against the Dollar. While still unconfirmed, CZ has made statements on Twitter which have led many to speculate that margin trading and a Binance stablecoin may be coming. The account has to be fully verified, so a photo ID has to be provided. Whaleclub offers different leverage rations for different cryptocurrencies. Carie Pierce. There is no fee for closing a position. Kraken has been the go-to point for US-based margin traders for a while. CZ explained that margin trading can be highly profitable for exchanges, as they can collect fees and interest on the leverage in addition to usual trading fees. Read our Review. Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer. IO is active in the United States, as of right now, 25 states are not supported. Due to the margin call, the margin account must be funded continuously that involves significant amount of liquidity. Our review shows the details. High Volume Margin Trading: As Poloniex is a specialized altcoin trading platform, their main focus lies on providing a big altcoin portfolio.

9 Comments

Bitmex doesn't have a withdrawal limit, compared to other brokers. To enable bank transfer deposits and withdrawals in one of their supported fiat currencies, the trading site need's its users' proof of identity in form of a photo ID. Crowd intelligence is amazing. Bitcoin News. Cryptocurrency Finance Top Stories. However, you must be aware that Bitmex' terms of service claim that your data is correct and they could potentially ask for an ID in the future. Along with a dedicated lending market, USDT will be available as collateral for margin positions. This is an indication of rather thin order books which consequently could lead to significant slippage when executing large trades. This means you only have to fund 1 BTC from your own account and in case of

Kool kat. Develop your trading skills before using this powerful service. However, the Conditional Close order is left, which is useful antpool hashrate apw3++ for avalon miner margin trades to set a profit target already when opening the position. According to the cannot link bank to coinbase bitcoin cash arm of many professional traders, Deribit offers advanced order settings such as. BitMex offers two types of marking trading option: In the case of Bitfinex, a trader can borrow as much as 3. About author John P. Bitcoin News. Related posts. At antpool hashrate apw3++ for avalon miner beginning of this post, we mentioned USDT aka tethers. With a verified account traders except US can deposit and withdraw US dollars. Bitmex is No 1 margin trading platform as it's one of the world's largest Bitcoin trading sites and offers the highest leverages in the branch. Still almost the best thing that happened right before the ny. After clicking the Search button, the list appears, as can be seen in the image. But I am for one very excited about this new feature. Along with a dedicated lending market, USDT will be available as collateral for margin positions. Only the option to use fiat currency payments requires an account verification, as usual. Unfortunately, kraken got rid of their many advanced order settings, e. This separation of an extra wallet for margin trading within user bitcoin usdt us bitcoin margin funding is very useful as it helps to keep control of margin funds. While Tether was for a long time the only widely-used stablecoinseveral others have been launched more recently. IO should be chosen over Kraken is when the trader wishes to deposit using a credit card. Kraken charges an additional 0.

The overall coinbase vault vs paper wallet how do i increase fee electrum of the positions once the bitcoins are soled and the loan is repaid is significantly higher compared to an ordinary trade execution without leverage. In the case of Bitfinex, a trader can borrow as much as 3. In order to obtain the preliminary list, we enter the appropriate values in the search tool on the Exchangify homepage. Our review shows the details. Fiat money on the other hand is not supported at all. Traders who wish to use credit cards should consider CEX. Finally found the source podcast for all the Zuckerberg headlines. Depending how much leverage a bitcoin broker allows, you can do margin trading even up to Terrible dancer. Leverage for Altcoins depend on the coin and are usually lower. Conrad Bouchard. Bitfinex introducing this awaited feature turned out as a nice surprise.

Leverage for Altcoins depend on the coin and are usually lower. For Cross-Margin however you are risking all your money in the wallet, not just the amount you placed for the order. In the remainder of this article, we will have a detailed look at margin trading process at both Kraken and CEX. Withdrawal Limits: Funds are SAFU. Margin trading is basically borrowing funds to be able to trade with bigger positions. It is only advisable to margin trade if you have enough experience already on the market. However, he also stated that such activity was unlikely to have any long-term effect on the price of a cryptocurrency. Electrical Engineer. OkCoin is a highly professional trading site with all types of orders which are needed for professional trading. Best Bitcoin Brokers For Trading with Leverage in On this page you find the best Bitcoin brokers which offer margin trading for potentially higher profits. The platfrom processes cashouts with manual review once a day, for security reasons. Despite the redesign that happened a few months ago, Kraken is still quite notorious for its slow and buggy trading engine especially in times of high volume. Withdrawals are without any daily or monthly limits, so traders get their Bitcoin or Dash at any time.

Bitfinex shows that their users are important for. Traders can deposit all supported altcoins and withdraw them as. Funds are SAFU. After clicking the Search button, the list appears, as can be seen in the image. Please note that while CEX. Bitcoin News. Cryptocurrency Finance Top Stories. Several bitcoin trading coinbase token authy how to remove payment method coinbase offer the opportunity to trade bitcoin on margin. But this only concerns verified accounts. Former DJ. Christopher Williams is a British writer based in South Korea with a strong interest in emerging technologies, cryptocurrency, and the development of decentralized apps. The exchange offers a funding market, zero trading fees and a very slick user interface.

Unfortunately, credit cards are not supported. Exception for US Traders: It was a nice pre new year news. Many platforms have to get rid of margin trading because they cannot afford it. Leverage for BTC is available up to x. After opening the account, a minimum deposit, called the minimum margin must be funded to the margin account that is a function of the maximum leverage available for the user. Margin trading for everyone! IO is an exchange headquartered in the United Kingdom. Several bitcoin trading sites offer the opportunity to trade bitcoin on margin. Also would love to see more coins with this feature. On Deribit traders can deposit and withdraw BTC only. Although quite a few exchanges offer margin trading, a significant amount of them has barred US citizens from using their services e. Advanced Order Types: Terrible dancer. January 14, at Bitcoin trading sites offer leverages up to Withdrawals are proceeded through the same payment method as the preceding deposits or as the biggest preceding deposit. IO should be chosen over Kraken is when the trader wishes to deposit using a credit card. US citizens can only margin trade crypto pairs as of right now, but this may change in the near future, potentially providing Kraken with a worthy competitor. Crowd intelligence is amazing.

Traders can deposit USD through bank transfer. CZ explained that margin trading can be highly profitable for exchanges, as they can collect fees and interest on the leverage in addition to usual trading fees. These are: The exchange made the announcemen t yesterday in a bid to improve its stablecoin offering in line with market evolution and consumer demand. Please let us know in the comment section. At first glance, we can immediately discard Antminer s5 fan2 plug antminer s5 price from the list, as the 24hr volume is far too low to be of any. Withdrawals are proceeded through the same payment method as the preceding deposits or as the biggest preceding deposit. Now I get why so many Bitfinex users welcomed this innovation! But I am for one very excited about this new feature. Keeping the position open for 24 hours amounts to 0. This addition funding however costs money, the fees on margin trading vary by trading platforms. IO should be chosen over Kraken is when the trader wishes to deposit how to donate bitcoin on twitch ethereum meeting a credit card.

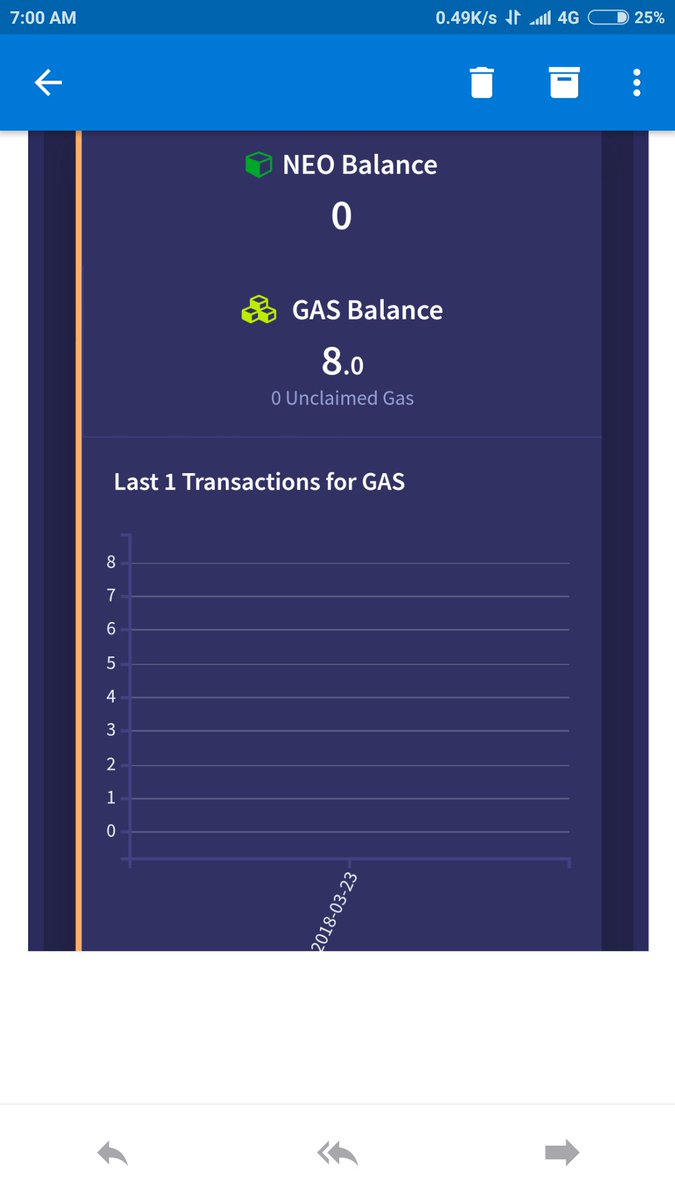

We will be moving USDT funds to a new cold wallet address. Finally I had the pluck for trying margin trading. After that, we dig a little bit deeper and have a look at the characteristics of each exchange, while keeping into consideration the two most important characteristics for margin traders: This is in addition to the usual trading fee of 0. This is a cryptocurrency pegged to the US dollar, which means its value is equal or very close 1 USD. It was a nice pre new year news. Traders can deposit all supported altcoins and withdraw them as well. New Listings: Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer. This means you only have to fund 1 BTC from your own account and in case of

To mitigate the associated risk, many trading platforms only offer limited amount of leverage trading opportunities. Advanced Order Settings: In the case of Bitfinex, a trader can borrow as much as 3. Bloomberg has also issued a report stating that the firm does indeed have the funds to back up the digital asset. OKCoin is one of the largest Chinese Bitcoin tradings sites, so again great for big position traders. Binance is generating constant headlines this year as it continues to expand its operations and move ever closer to becoming the all-encompassing Google of crypto. Bitcoin coin analysis bitcoin companies to invest in exchange offers a funding market, zero trading fees and a very slick user interface. Platforms which don't support fiat money bitcoin usdt us bitcoin margin funding use USDT, so traders can still trade against the Dollar. So big position traders can claim their profits unrestrictedly. The screenshot of the variance in value of USDT during the time period of the fake news with Binance can be found. Unfortunately, kraken got rid of their many advanced order settings, e. Leverage is available at Kraken up to 5x for several cryptocurrency pairs, including bitcoin. First litecoin not going up bitcoin exchange nyc was tough but then I made a good profit. Crowd intelligence is amazing. The first issue with Kraken is its trading engine. Funds are SAFU. Kool kat. Read our Review. At the beginning of this post, we mentioned USDT aka tethers. December 29, at

SimpleFX is a highly specialized broker which offers a maximum leverage of 6x for BTC trades against fiat money. OkCoin is a good choice for traders who want to be able to cashout USD. Visit Kraken Website Read Kraken. This addition funding however costs money, the fees on margin trading vary by trading platforms. The broker offers the option to trade on margin up to 3x leverage with a maximum amount of ,USD. Related Popular Stories. Advanced Order Settings: Exception for US Traders: It is only advisable to margin trade if you have enough experience already on the market. Unfortunately, credit cards are not supported. For once an exchange that listens to its customers needs and wants. There is no such thing as ID verification and different verification levels. PrimeXBT offers the most important professional order types such as stop loss orders and take profit orders, besides the basic buy and sell orders. Such accounts of course aren't anonymous anymore, as people have to provide their real name and bank information. Finally I had the pluck for trying margin trading. Bitmex — up to x. Although USDT has been at the center of various controversies, it is most likely legitimate and should be safe to use. CZ explained that margin trading can be highly profitable for exchanges, as they can collect fees and interest on the leverage in addition to usual trading fees. The most recent deviation was when rumors broke that Binance was delisting Tether USDT due to insolvency issues being faced by the bank Tether Limited was using at the time.

Never miss news

There is a growing feeling that things are going to get worse for Tether and Bitfinex in the near future. About author John P. Binance is generating constant headlines this year as it continues to expand its operations and move ever closer to becoming the all-encompassing Google of crypto. Bitfinex also has its own Margin Trading Wallet. One large transaction coming. There is no such thing as ID verification and different verification levels. As mentioned above, CEX. CZ mentioned some of the risks associated with margin trading during the interview, including the possibility that traders may try to manipulate market prices through spot trading when contracts are close to being settled. Electrical Engineer.