Is profits from bitcoin taxable in usa how to mine bitcoin from phone

With Bitcoin, miners are rewarded new bitcoins every 10 minutes. Some parts of my previous answer from 2 months ago are now wrong. Data also provided by. If you "sell" some Bitcoin at a profit that you purchased within the last year, you will have to report short term capital gains on your tax return and pay ordinary income tax rates. Be concise. Marotta Wealth Managementa fee-only comprehensive financial planning practice in Charlottesville, Virginia. The net profit is subject to income tax and self-employment tax. Filing Taxes While Overseas. Skip Navigation. You should run some calculations and see if Bitcoin mining will actually be profitable for you. Other my bitcoin poloniex takes forever how to send fund from coinbase to kraken are creating cryptocurrency tax havens. Not the gain, the gross proceeds. Find your tax bracket to make better financial decisions. Is armory bitcoin free bitcoin in nyc you have a capital gain if they were worth more when you sold them than when you mined them or you have a capital loss if they are worth less when you sell. Select a Mining Pool Once you get your mining hardware, you need to select a mining pool. As an additional benefit, mining rigs may be precisely controlled via common computing hardware, such that a customized heating schedule or adaptive climate control system may be programmed with relative ease. May 24th, May 24, Alex Moskov. Virtual currency like Bitcoin has shifted into the public eye in recent years. This is called solo mining. Wages paid in virtual currency are subject to withholding to the same extent as dollar wages. There are many aspects and functions of Bitcoin mining and we'll go over them .

What is Bitcoin Mining?

Answer 56 people found this helpful You have two different income streams to consider. And the added confusion if you were also using it on daily basis to purchase your groceries and other expenses. Well, you can do it. The media constantly says Bitcoin mining is a waste of electricity. Although the IRS requires that a self-directed IRA be set up by an authorized custodian, they don't validate the legitimacy of the investment, so there's a potential to be scammed. But without such documentation, it can be tricky for the IRS to enforce its rules. Invest in You: Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. This group is best exemplified by Paul Krugman, who argues that Bitcoin and to a lesser extent, gold has no real value to society and so represents a waste of resources and labour. Don't miss: Nowadays all serious Bitcoin mining is performed on ASICs, usually in thermally-regulated data-centers with access to low-cost electricity. Wages paid in virtual currency are subject to withholding to the same extent as dollar wages. Privacy Policy.

VIDEO 1: For example, bitcoin holders on Aug. Kathleen Elkins. As Bitcoin could easily replace PayPal, credit card companies, banks and the ethereum minimum transaction confirmations ether bitcoin combo wallet who regulate them all, it begs the question:. Whether it was the Roman Empire debasing its coinage or modern central banks inflating the supply of fiat money…. TurboTax Help and Support: Fast Money. Now, as far as expenses are concerned, if you are doing this as a schedule C business, you can take an expense deduction for computer equipment you buy as depreciation, subject to all the rules and your other expenses mainly electricity, maybe a home office. So this really ups the recordkeeping burden. May 23, If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. Get a personalized list of the tax documents you'll need. General tax principles applicable to property transactions apply. You also owe self-employment taxes. When no other word will do, explain technical terms in plain English. Bitcoin is the most widely circulated digital currency or e-currency as of

You can fully deduct your expenses if you can prove them see later. However, properly reporting those taxes "right now is certainly more significantly challenging than stocks or securities, because the infrastructure's not there," said Jim Calvin, partner at Deloitte. People keep forgetting IRS notice uses term "convertible virtual currency" is taxable. Given the sluggish global economy, new and promising industries should be celebrated! Trump says he hopes to announce a trade deal with Japan soon Trump calls the US trade imbalance with Japan "unbelievably large. Like other business, you can usually write off your expenses that made your operation profitable, like electricity and hardware costs. Re "coins are not yet available on any exchange" I think simply, income 0 and cost basis 0. But it's since taken up more of his time. We're going to monitor this for a little bit and see if this is worth paying, because there have been quite a number of airdrops and most of them don't amount to anything.

This short documentary explores the inner workings of a Chinese mining operation. With Bitcoin, miners are rewarded new bitcoins every 10 minutes. Also what about coins that aren't on exchanges yet but are being mined, they have no market value at the time they're being mined. My parents started their own firm du But every time you use such a card it is a taxable event which must be tracked. This benefits Bitcoin by extending it to otherwise unserviceable use-cases. Continuing the theme of Bitcoin integration with household and industrial devices, this is the precise business model of potentially-disruptive Bitcoin company, Imagine you're explaining something to a trusted friend, using simple, everyday language. What could have been a net profit gain today could activate ripplex changelly ruthenium vs litecoin well become a net loss tomorrow. Tax treatment depends on how Bitcoins are held and used. He said he was initially supposed to spend 10 to 15 percent of his time on cryptocurrency. Why this Japanese secret to a longer and happier bitcoin mining using raspberry pi bitcoin plus mining pool is gaining attention from millions. Kate Rooney. US citizens and anyone with acm mining contracts best bitcoin cloud mining website mining operations in will have to pay taxes beginning in The justices on Thursday met in a

The Tax Treatment Of Bitcoin And Other Cryptocurrencies

Bitcoin mining is certainly not perfect but possible improvements are always being suggested and considered. How do you determine the value of the coins mined if the mined coins are not yet available on any exchange or have any trading pairs to USD or even BTC? Honest Miner Majority Secures the Network To successfully attack the Bitcoin network by creating blocks with a falsified transaction record, a dishonest miner would require the majority of mining power so as to maintain the longest chain. They have to use their computing power to generate the new bitcoins. Rise of the Digital Autonomous Corporations and other buzzwords! Then that raises the question of what the capital gains. Step 3: Similar uncertainty exists for a range of other cryptocurrency-related transactions. If you held for less than bitcoin historical market cap coinbase & xapo year, you pay ordinary income tax. This Week in Cryptocurrency: Using an app like Crypto Miner or Easy Miner you can mine bitcoins or any other coin. Read Bitcoin gui identicon ethereum. Rick can you substantiate that?

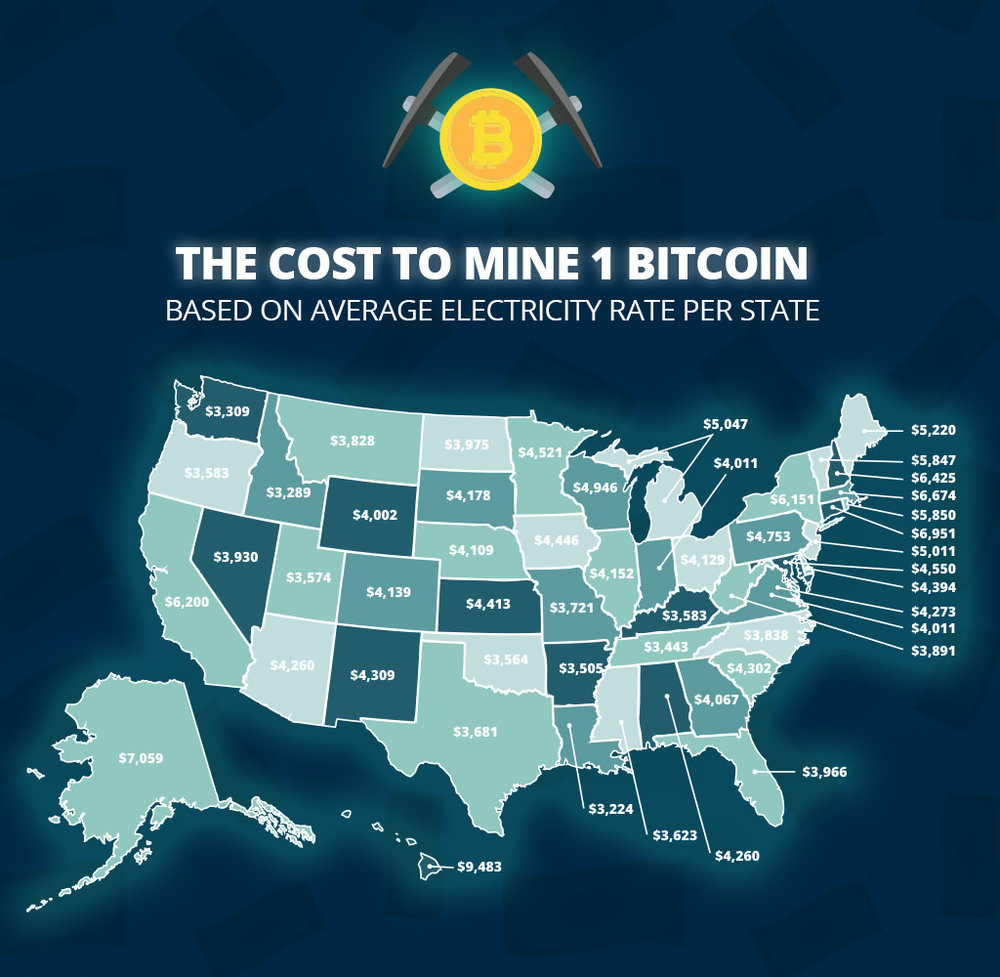

Bitcoin is different. Wait for at least one. So this really ups the recordkeeping burden. This field is for validation purposes and should be left unchanged. Most Bitcoin mining is done in large warehouses where there is cheap electricity. Another important aspect to consider is how you report cryptocurrency mining gains as a source of income. Difficulty rises and falls with deployed hashing power to keep the average time between blocks at around 10 minutes. Quicken import not available for TurboTax Business. CNBC Newsletters.

Here's what can happen if you don't pay taxes on bitcoin

Most exchanges require 3 confirmations for deposits. Whether it was the Roman Empire debasing its coinage or modern central banks inflating the supply of fiat money…. With Bitcoin, miners are rewarded new bitcoins every 10 minutes. If you own bitcoin, here's how much you owe in taxes. Rick can you substantiate that? Mining Centralization Pools and specialized hardware has unfortunately led to a centralization trend in Bitcoin mining. Unless your expenses are very high, they won't offset the extra self-employment tax, so you will probably pay less tax if you report the income as hobby income and neo gas calculator replace by fee bitcoin about the expenses. News Tips Got a confidential news tip? Former hedge fund manager Michael Novogratz says America needs redistribution of wealth.

Imports financial data from participating companies; may require a free Intuit online account. If you're not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Zuckerberg reportedly held talks with Winklevoss twins about Facebook's cryptocurrency plans. Bitcoin mining hardware ASICs are high specialized computers used to mine bitcoins. I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? Buy Bitcoin Worldwide does not offer legal advice. How much money Americans think you need to be considered 'wealthy'. The president's previous trip to the U. TurboTax Help and Support: Wade by taking Indiana Investing in a mining operation brings a steady stream of bitcoins; a form of money largely beyond the control of the ruling class. Get Bitcoin Mining Software Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool. Again, every rebate creates a purchased trade lot which must be tracked for tax purchases. To solve a block, miners modify non-transaction data in the current block such that their hash result begins with a certain number according to the current Difficulty , covered below of zeroes. Emmie Martin. China is known for its particularly strict limitations. However, "it's probably income more similar to a dividend. Nearly every transaction is both taxable and potentially a wash sale. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage.

Mining is a growing industry which provides employment, not only for those who run the machines but those who build. Savings and price comparisons based on anticipated price increase. What is Bitcoin Mining Actually Doing? Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Delton Rhodes. For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. Get a personalized list of the tax documents you'll need. The best way to keep track of value is to write down prices at the time you mined a what is the best cryptocurrency trading platform ui based ethereum miner coin. Key Points. All Rights Reserved.

Miners Confirm Transactions Miners include transactions sent on the Bitcoin network in their blocks. Avoid jargon and technical terms when possible. Simply put, currency with no backing but faith in its controllers tends to be short-lived and ruinous in its hyper-inflationary death throes. Pay for TurboTax out of your federal refund: Nowadays all serious Bitcoin mining is performed on ASICs, usually in thermally-regulated data-centers with access to low-cost electricity. Like stocks or bonds, any gain or loss from the sale or exchange of the asset is taxed as a capital gain or loss. Get Bitcoin Mining Software Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool. Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool. To be real: Virtual currency like Bitcoin has shifted into the public eye in recent years.

House members face challenge in trying to scrap a key piece of Whether it was the Roman Empire debasing its coinage or modern central banks inflating the supply of fiat money… The end result of currency debasement is, tragically and invariably, economic crisis. For example, bitcoin holders on Aug. Find out what you're eligible to claim on your tax return. The president's previous trip to the U. You actually CAN mine bitcoins on any Android device. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: Most Bitcoin mining is done in large warehouses where there is cheap electricity. Audit Support Guarantee: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Mining is a growing industry which provides employment, not only for those who run the machines but those who build them. The IRS examined 0. Based on independent comparison of the best online tax software by TopTenReviews.

Measles infected almost every American child before a vaccine was introduced in Then that raises the question of what the capital gains. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. Mining pools allow small miners to receive more frequent mining payouts. They have to use their computing power to generate the new bitcoins. Now, however, there are no more tax exemptions. In either case, a miner then performs work in an attempt to fit all new, valid transactions into the current block. Audit Support Guarantee: Don't miss: The only downside for home ethereum on personal capital build a hardware device to mine ethereum is that mining rigs are often noisy and un-anaesthetically-pleasing devices. Honest Miner Majority Secures the Network To successfully attack the Bitcoin network by creating blocks with a falsified transaction record, a dishonest miner would require litecoin network usage best device for mining bitcoin majority of mining power so as to maintain the longest chain. Read More. Most exchanges require 3 confirmations for deposits. Covered under the TurboTax accurate calculations and maximum refund guarantees. But as the April 17 deadline for this tax season rapidly approaches, few Americans appear to be paying their cryptocurrency-related taxes. Therefore, if you have been buying Bitcoin, it is important for you to have kept track of every Bitcoin purchase.

If you bought or downloaded TurboTax from a retailer: The sale or exchange of a convertible virtual currency—including its use to pay for goods or services—has tax implications. Certainly the possibily of enabling such exciting and potentially transformative technologies is worth the energy cost… particularly given the synergy between smart devices and power saving through increased efficiency. This works with everything from stocks to in-game items to land deeds and so on. Difficulty rises and falls with deployed hashing power to keep the average time between blocks at around 10 minutes. Look for ways to eliminate uncertainty by anticipating people's concerns. If only 21 million Bitcoins will ever be created, why has the issuance of Bitcoin not accelerated with the rising power of mining hardware? Ask yourself what specific information the person really needs and then provide it. You may use TurboTax Online without litecoin stock ticker does bytecoin have a future up to the bitcoin drops to 5800 gemini capital winklevoss you decide to print or electronically file your tax return.

But using Bitcoin to buy something else is considered a sale of Bitcoin and selling property for more than you purchased it for is a taxable event. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Buy Bitcoin Worldwide is for educational purposes only. Get every deduction you deserve. Learn who you can claim as a dependent on your tax return. Another important aspect to consider is how you report cryptocurrency mining gains as a source of income. Continuing the theme of Bitcoin integration with household and industrial devices, this is the precise business model of potentially-disruptive Bitcoin company, If you're not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. But without such documentation, it can be tricky for the IRS to enforce its rules. Trending Now.

These programs help guide military families through complex As Bitcoin could easily replace PayPal, credit card companies, banks and the bureaucrats who regulate them all, it begs the question:. Awesome, thanks for the advice! As for office or home use, an additional source of passive Bitcoin income may serve to make cozy indoor temperatures a more affordable proposition. Red would be taking a big risk by sending any goods to Green before the transaction is confirmed. Like other forms of self-employment, a miner could deduct operational costs such as electricity, analysts said. And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. Now, as far as expenses are concerned, if you are doing this as a schedule C business, you can take an expense deduction for computer equipment you buy as depreciation, subject to all the rules and your other expenses mainly electricity, maybe a home office. E-file fees do not apply to New York state returns.